Sequester Relief is Too Costly to Add to the Credit Card

During the busy end to the year, lawmakers enacted a continuing resolution (CR) to keep the government funded through January 19. When that CR ends, they will likely move to raise the discretionary caps that currently apply to Fiscal Years (FY) 2018 and 2019, with reports from last month indicating that the deal could provide sequester relief of $200 billion or more over the next two years. Lawmakers should offset this sequester relief or they will set the stage for a nearly $1.2 trillion deficit increase over ten years, almost as costly as the tax cut passed in December. As we have shown, there are many budget options available to use as offsets.

Reports last month indicated that policymakers were discussing a combination of adjustments to the discretionary spending caps and increases in Overseas Contingency Operations (OCO) spending totaling $230 billion over two years. For FY 2019, the deal would increase defense spending by $63 billion per year and non-defense by $52 billion, the equivalent of fully repealing the sequester caps and adding another $9 billion to defense and $15 billion to non-defense annually. While the final deal may differ from this report, is seems likely to cost at least $100 billion per year.

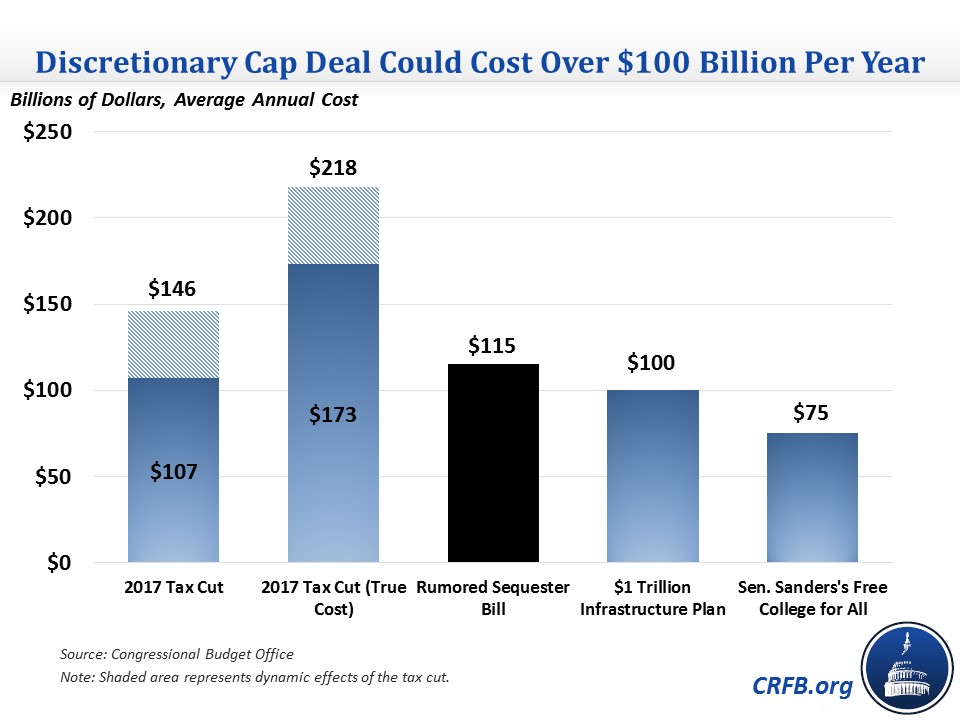

While $230 billion might not seem so large relative to the $1.5 trillion cost of the recent tax cut, in reality it is comparable. The $230 billion price tag understates the true cost, since it describes the ten-year cost of only two years' worth of policy action. The $115 billion annual cost of this package would be the same order of magnitude as the tax cut or larger than other major proposed initiatives.

If lawmakers continued sequester relief beyond this deal rather than allowing a massive drop-off in spending after two years, total discretionary spending would increase by nearly $1.2 trillion over ten years. In other words, sequester relief could be 80 percent as large as the $1.5 trillion tax cut package lawmakers charged to the national credit card last year ($1.2 trillion would actually be larger than the $1.1 trillion dynamic cost of the bill, though it would be smaller than the $1.6 trillion to $2.2 trillion potential "true cost" of the tax bill if its expiring provisions were extended and backloaded offsets were removed).

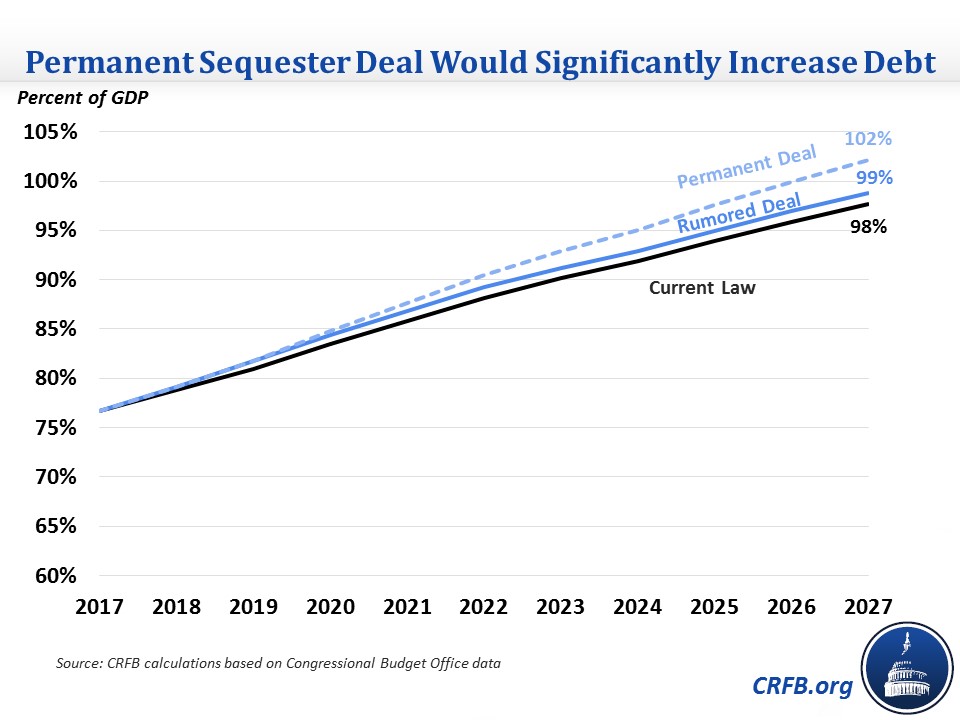

If $1.2 trillion of sequester relief were passed without offsets, debt would soon exceed the size of the economy, rising from 77 percent of Gross Domestic Product (GDP) this year to 102 percent of GDP by 2027.

Fortunately, the cost of the sequester deal need not be added to the national debt. Since 2013, lawmakers have enacted three different sequester relief packages, all of which paid for increases in discretionary spending with future changes to mandatory spending and receipts (at least on paper – some gimmicks were used).

Re-establishing the precedent of fully offsetting sequester relief would allow lawmakers to responsibly increase defense and non-defense spending while actually reducing long-term deficits.

Lawmakers have many options available to offset this sequester relief in a bipartisan way. Our Mini-Bargain to Improve the Budget, for example, included over $500 billion of bipartisan mandatory savings and receipts with the potential for bipartisan support that could be used to help offset sequester relief. Among the options: lawmakers could adopt a more accurate measure of inflation to index spending as has already been done on the tax side; reduce overpayments in Medicare and Medicaid; increase Medicare premiums for high earners; reform student loan programs; adjust federal employee retirement benefits; reduce farm subsidies; increase various premiums and user fees; and replace the current mandatory spending sequester with more stable and permanent changes to Medicare reimbursements.

Short descriptions of these proposals are available in our Mini-Bargain to Improve the Budget.

Options from Our Mini-Bargain to Finance Sequester Relief

| Policy | Ten-Year Savings |

|---|---|

| Index Non-Social Security Spending Using Proper Measure of Inflation | $80 billion |

| Replace Mandatory Sequester With Permanent Spending Rebasing | $30 billion |

| Rescind Funds from Crime Victims Fund | $10 billion |

| Extend and Expand Medicare Means-Tested Premiums | $50 billion |

| End Medicare Reimbursement for Bad Debts | $50 billion |

| Reduce Provider Payments and Drug Prices; Enact Other Medicare Reforms | $100 billion |

| Restrict Abuse of Provider Taxes and Enact Other Medicaid Savings | $50 billion |

| Consolidate Income-Based Repayment Programs and Enact Other Student Loan Reforms | $50 billion |

| Adjust Federal Employee Retirement Contributions and Benefits | $50 billion |

| Reduce Farm Subsidies | $25 billion |

| Increase Pension Benefit Guaranty Corporation Premiums | $10 billion |

| Increase and Enact Certain User Fees and Sell Certain Federal Assets | $15 billion |

| Total Savings | $520 billion |

| Memorandum: Off-Budget Savings Options | |

| Index Social Security Using Proper Measure of Inflation | $120 billion |

| Strengthen and Improve Social Security Disability Insurance | $25 billion |

Lawmakers could also look to revenue options to help finance sequester relief. For example, closing loopholes related to carried interest and reasonable compensation for S-corporations could easily raise $10 billion to $20 billion each. Cutting tax breaks not addressed in the final tax bill last year could easily raise tens or hundreds of billions of dollars more.

Lawmakers should also close new loopholes that have arisen as a result of the recent tax bill – for example, those related to avoidance of the limit on the state and local tax deduction or reclassification to take advantage of the lower pass-through rate. They could also consider scaling back some of the tax cuts within the bill. Ideally, any of these changes should be used to reduce the deficit and help offset the cost of the tax law rather than to pay for other priorities.

Of course, these options are just a sample of what lawmakers could use. There are countless deficit reduction options in health care and other mandatory programs that were not included in the mini-bargain and numerous revenue options that could be used to offset the cost of sequester relief. Importantly, offsets should be real – using gimmicks to offset new spending is no better than not offsetting it at all.

An unoffset or gimmick-ridden sequester deal would not only add a couple hundred billion dollars to the debt, it would also the set the stage for almost one trillion more of increased spending and open the door to even further increases in the deficit. Lawmakers need to re-establish the precedent of paying for priorities like sequester relief and break their addiction to the debt.