On Reinhart and Rogoff

Harvard professors Carmen Reinhart and Kenneth Rogoff’s (R&R) 2010 paper, Growth in a Time of Debt, has been all over the news in the past few weeks due to a critique of their methodology by a team of University of Massachusetts-Amherst economists. Since the R&R study has been frequently cited as an argument in support of fiscal responsibility, we reviewed the critique of the paper, the two authors' response, implications of high debt levels, and other studies that examine the relationship between government debt and the economy.

The Reinhart and Rogoff Paper

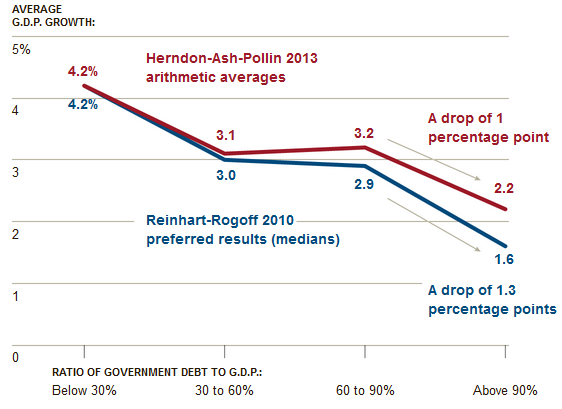

For those who haven’t followed the controversy, R&R used an extensive data set of advanced economies to show that countries with gross government debt levels above 90 percent experienced a sharp drop off in economic growth rates. Their analysis grouped data into four "buckets" – instances with debt levels less that 30 percent of GDP, between 30 percent and 60 percent, between 60 percent and 90 percent, and greater than 90 percent – and then determined mean growth rates (as well as median growth rates), with the findings showing a strong negative correlation between debt and GDP growth rates. The study proved particularly influential not only for finding a relationship but for finding a nonlinear relationship: a sharp drop-off in growth rates at 90 percent.

However, a recent critique from Thomas Herndon, Michael Ash, and Robert Pollin (HAP) of the University of Massachusetts-Amherst had two methodological concerns in the report along with an Excel coding error that R&R have since acknowledged as a clear mistake. R&R accidentally excluded five countries from their calculation of the mean and one of these countries, Belgium, contributed to the high debt category. But the coding error wouldn't change the findings significantly; the HAP authors calculate that fixing the Excel error would raise the mean growth rate of high debt countries by 0.3 percentage points. The main dispute is with the other two methodological concerns, which R&R have defended.

First, the HAP authors argue that the R&R paper did not include data for three countries – Australia, New Zealand, and Canada – for the first five years of the study. Second, they take issue with R&R's use of average growth rates for each country over pooling the data and then taking average – which could potentially make the result susceptible to outliers or countries with small data samples. The HAP authors find that after adjusting for their three concerns (and a minor transcription error), average growth rates for the 90 percent category would be 2.2 percent, instead of the -0.1 percent average in the R&R paper.

The duo has responded to these concerns in an email response and in a New York Times op-ed and technical appendix. They write that the excluded data had just been recently acquired and had not been vetted. As it turns out, some of that recently acquired data may have had serious flaws, and a later R&R study used revised data. Other gaps in the data set were also present due to inconsistencies among data sources, including debt and growth rates Spain in the 1960's, which would have strengthened R&R's argument with debt levels below 30 percent and economic growth over 6 percent. This is a familiar problem with using old historical data as sources may greatly differ on estimates and possible inaccuracies may require judgment calls about what to include.

On the weighting issue, they defend their methodology as an attempt to reduce the excessive effect of countries like Japan and Greece, which have persistently had high debt levels, on the study's results. The R&R method would reduce impact of country-specific characteristics (like structural problems or high savings rates) on the relationship between debt and economic growth. As Reinhart and Rogoff argue, "Our approach has been followed in many other settings where one does not want to overly weight a small number of countries that may have their own peculiarities." In reality, no weighting mechanism is perfect and the choice of the mechanism will depend on what the author is trying to investigate as well as potential biases in the data.

R&R also present two additional defenses of their conclusion. First, they point out that they generally rely on median rather than mean change – which would reduce the effect of the HAP concerns on the paper’s results – since this approach corrects for potential outliers. Second, as they demonstrate in the graph below, the HAP methods and results actually lead to the same conclusion as the R&R paper – that countries with higher debt levels experience slower economic growth.

Source: New York Times (Reinhart and Rogoff)

The Reality of High Debt Levels

With the Reinhart and Rogoff paper now in question, what does this new information mean? While the HAP report finds no evidence of a 90 percent "debt cliff" after making their adjustments, it does find a negative correlation between debt and GDP. This conforms with the standard theory in normal economic times -- as debt rises, economic growth slows as debt "crowds out" private investment. This was the central point behind a recent post from former OMB Chief Economist Joe Minarik, on his "Back in the Black" blog. Minarik gave four reasons why a nation would be better off with a smaller debt stock, then a larger one:

- I’d rather spend my scarce tax dollars on something other than debt service.

- I want flexibility to respond to problems like the financial crisis.

- I don’t like to worry about a financial meltdown.

- There is a relationship – not a cliff, but a meaningful slope – between debt and growth.

Some have taken the HAP paper as a victory for Keynesians and a loss for so-called "austerians." But there is no need to divide the policy world into opposing camps. The original paper's findings should not have done that, and neither should the review of the study. As Holman Jenkins writes in The Wall Street Journal:

As much as some try to invent a fierce debate between "austerians" and advocates of stimulus, the policy consensus, in fact, has been strikingly solid. Michael Kinsley nicely demonstrates in a Los Angeles Times column that even Paul Krugman and his bête noire, deficit hawk Pete Peterson, have been saying the same thing: NO to immediate fiscal stringency, YES to long-term reform.

The U.S.'s long-term fiscal outlook is troubling, but engaging in austerity would largely be counterproductive and likely wouldn't address the drivers of our long-term problem anyway. Lawmakers need to strike a careful balance between these two concerns and this can easily be lost if the takeaway is either that we shouldn't worry about debt or that austerity would do no harm - sequestration is evidence of that. Smart deficit reduction plans often reduce short-term austerity while making progress on long-term fiscal sustainability, the recently released Simpson-Bowles plan is such an example.

Other Research and Studies Confirm Risk of High Debt

Regardless of the criticism of the R&R study, there is still strong evidence from many other studies that shows a negative relationship between debt levels and economic growth, using more sophisticated econometric techniques than "Growth in a Time of Debt." Economists from the CBO, IMF, OECD, and academic institutions have investigated the relationship between debt and growth, generally coming to the consensus that higher debt slows growth due to crowding out effects.

- The Congressional Budget Office: Economists at the CBO have warned of both slower growth and an increasing probability of a fiscal crisis with high debt levels. In one simulation, the Macroeconomic Effects of Alternative Budget Paths, CBO projected that a $2 trillion deficit increase package would slow output (measured by GNP) by nearly 1 percent by 2023, although it would boost in the short term.

- Manmohan Kumar and Jaejoon Woo of the International Monetary Fund: In a study of advanced economies from 1970 to 2007, economists at the IMF found that a 10 percentage point increase in countries debt level corresponds with a 0.15 percent lower growth rate of GDP, largely due to "crowding out" and a reduced capital stock.

- Stephen Cecchetti, M S Mohanty, and Fabrizio Zampolli of the Bank of International Settlements: Using data for 18 OECD countries from the last three decades, economists at the Bank of International Settlements found thresholds for corporate, household, and government debt, beyond which increased debt is associated with slower growth. For government debt, this threshold is roughly around 85 percent of GDP, beyond which a 10 percentage point increase is associated with a 0.1 percentage point reduction in growth rates.

- Jorgen Elmeskov and Douglas Sutherland of the OECD Economics Department: This study focuses on "debt overhangs," long periods of persistently high debt levels. Debt levels are associated with higher interest rates, and at higher debt levels dramatic fiscal consolidation may be needed to put debt on a stable or downward path, which could further reduce growth.

- David Greenlaw, James Hamilton, Peter Hooper and Frederic Mishkin: Similar to the OECD study, this paper also estimates a tipping point for debt at around 80 percent, at which point an interest rate and interest payment spiral may quickly cause the fiscal outlook of a country to become unsustainable.

Reinhart and Rogoff's famous paper should be re-examined in light of the new critique, but the established relationship between debt and economic performance has not changed. Economic growth is expected to slow as debt levels rise higher, and although evidence of a key threshold may be hard to find, current projections for the federal government show that debt is on an unsustainable upward path.

Although it is impossible to know the “tipping point,” there is no question that increasing debt cannot be sustained forever. As Reinhart and Rogoff say, “Debt is a slow-moving variable that cannot – and in general should not – be brought down too quickly. But interest rates can change rapidly." Importantly, the longer we delay to enact changes to right our course, the tougher and more abrupt those changes will need to be. For these reasons, it would be far preferable to enact changes today which phase in very slowly (even reversing much of the immediate austerity currently in place) and are designed on a whole to promote rather than inhibit overall economic growth.