Social Security Trustees Sound the Solvency Alarm

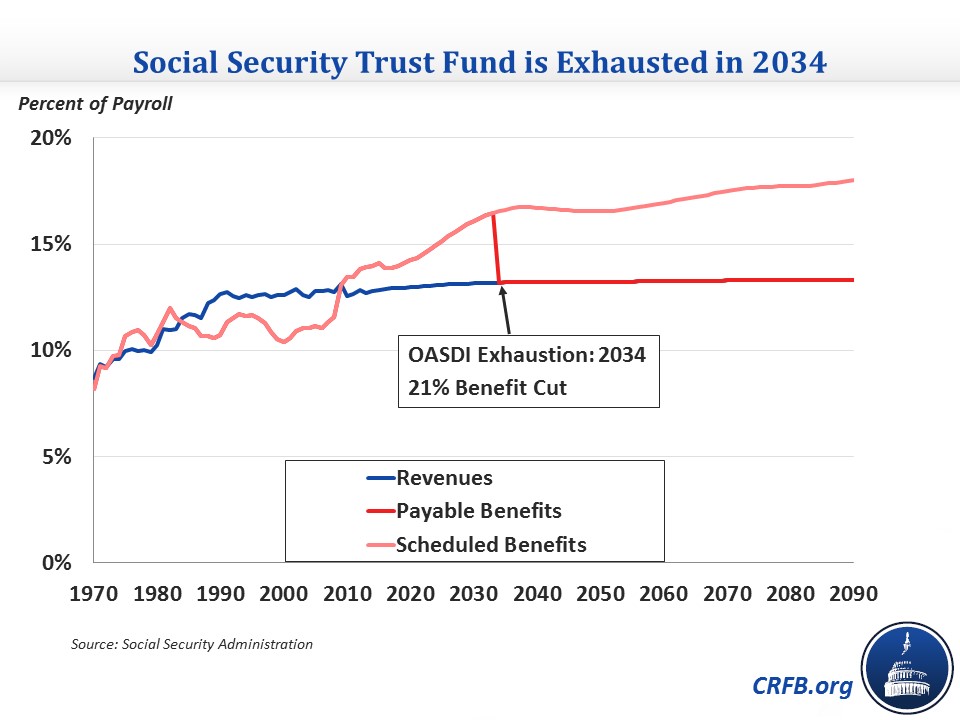

The Social Security and Medicare Trustees have released their reports on the long-term finances of each program, showing those programs remain financially unsound and on the road toward insolvency. The reports project the Social Security Disability Insurance (SSDI) trust fund being exhausted late next year, the Medicare Hospital Insurance Trust Fund to run dry in 2030, and the theoretically combined Social Security trust funds to deplete their results by 2034.

Overall, the Trustees project Social Security to be in somewhat better health than projected last year – when the insolvency date was 2033 – but still in need of a significant course correction.

According to the Trustees, Social Security faces a 75-year shortfall of 2.68 percent of payroll (0.96 percent of GDP), meaning the payroll tax would have to be raised immediately from 12.4 to about 15 percent to ensure 75-year solvency. By 2090, the payroll tax would need to rise further to about 17 percent. Alternatively, policymakers could reduce benefits by about 16 percent today, with reductions growing to 27 percent by 2090.

Absent reform, the combined trust funds are on course to run out of reserves by 2034, leading to an immediate automatic 21 percent benefit cut for all beneficiaries, growing to 27 percent by 2089. Of more immediate concern, the SSDI program is projected to run out of reserves in the fourth quarter of 2016, resulting in a 19 percent across-the-board benefit cut.

The 75-year shortfall projected by the Trustees is 0.2 percent of payroll smaller than the 2.88 percent of payroll shortfall they forecasted last year. This decrease is largely due to more favorable economic assumptions – largely from higher wage growth due to slower health insurance premium growth – and improved projection methods and data involving the earnings of older workers, Social Security coverage of certain immigrants, and taxation of benefits. Other changes include President Obama's executive actions on immigration, which slightly improved projections, and small changes in fertility and mortality rates. Finally, shifting the 75-year projection window forward one year widens the shortfall by 0.06 percent of payroll.

| Change in 75-Year Balance Since Last Year (Percent of Payroll) | |

| Effect on 75-Year Shortfall | |

| 2014 Report's 75-Year Shortfall | -2.88% |

| Legislation/Regulation | +0.02% |

| Change in Valuation Period | -0.06% |

| Demographic Data and Assumptions | -0.03% |

| Economic Data and Assumptions | +0.10% |

| Disability Data and Assumptions | 0.00% |

| Methods and Program Data | +0.17% |

| 2015 Report's 75-Year Shortfall | -2.68% |

Source: Social Security Administration

The Trustees report shows the need to take action to ensure Social Security's solvency sooner rather than later. The impending insolvency of the SSDI trust fund with a year and a half is of particular concern. Yet even if lawmakers relay on reallocation or some other means to keep the Disability Insurance program solvent, the combined trust funds are projected to run out of money within two decades.

As we've explained before, waiting to address this problem literally makes it larger, and also gives workers and beneficiaries less time to plan and adjust. Reforming Social Security is easy, and policymakers should act soon to do so.

CRFB will provide more detailed analysis of the Trustees report in the coming days.