CBO Releases Additional Details on Social Security Projections

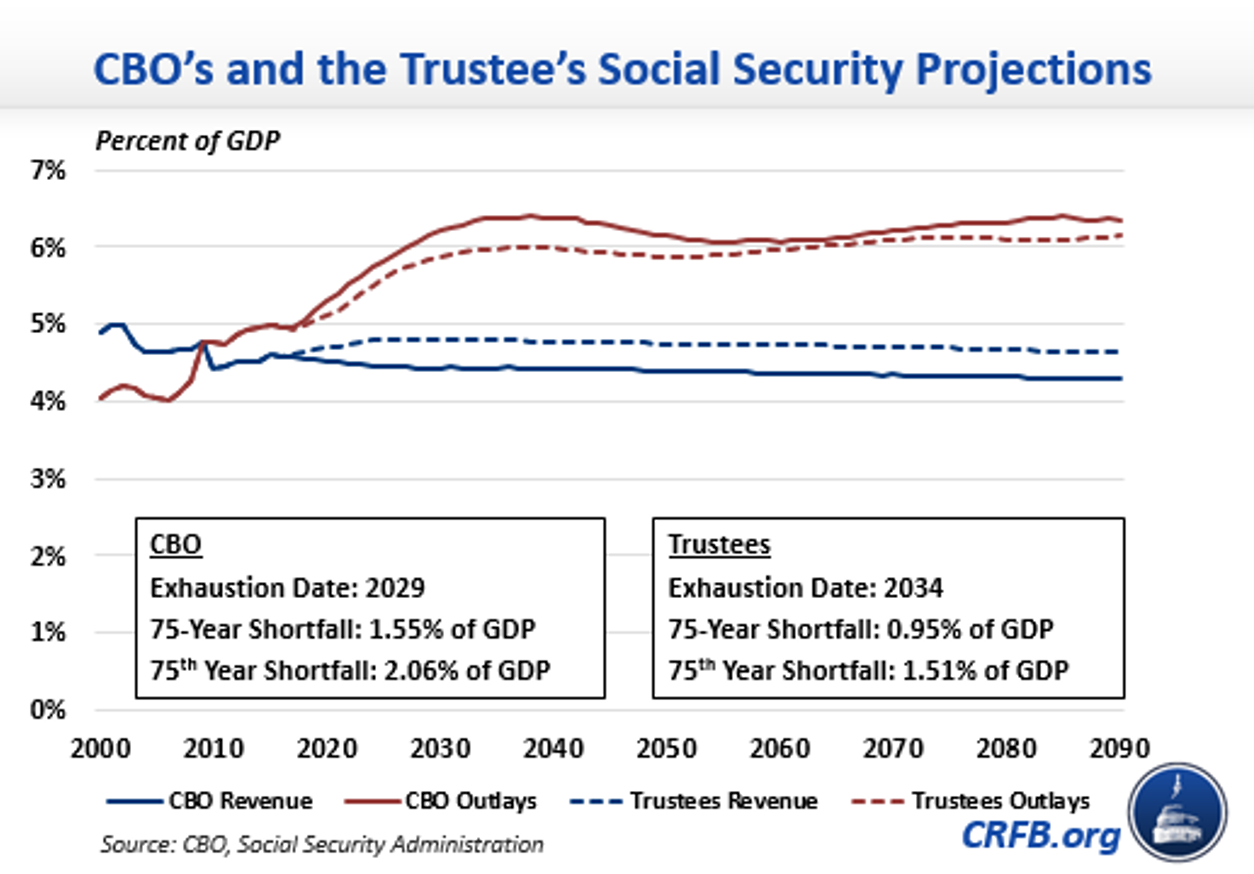

CBO's annual report on its long-term projections for Social Security continues to show a major shortfall for the program, even larger than the one projected by the Social Security Trustees. The report provides more detail on the projections included in CBO's 2016 Long-Term Budget Outlook, including detailed year-by-year data on the program's finances, as well as the distribution of benefits and payroll taxes among different groups.

CBO projects the combined Social Security trust funds will be exhausted in 2029 – five years earlier than the Social Security Trustees – when beneficiaries would face a 29 percent cut in benefits (our interactive tool showing users how they would be affected when the funds run out uses the Trustees' estimates). The Disability Insurance trust fund, which is currently benefiting from a short-term payroll tax reallocation from the larger Old-Age and Survivors Insurance (OASI) trust fund, will be exhausted by Fiscal Year 2022, at which point benefits will be cut by 20 percent. If lawmakers were to reallocate additional revenue from the old-age program, it would move the OASI trust fund’s exhaustion date from 2030 to 2029.

The exhaustion of the trust funds is due to the large and growing deficits that Social Security has run since 2010 and are on a path to continue running indefinitely. Spending on the program has already grown from 4.04 percent of GDP in 2000 to 4.97 percent today, and will only increase as the baby boomer generation continues to age and life expectancy rises. Outlays will reach 6.14 percent of GDP by 2029 and 6.35 percent by 2090. Meanwhile, tax revenues have fallen from 4.9 percent of GDP in 2000 to 4.59 percent today. CBO expects they will continue to decline as a share of GDP as the share of wages above the taxable maximum grows and the share of compensation received as earnings shrinks, declining to 4.43 percent by 2029 and 4.29 percent by 2090.

CBO estimates Social Security faces a 75-year shortfall of 4.68 percent of taxable payroll (1.55 percent of GDP), meaning it would require an immediate payroll tax increase of about 4.68 percentage points to make the program solvent for the next 75 years. Alternatively, solvency could be achieved by reducing benefits for current and future beneficiaries by 28 percent, or 33 percent for only new beneficiaries.

As we noted earlier this year, CBO projects a much larger shortfall than the Social Security Trustees, owing largely to differences in economic and demographic assumptions. CBO assumes greater improvements in life expectancy, lower fertility rates, a larger share of earnings above the taxable maximum, a smaller labor force, and lower interest rates (which lower the return earned by the trust fund and affect discount rates). In addition, around 30 percent of the difference has to do with differences in the two scorekeeper’s methodologies. CBO uses a microsimulation model that starts with data on individuals in a representative sample of the population and projects demographic and economic outcomes for that sample over time. The Social Security Trustees, meanwhile, utilize several different models, but predominantly use a cell-based approach that deals with groups rather than individuals.

Both CBO and the Trustees agree that Social Security faces a major financing shortfall and will be unable to pay full benefits within the next two decades. There are plenty of proposed solutions, but the longer lawmakers wait to take action, the harder it is to fix the program's finances.