Don't Use a Gimmick to Fund Our Highways

The House Ways and Means Committee just published its plan for a short-term fix to the Highway Trust Fund, which needs an additional $8 billion to fund highway construction through the end of the year. Unfortunately, it relies on a known gimmick called "pension smoothing," which technically raises revenue on net over 10 years but may cost money in future years. Lawmakers should not be using any gimmick, let alone a "pay-for" that may increase future deficits.

Since lawmakers have less than a month before disruptions occur, they may need to rely on a short-term patch while a long-term highway bill is being negotiated. To help, we published a list of options to offset a transfer of general revenue into the highway fund, which intentionally left off pension smoothing, even though it was used to "fund" the last highway bill, because it is a gimmick.

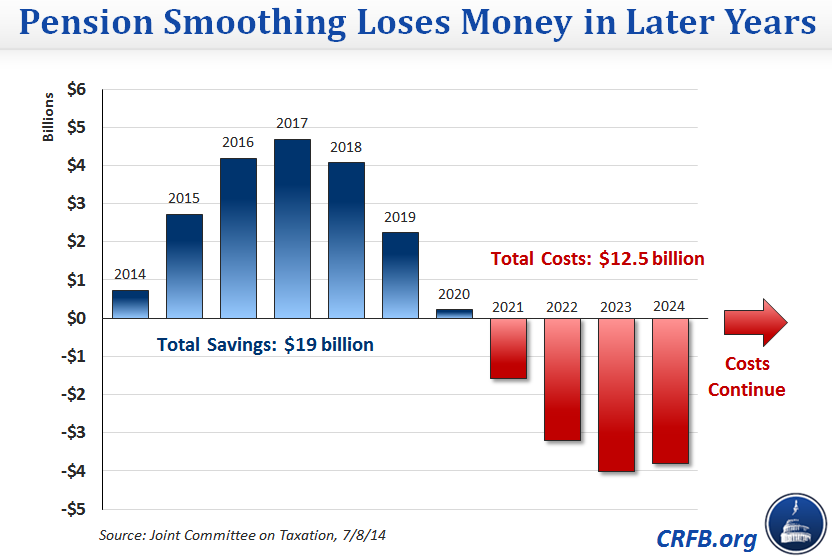

The Ways & Means plan raises $10.9 billion for the Highway Trust Fund: $6.4 billion from the pension smoothing gimmick, $3.5 billion from extending customs fees through 2024, and $1 billion transferred from an over-funded trust fund for leaking underground oil tanks. However, the pension smoothing money is entirely a timing shift that raises money upfront and transfers the costs beyond the 10-year budget window.

The pension smoothing provision temporarily reduces the amount that companies are required to pay into their pension funds. In the short term, companies have higher profits or employees have higher wages in lieu of the pension contributions. Taxes increase since companies show a higher profit and take fewer deductions for pension contributions; employees also have more taxable income. However, contributing less to pension plans now means that companies must make greater contributions in later years, thus increasing their deductions, reducing tax revenue, and increasing the deficit.

In addition, reduced pension payments mean further underfunding of single-employer pension plans, risking leaving taxpayers on the hook. A report released last week by the Pension Benefit Guaranty Corporation, a government entity that insures pensions, shows a 10-year deficit of almost $8 billion for single-employer plans, meaning that even before this gimmick it will have to dip into a revolving fund to guarantee benefits for failed plans.

The plan discussed by the Senate Finance Committee would transfer $8.4 billion and reauthorize highway programs through the end of December. That plan relied on real offsets by proposing to reduce the amount of uncollected taxes. The Ways and Means plan would raise $10.9 billion and reauthorize funding through the end of May. Unfortunately, the bulk of the money comes from a provision that does not save any money at all and may actually increase deficits over the long term.

Related Posts: