Peterson-Pew Commission Policy Paper on Budget Reform Proposals

Today, the Peterson-Pew Commission on Budget Reform issued its first policy paper, “A Closer Look at the President’s FY 2010 Budget Process Reform Proposals.”

The paper examines in detail how the administration’s first budget takes a few initial steps toward establishing a more fiscally responsible budget process.

1) The administration's proposal to reestablish a legally binding pay-as-you-go requirement for both entitlement and tax initiatives comes at a critical juncture when Congress is considering major legislation with profound budgetary implications.

2) The inclusion of the estimate of future-year disaster spending makes its total request more realistic and credible.

3) The budget also resumes using ten-year budget projections, a very important step that highlights the longer-term consequences of today’s policy decisions.

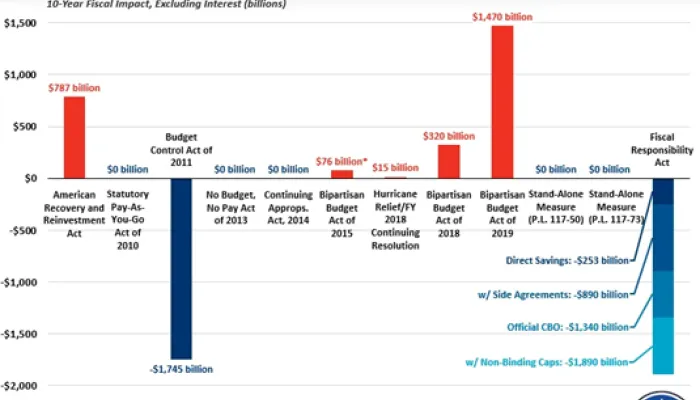

In addition, the paper looks at the deficiencies and significant omissions in the administration’s budget reform proposals including the cost of the original PAYGO exemptions (see chart), its complexity, and lack of caps on discretionary spending.

Budgetary Effects of PAYGO Exemptions (in billions of dollars)

| FY 2010 | FY 2010-2019 | |

| Extending expiring provisions | ||

|

Expiring tax cuts |

4.0 | 2682.0 |

|

Physician Payments |

12.0 | 311.0 |

|

Alternative Minimum Tax |

13.0 | 546.0 |

|

Other adjustments |

-2.0 | -12.0 |

| Total expiring provisions | 27.0 | 3527.0 |

And then in OMB’s Mid-Session review, the Administration added three more provisions to the current-policy baseline at a cost of approximately $180 billion: the earned income and child tax credits (extended in the 2009 stimulus package but first enacted as a part of the 2001 tax cut package) as well as certain Pell Grant adjustments.

In addition to the budgetary costs ($3.5 trillion over ten years for the first set of exemptions and then another $180 billion for the August additions), these exemptions represent a dramatic shift on how the official arbiters of budget numbers (OMB and CBO) have calculated the baseline for many years. Proponents of the exemptions argue that it is better to exempt these provisions (which are supported by many in both political parties) from PAYGO rules than to have the new PAYGO law waived almost immediately.

Ultimately, they may be right. But it is a slippery slope in moving to a current policy baseline as it opens up the possibility that PAYGO will be waived for other legislation and programs that are politically popular. Beyond PAYGO:

Congress and the White House have spent a lot of time this summer emphasizing PAYGO legislation. But the paper warns us not to rely solely on PAYGO as it has some significant limitations:

1) It does not apply to the growth in mandatory spending that will occur under existing law.

2) It is essentially a “make matters no worse” budget rule.

3) It does not look at the long-term (beyond the five or ten year budgetary window) of new mandatory spending programs or tax provisions.

4) It exempts 95 percent of all mandatory spending outlays from sequestration.

5) It excludes the single largest entitlement, Social Security, and protects most existing mandatory programs— approximately 95 percent of all mandatory spending outlays—from sequestration.

6) It does not apply to discretionary appropriations, which are a full third of federal spending.

7) Can be waived.

Some leading budget experts voiced a similar concern at the Commission’s event on budget reform. While they acknowledged the value of a strong budget process and the accompanying enforcement mechanisms, they all agreed that process is more successful when it is used to enforce bipartisan agreements about federal fiscal policy than when it is used to force agreement on fiscal policy.