Treasury Data Shows Other Countries Not Buying Additional Debt

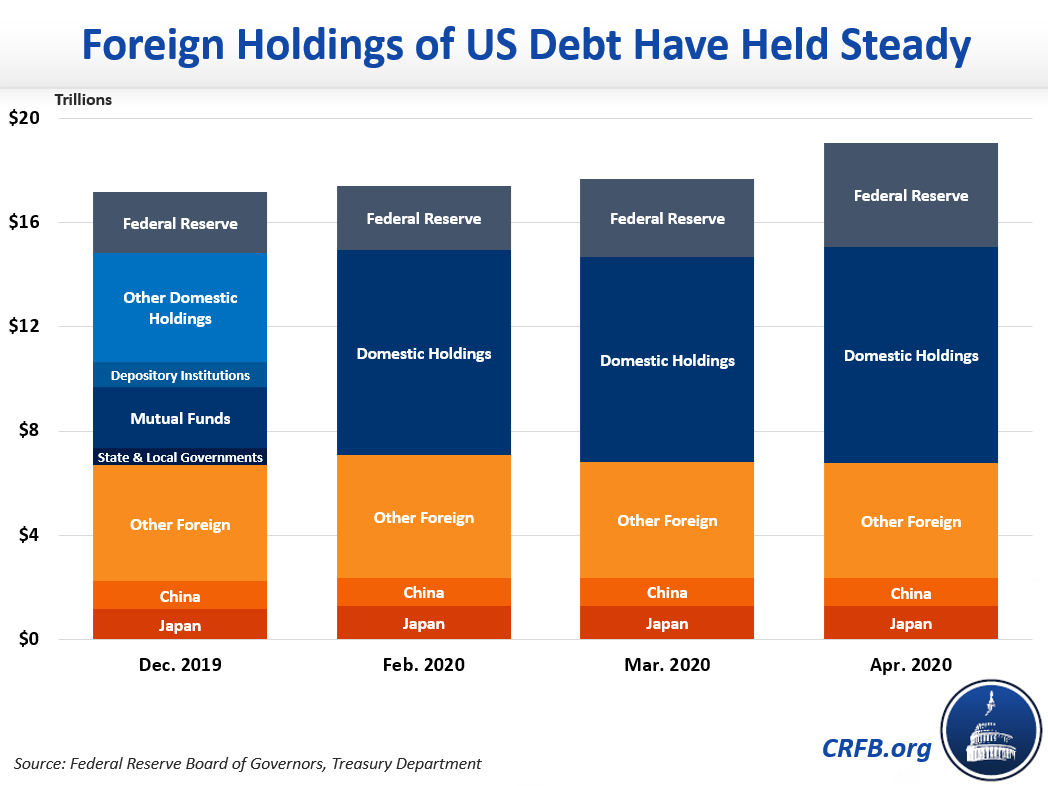

Total foreign holdings of United States debt held steady during the month of April despite the massive increase in government borrowing that took place over the same time period, according to data released today by the Treasury Department.

The federal government borrowed $1.4 trillion in the month of April, largely to finance the CARES Act and several other pieces of legislation to address the current pandemic and public health crisis. Over the same period, according to new data, foreign holdings decreased by $45 billion. This means that, on net, none of the additional debt was purchased by investors outside the U.S. About $1 trillion of the additional debt was indirectly financed by the Federal Reserve. The remaining $430 billion came from higher domestic holdings.

Because total foreign holdings of debt decreased from $6.81 trillion at the end of March to $6.77 trillion at the end of April while debt increased, the percentage of debt owned by foreign investors dropped from 38.5 percent in March to 35.5 percent in April.

While the total amount of debt held abroad remained relatively constant, some countries increased holdings and others decreased. The countries with the largest decrease in percentage terms were Saudi Arabia (21.2 percent) and France (11.4 percent). The countries with the largest percentage increases were Mexico and Kuwait, both increasing by 11.0 percent. Both Japan and China – the largest foreign holders of US debt – kept their holdings relatively steady, with slight decreases of 0.4 percent and 0.8 percent, respectively.

Importantly, Treasury's data shows the holdings by investors in each country, but that data does not distinguish between debt held by foreign governments and debt held by foreign individuals, businesses, or other investors.