Second Half of the Year Means Plenty of Fiscal Speed Bumps Ahead

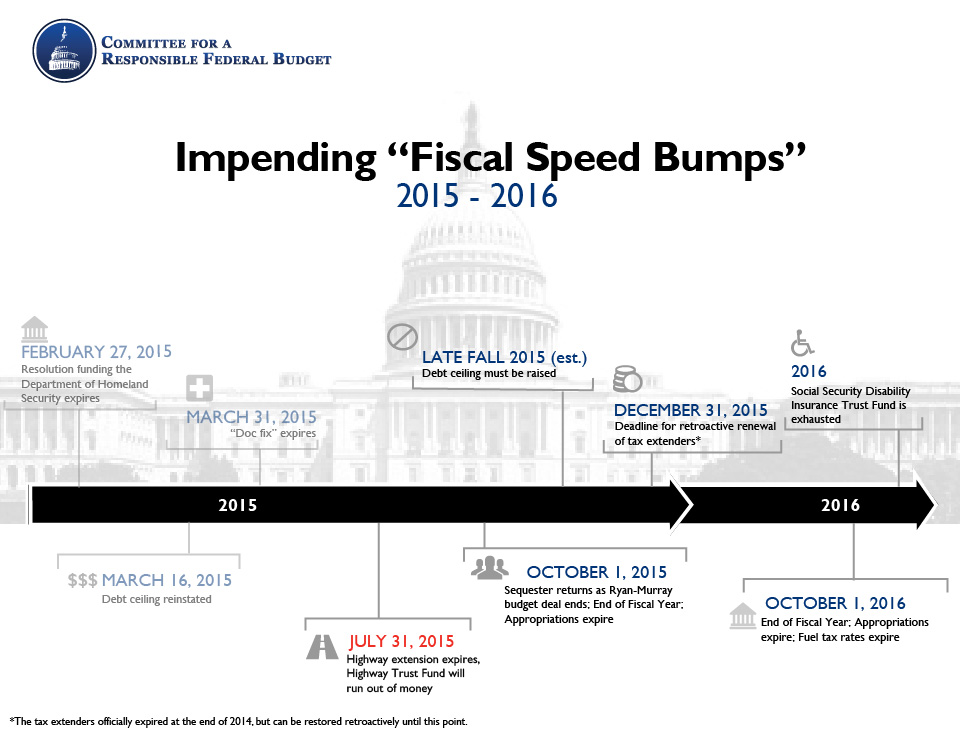

As we move past the midpoint of 2015, several fiscal deadlines are fast approaching. Congress is preparing to act on two important Fiscal Speed Bumps in Congress: the pending insolvency of the Highway Trust Fund, and the upcoming deadline for the retroactive renewal of tax extenders. Our updated infographic illustrates these and other Fiscal Speed Bumps ahead.

The U.S. House of Representatives on Wednesday passed the bill extending highway funding through December 18. The transportation package, introduced by House Ways and Means Chairman Paul Ryan (R-WI), replenishes the Highway Trust Fund by $8 billion. To offset the $8 billion cost, the bill includes provisions such as adjusting tax filing deadlines for businesses, extending the current dedication of TSA fees to deficit reduction, increasing reporting requirements for outstanding mortgages, and requiring the value of an estate to be reported the year that it is inherited.

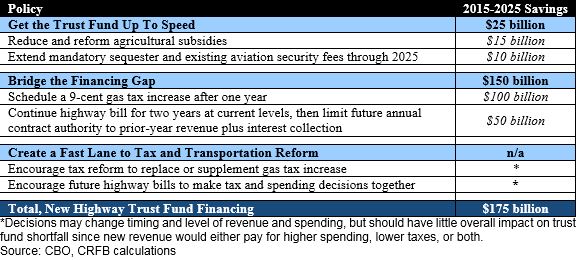

As we noted in a statement, it is encouraging to see that Congress is looking to adopt responsible offsets rather than resort to budget gimmicks like pension smoothing, but lawmakers still need to find a long-term solution that brings highway spending and revenue into alignment. Since 2001, spending from the Highway Trust Fund has consistently outpaced revenues, resulting in a projected shortfall of nearly $175 billion over the next 10 years. We have already released a comprehensive plan – the Road to Sustainable Highway Spending – representing one possible way to close the shortfall responsibly and permanently.

Other Congressional action focuses on the tax extenders – a set of temporary tax breaks that are generally extended for a year or two at a time – could be scheduled for a mark-up next week by the Senate Finance Committee. There are about 55 extenders that expired at the end of 2014, and lawmakers may choose to extend some or all of these provisions. Renewing the tax breaks could be very costly if not offset; last year's one-year retroactive extension cost $42 billion. Ideally, Congress should address these extenders as part of a broader discussion about the need for a comprehensive tax reform, but at the very least they should offset any extensions they make. When we released our PREP Plan, it contained a section on how to pay for tax extenders on a temporary (2-year) basis as a bridge to tax reform.

Summary of the PREP Plan Extenders Package

| Policy | Ten-Year Savings |

| Extend "Tax Extenders" to 2015 | $83 billion |

| Improve Tax Enforcement | -$35 billion |

| Close Tax Avoidance Loopholes | -$45 billion |

| Restrict Inversions | -$3 billion |

| Total Offsets | -$83 billion |

| Set Up Fast Track Process for Comprehensive Tax Reform | TBD |

Meanwhile, other deadlines loom. The annual appropriations process has stalled ahead of the September 30 deadline, and no negotiations over the sequester have taken place yet, meaning a continuing resolution or government shutdown is likely. Stay in the loop on the latest developments with our Appropriations Watch. In addition, higher-than-expected revenue growth may have moved back slightly the deadline to raise the debt limit until late this year, which could coincide with the potential new highway deadline and action on appropriations.

These Fiscal Speed Bumps present unique opportunities for lawmakers to pursue substantive reforms that will grow the economy and improve the fiscal trajectory of the country. Instead of constantly kicking the can down the road, Congress needs to find solutions. At the very least, legislators should not use these speed bumps as an opportunity to add to the national debt.