Would Bonus Depreciation Grow the Economy and Pay For Itself?

The House passed legislation today to expand and make permanent the bonus depreciation rules that expired at the end of last year. A key argument for this proposal is that making bonus depreciation permanent would reduce the tax rate on capital and therefore encourage investment and faster economic growth. Some analysts have even found that economic growth would generate enough dynamic revenue to more than pay for the $287 billion cost of the legislation. At the same time, others have claimed that permanent bonus depreciation would not have any significant effect on the economy and would only add to deficits and debt.

A recent Joint Committee on Taxation (JCT) macroeconomic analysis aims to settle this debate. Using a variety of models, JCT finds that permanent bonus depreciation would in fact increase economic growth -- by an average of 0.2 percent over the next decade -- but would cost about the same as under conventional scoring.

JCT's analysis includes 6 different scenarios using two different economic models. The different scenarios are designed to account for differences in savings elasticities, monetary policy, and future fiscal policy to correct for the higher debt. All models find that permanent bonus depreciation would increase business capital -- by between 0.6 and 1 percent over the decade -- and as a result would modestly increase economic growth.

| Economic and Revenue Effect of Bonus Depreciation | |||||

| 2015-2019 | 2020-2024 | 2015-2024 | |||

| Percent Change in Business Capital | 0.4% to 0.5% | 0.8% to 1.4% | 0.6% to 1.0% | ||

| Percent Change in Residential Capital | -0.1% | -0.1% | -0.1% | ||

| Percent Change in Consumption | -0.1% to -<0.05% | 0.1% | -<0.05% to 0.1% | ||

| Percent Change in Real GDP | 0.1% | 0.2% to 0.3% | 0.2% | ||

| Percent Change in Total Receipts | -0.1% to <0.05% | <0.05% to 0.1% | -<0.05% to <0.05% | ||

| Dollar Change in Revenue (billions) | -$20 to $10 | $0 to $20 | -$20 to $20 | ||

Source: JCT, CRFB rough estimates

While JCT finds the economy would grow by about 0.2 percent over a decade, it expects revenue to increase by significantly less. This is in part because the areas of the economy that they expect to grow are simultaneously being given a tax break and effectively a tax deferral. As a result, one would expect some increase in revenue feedback over the long run (assuming fiscal policy compensated for the rise in debt). However, within the ten-year window, JCT finds that the economic impact of bonus depreciation will generate at most $20 billion, and in one scenario they find that it could actually lose revenue.

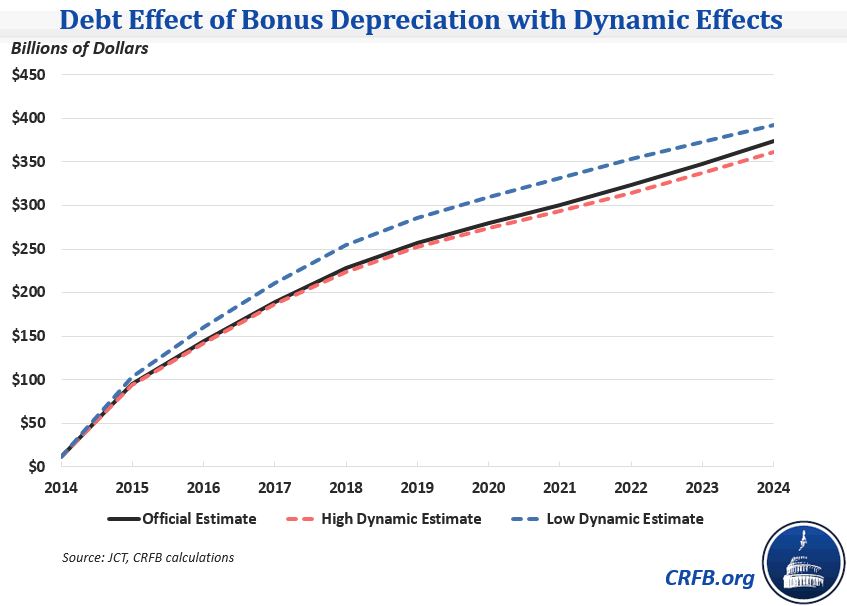

The graph below shows what the debt effect of bonus depreciation would look like incorporating the most and least optimistic revenue effect. Without economic effects, the provision would add $375 billion to debt over ten years (including interest), while incorporating the more optimistic and pessimistic estimates of the economic effects would lower that impact to $360 billion or raise it $390 billion. In other words, the economic feedback effect is relatively small within the decade.

The JCT analysis shows that there is a positive economic benefit to bonus depreciation, but it would not be nearly enough to compensate for the revenue loss from making the provision permanent. We've argued before that major changes to depreciations schedules should be addressed in the context of comprehensive tax reform, where decisions can be made on other cost-recovery issues, the deductibility of interest, overall tax rates, and the fiscal implications of reform.

If policymakers prefer not to pursue this approach, they should at least identify offsets to comply with PAYGO and avoid adding to the national debt.