Social Security Will Start Spending Trust Fund Reserves Next Year

The 2019 Social Security Trustees' report reminded us that Social Security faces large and rising imbalances, projecting that the theoretically combined trust funds will become depleted by 2035. They also project the program will hit an important (and unfortunate) milestone next year – it will have to start drawing down its trust fund.

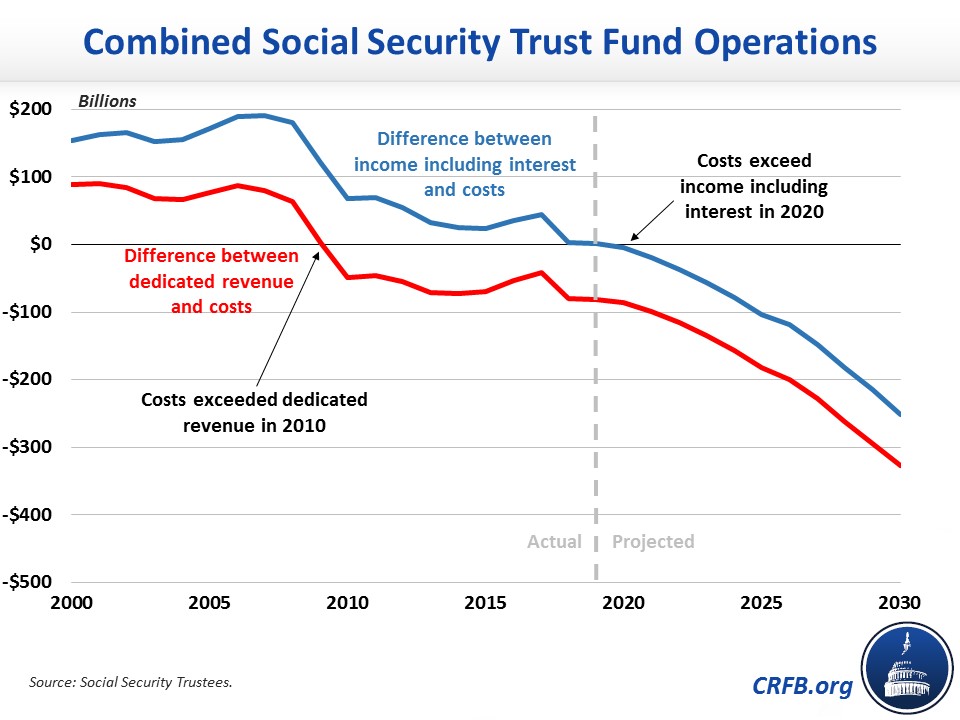

Social Security has been running cash-flow deficits since 2010, meaning the program is already spending more than it is bringing in through dedicated revenue. Those deficits have totaled $538 billion since 2010 and will be about $82 billion this year.

But up to this point, that shortfall has been covered by interest credited to the trust fund (paid from other parts of government) on its reserves. This year, the Trustees estimate that interest will be just enough to cover the gap: total income (including interest) will be $1.061 trillion, while total costs will reach $1.060 trillion. By next year, the Trustees project that relationship will reverse and the combined programs' finances will run a $4 billion deficit (including interest), drawing down the combined assets for the first time since 1981.

Over the next decade, the Trustees project Social Security will run $1.8 trillion of cash-flow deficits and have to draw down $964 billion of trust fund reserves. By 2035, there will be no reserves left. Without any change in the law, this would result in a 20 percent across-the-board benefit cut to bring revenues in line with spending.

These projections are a slight improvement from last year, when the Trustees projected Social Security would need to start drawing from its trust fund in 2018. Due to slightly higher payroll tax revenue and lower disability payments than anticipated, the program's income including interest actually exceeded costs by $3 billion. The same could occur in 2020, but it is highly unlikely after that – the Trustees project a $20 billion shortfall in 2021 and $37 billion in 2022.

The beginning of the drawdown of Social Security trust fund reserves next year underscores the cost of delayed action on sensible proposals to get the system on a path to balance. Going forward, tax increases and/or benefit cuts to current and new beneficiaries will only become more abrupt as lawmakers wait to deal with Social Security's financial woes.