Omnibus Bill Falls Back on the Usual Budget Gimmicks

The negotiations that concluded this week produced two major pieces of legislation. The most consequential for the budget is the $680 billion package of tax cuts that includes tax extenders and several other provisions. The second is the omnibus appropriations bill that will fund the government for the rest of FY 2016. Leaving aside the fact that the omnibus includes some tax cuts to maximize votes, it is largely about funding the government at the limits already set in the earlier budget agreement. But it still has fiscal consequences because of the use of familiar appropriations gimmicks.

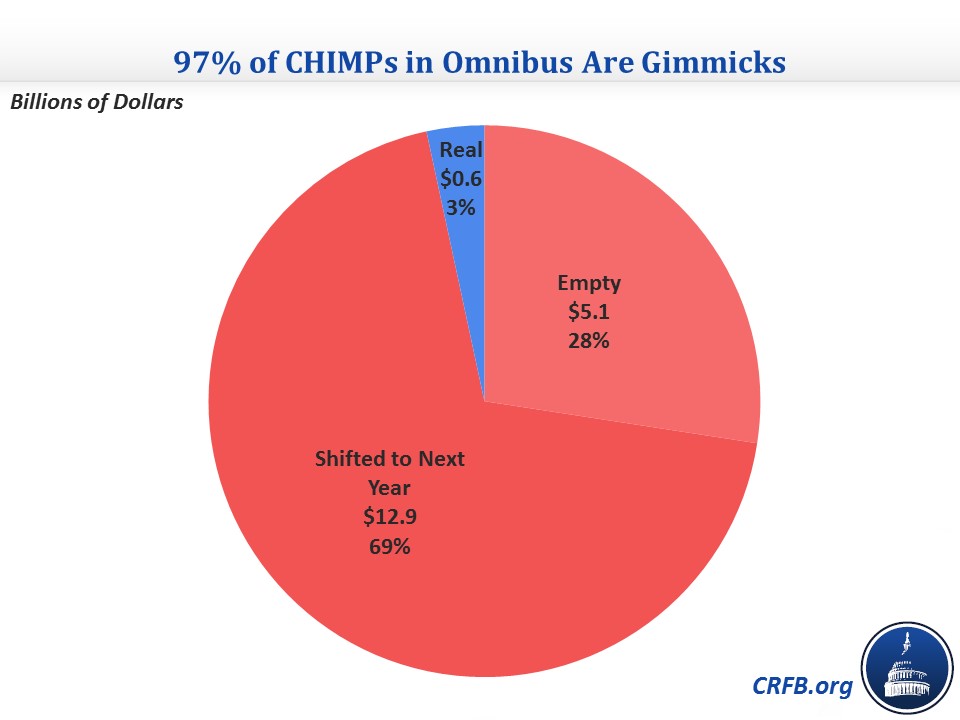

The first is the use of changes in mandatory programs (CHIMPs), which allow lawmakers to appropriate funds above the spending caps by making cuts to mandatory programs. However, as has been the case in recent years, the vast majority of the $18.6 billion in CHIMPs in this omnibus bill won't actually save any money, either because the budget authority they cut was never going to be spent or because the money is simply shifted into next year so it doesn't count against this year's spending limits (and will likely be shifted again next year). Specifically, $5 billion of the changes come from cuts in budget authority that don't produce real savings in the form of lower outlays and $13 billion comes from spending that is shifted into next year, while only $0.6 billion of the savings are real.

This year's budget resolution set a generous $19 billion limit on CHIMPs that phases down to $15 billion by 2019. The Senate-passed budget by contrast phased CHIMPs out entirely over a five-year period. Future budget resolutions should adopt a more aggressive limit on CHIMPs, like the Senate bill, to avoid this kind of gaming.

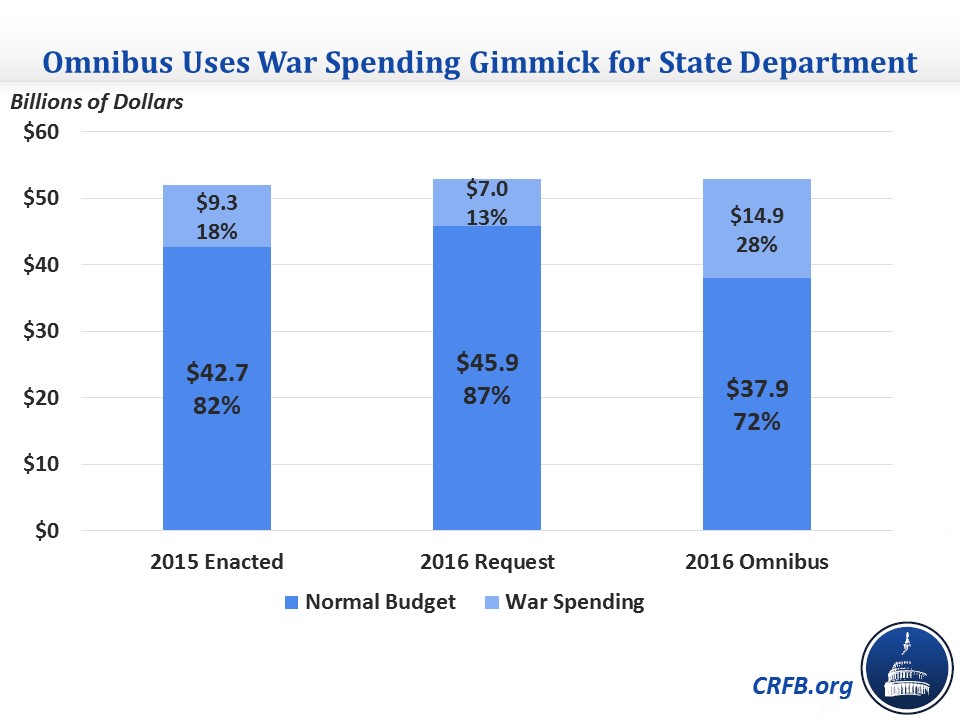

The second major gimmick involves the use of war spending as backdoor for sequester relief. In past years, appropriators quietly shifted defense spending into the war category to create room for more spending under the cap. This year, lawmakers explicitly endorsed using the war category for sequester relief by allotting $16 billion more in the recent budget deal than the Obama Administration requested, split evenly between defense and non-defense spending.

The gimmick shows up starkly in the State Department budget. The omnibus provides nearly $15 billion to the Department through war spending, which is $5.6 billion more than it received in FY 2015 and nearly $8 billion more than the Department's 2016 request. At the same time, Congress reduced the State Department's normal budget by nearly $5 billion from the FY 2015 level and $9 billion less than the 2016 request. As a result, 28 percent of State's funding comes through war spending compared to 18 percent in 2015 and 13 percent in the 2016 request. Appropriators use this war spending gimmick to bypass the budget caps and spend more on other non-defense programs, which here and in this case, amounts to $8 billion in spending above the caps.

The Defense Department's budget looks similar. The omnibus appropriates $7.7 billion more for war spending than the Pentagon's request while coming in $13 billion below the request for normal defense spending.

While the omnibus bill contains some gimmicks, it also does responsibly offset other priorities. Most notably, the bill includes a 75-year extension of the World Trade Center Health Program, a five-year extension of the 9/11 Victim Compensation Fund, and increased payments for hospitals and electronic health records in Puerto Rico, which combined cost $9 billion over ten years.

These costs are fully offset with a number of different policies like limiting Medicaid payments for durable medical equipment to Medicare rates, limiting payments for film X-rays, increasing visa fees, and dedicating penalties from a settlement with BNP Paribas to deficit reduction. The bill also lifts the ban on oil exports, which saves $1.4 billion. Overall, this part of the omnibus modestly reduces deficits by $75 million in FY16 and by $4 billion in the 2021-2025 period.

Still, the fact that the omnibus avoids digging an even deeper hole does not make up for the gimmicks the bill uses to increase domestic spending. These gimmicks have become common in the appropriations process and should be clamped down on, as the Better Budget Process Initiative has recommended.