Senators Push Back Against Current Policy Gimmick

Update: JCT issued a response to the letter confirming the default approach to scoring tax legislation is using a current law baseline as established by the Congressional Budget and Impoundment Control Act of 1974. Though JCT provides revenue estimates relative to its current law baseline, it also provides estimates based on alternative assumptions, including current policy, upon request. JCT clarified there is no agreed upon current policy baseline so members of Congress must set the parameters when making such a request. Regarding specific provisions, JCT asserted that extensions of the Tax Cuts and Jobs Act (TCJA), child tax credit, and Affordable Care Act premium tax credits would typically be scored against the current law baseline unless directed otherwise by policymakers.

A group of senators are pushing back against efforts to use a current policy baseline to extend expiring Tax Cuts and Jobs Act (TCJA) provisions through reconciliation without recognizing the deficit impact. In a recent letter to the Joint Committee on Taxation (JCT), Senator Elizabeth Warren (D-MA) and colleagues Catherine Cortez Masto (D-NV), Michael Bennet (D-CO), Mark Warner (D-VA), and Peter Welch (D-VT) sought clarity on how JCT has historically applied baselines and whether lawmakers could manipulate the process to mask the true fiscal impact of extending TCJA.

The letter explains that TCJA included policy expirations precisely because lawmakers wanted to stay within the $1.5 trillion deficit increase reconciliation instruction at the time. If instead the bill had been scored to assume the provisions would not be allowed to expire, it would not have complied with reconciliation limits.

The letter correctly criticizes a potential switch to a current policy baseline for TCJA extensions:

This is magic math. The deficit cost of tax cuts is real, even for those who do not like the way the math works… Measuring the cost of a tax bill requires a baseline to evaluate the bill against – and by law, that baseline has been “current law.” A “current law” baseline means that if a tax cut is set to expire, as much of the TCJA will under law, extending the tax cut costs money… All costs must be counted at some point, and since the full cost of TCJA was not counted in 2017, it must be accounted for now…

The letter poses five questions to JCT:

- Is JCT’s default approach to scoring tax legislation to score it on a current law baseline or a current policy baseline? How long has this been the Committee’s approach?

- Has JCT ever produced a score on a current policy baseline for official use on the Senate floor?

- Assuming JCT were not directed by members of Congress to score the bill in a particular way, would JCT use a current law baseline or a current policy baseline to score a 10-year extension of TCJA?

- If JCT were to employ a current policy baseline, would you have estimated a budgetary impact from an extension of the child tax credit expansion from the American Rescue Plan Act (ARPA)?

- If JCT were to employ a current policy baseline, would you estimate a budgetary impact from an extension of the Affordable Care Act (ACA) enhanced insurance premium tax credit, which is otherwise set to expire in 2025?

These questions rightly point to the fact that all previous reconciliation legislation was scored with a current law baseline, and switching now would set a fiscally dangerous precedent that would encourage lawmakers to use this gimmick in the future to ignore the deficit increases from other policies.

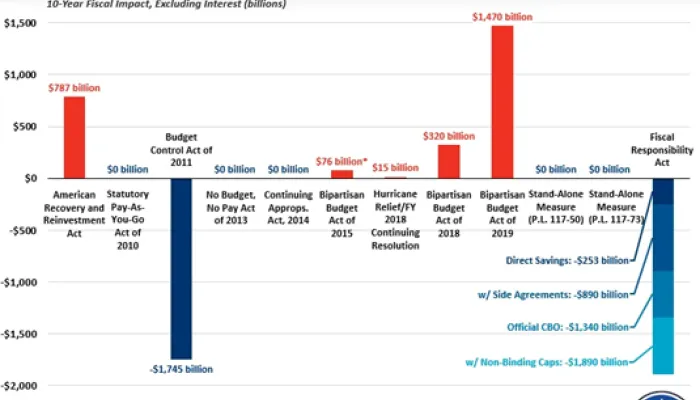

With the national debt on track to reach record highs, it is critical that lawmakers focus on deficit reduction and at a minimum fully offset any tax cuts or spending increases. Switching to a current policy baseline for extending TCJA provisions permanently would allow lawmakers to hide $3.4 trillion to $4.6 trillion of borrowing over the next decade and trillions more beyond.

As we’ve explained before, switching to the use of a current policy baseline for TCJA is a gimmick that would upend the reconciliation process.

You can see our recent work explaining the switch to a current policy baseline here, here, and here. You can read all of our reconciliation and budget resolution work on our 2025 Reconciliation Resources page.