Social Security May Be In Worse Shape Than Trustees Suggest

The Social Security Trustees made their projections last week showing the program's sizeable shortfall and its trust fund's insolvency date, but there are other projections that show a more dire state. The Congressional Budget Office (CBO) and the Social Security Advisory Board's Technical Panel on Assumptions and Methods also produce their own long-term estimates of Social Security's benefits, revenue, and insolvency date. There are many different assumptions regarding things like birth rates, life expectancy, income growth, income distribution, inflation, and interest rates, so not surprisingly each projection has different estimates of the 75-year shortfall and the insolvency date. The Trustees' assumptions, while reasonable, are the most favorable, and the Technical Panel and CBO both show much larger shortfalls and earlier insolvency dates.

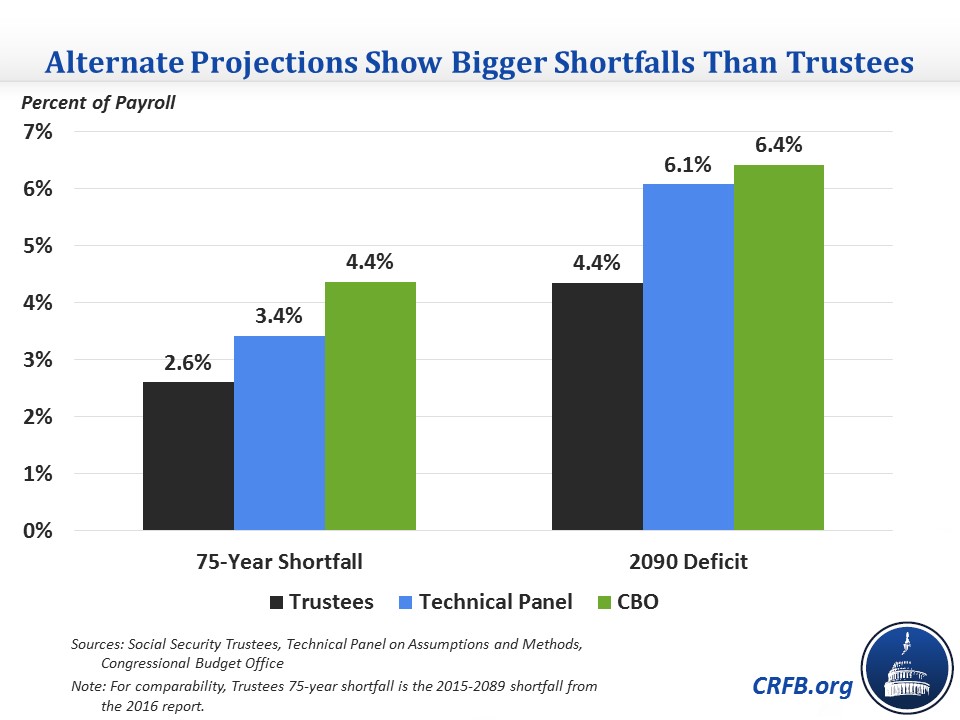

The Trustees' intermediate scenario shows the combined Social Security trust funds being exhausted in 2034, a 2.6 percent* of payroll 75-year shortfall, and a 2090 deficit of 4.35 percent. The Technical Panel last year estimated worse numbers: a 3.42 percent of payroll shortfall, a 6.08 percent deficit in 2090, and a trust fund exhaustion date one year earlier at 2033. CBO's numbers were worse than that: a 75-year shortfall of 4.37 percent of payroll, a 2090 deficit of about 6.4 percent, and an insolvency date of 2029 – five years earlier than the Trustees.

Both CBO and the Technical Panel use some different economic and demographic assumptions that are generally less favorable. The Technical Panel's main differences are demographic: it expects lower fertility rates and longer life expectancy. To a lesser extent, lower real interest rates, inflation, and taxable earnings also contribute to a larger shortfall, while higher immigration slightly lowers the difference. Because the differences in demographic assumptions generally take a long time to play out, they have a greater effect on the Technical Panel's long-term deficits than the insolvency date.

CBO also has less favorable demographic assumptions – it has higher life expectancy and a higher disability rate than even the Technical Panel – but also has notably worse economic assumptions as well. In particular, it expects a much lower share of earnings to be subject to the payroll tax and interest on trust fund bonds to be lower. These economic differences have a much greater effect in the short term than the demographic differences, leading to an earlier trust fund insolvency date.

Thus, both CBO and the Technical Panel find that lawmakers have less time to extend trust fund solvency and would need to enact larger tax increases or spending cuts to ensure 75-year solvency. Comparing CBO and the Trustees, CBO projects insolvency to come in 2029 instead of 2034, with beneficiaries receiving a 29 percent benefit cut instead of a 21 percent cut. According to CBO, lawmakers could prevent insolvency over the next 75 years with a one-third tax increase or a one-quarter benefit reduction, compared to a 21 percent tax increase or 16 percent benefit reduction according to the Trustees. Eliminating the payroll tax cap and crediting benefits on that new income would close about 70 percent of the shortfall according to the Trustees but less than half of the shortfall according to CBO.

| Comparing the Trustees and CBO | ||

|---|---|---|

| Trustees | CBO | |

| Insolvency Date | 2034 | 2029 |

| Automatic Benefit Cut At Insolvency | 21% | 29% |

| Benefit Cut Needed for 75-Year Solvency | 16% | 24% |

| Tax Increase Needed for 75-Year Solvency | 21% | 35% |

| Shortfall Closed From Eliminating Tax Cap | 72% | 41% |

Source: Social Security Trustees, Congressional Budget Office

These alternative estimates show the importance of acting on Social Security sooner rather than later so that deterioration in the program's finances doesn't force the need for sudden changes. They also show the importance not just of making changes to ensure solvency based off current projections but also of making changes that can mitigate the effect of developments – like longer life expectancy or erosion of taxable payroll – that would worsen the program's financial status. Making these kinds of changes can ensure "robust solvency" that still results in a financially sustainable system despite adverse revisions to projections.

*For comparison purposes, we use the 2015-2089 75-year shortfall rather than the current 2016-2090 window, which shows a 2.66 percent of payroll shortfall.