New Paper Shows We Are Getting Close to a Tipping Point on Debt

Today, a new paper was presented at the U.S. Monetary Policy Forum by David Greenlaw, James Hamilton, Peter Hooper and Frederic Mishkin on a possible tipping point for government debt as a share of the economy, past which a country may be vulnerable to a self-reinforcing cycle.

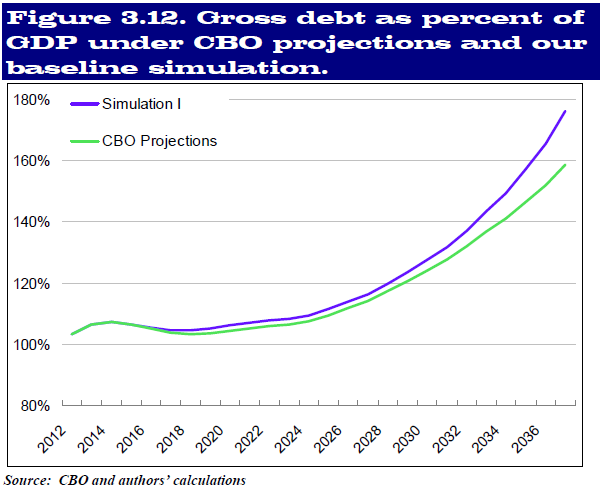

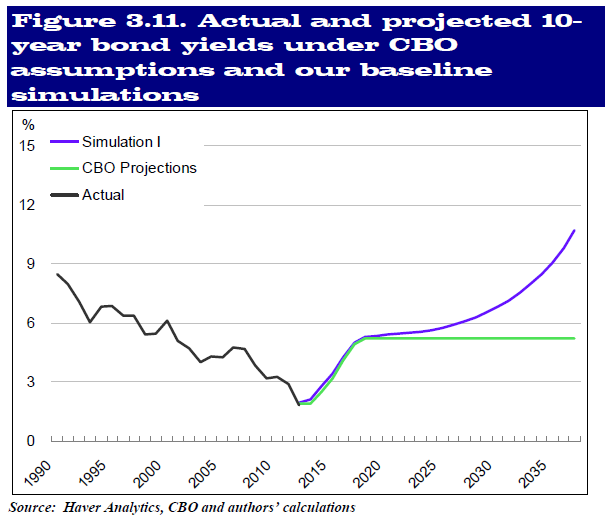

The paper examines 20 industrialized countries and analyzes how borrowing costs change based on certain levels of debt. Beyond net public debt levels of 80 percent of GDP, borrowing costs begin to rise exponentially to the point that countries may fall into "a debt trap" that is difficult to escape. This happens because lenders demand higher interest rates, leading to higher interest payments and debt. Based on the authors' calculations of net public debt (which appear to be a slightly different meaure than used by OMB and CBO) the U.S. was at the 80 percent threshold in 2011. The effects of rising borrowing costs on debt can be seen in the graph below, where CBO projections are compared to a simulation that doesn't assume constant interest rates as CBO does in its model.

Many papers have studied tipping point or thresholds beyond which a fiscal crisis could take place or economic performance would languish. A paper from Carmen Reinhart and Kenneth Rogoff found that gross debt levels above 90 percent, which the U.S. has already reached, could reduce growth. Other reports from CBO, the IMF, Cecchetti, and others have found similiar effect of debt on growth. The thresholds found in these papers range and may not be exact, but our current debt levels are close enough that we should be paying serious attention, especially given our long-term budget outlook driven by aging and health care cost growth.

As we explained in our report on the topic, fiscal crises can happen and be responded to in different ways. We detail several scenarios about how a fiscal crisis might play out, including:

- A Gradual Crisis: We muddle along with inadequate high value government investments and slower growth.

- A Catastrophic Budget Failure: An abrupt crisis occurs.

- An Inflation Crisis: Higher debt is managed through inflation.

- An External Crisis: A dollar or trade crisis leads to a fiscal crisis.

- A Default Crisis: A series of events leads to a default.

We may not be in a fiscal crisis yet, but that is no reason to be complacent. As Federal Reserve Governor Jerome Powell said in a response to the paper, we are getting closer and closer to a point where the debt could do serious damage:

We may have more room than other economies around the globe, but I do not intend to project any sense of complacency around this topic. The authors' basic message seems just right to me: We don't know where the tipping point is; wherever it is, we are clearly getting closer to it, and the costs of misestimating its location are enormous and one-sided. The benefits to long-term fiscal consolidation--conducted at the right pace, and without jeopardizing the near-term economic recovery--would be substantial.

We don't know exactly at what levels of debt would trigger a fiscal crisis for the U.S., but it would be best if we never found out. There are disastrous risks associated with doing nothing and economic benefits to enacting a comprehensive plan as a solution. We know we will have to solve this problem, so it's time for lawmakers to come together and work toward a compromise.

The full paper can be found here.