Partial Student Debt Cancellation is Poor Economic Stimulus

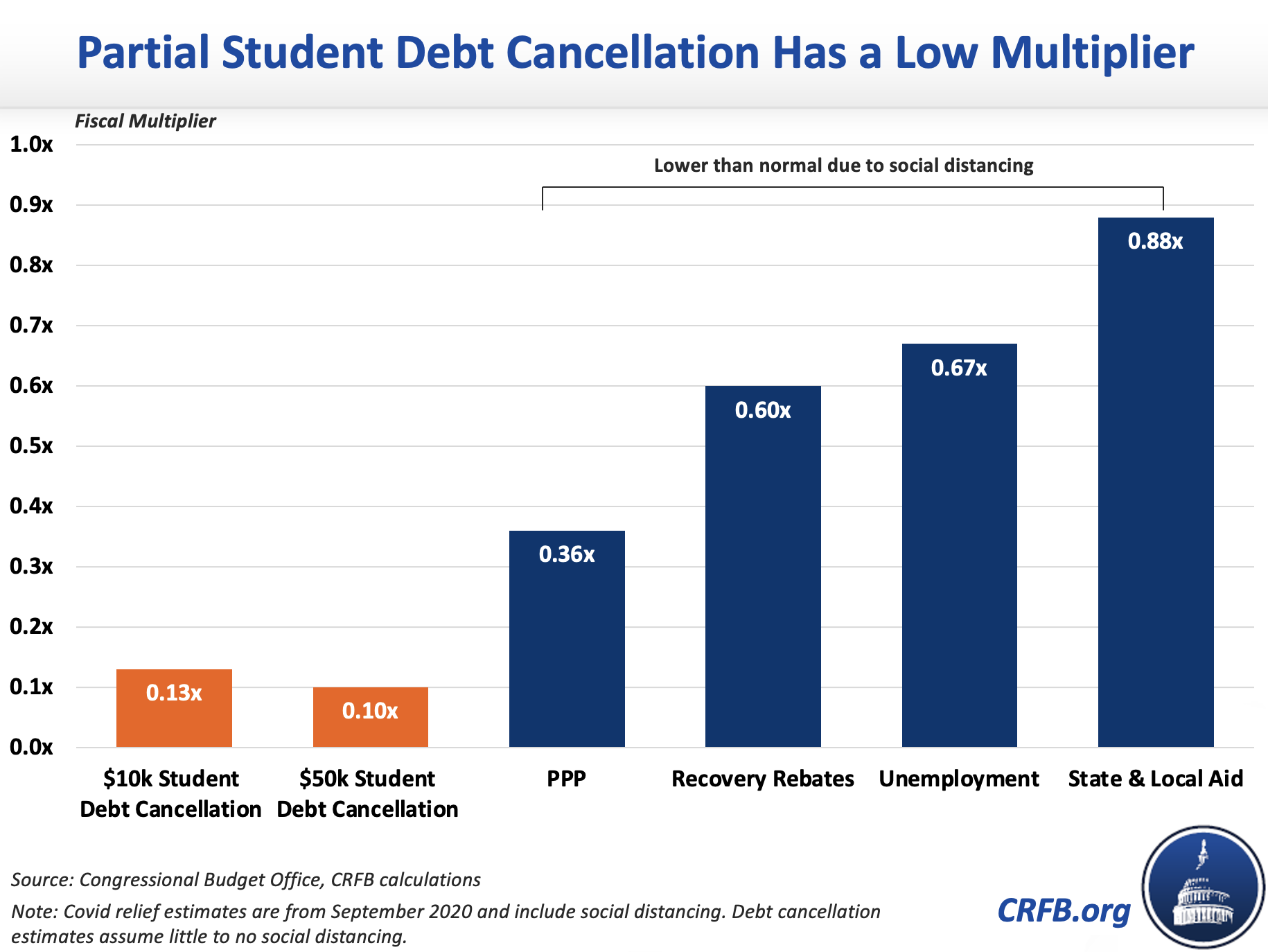

Last year, we estimated that fully canceling student debt would produce eight to 23 cents of economic activity for every dollar of cost and speculated that partial student debt cancellation might have a higher multiplier.

In light of the current economic recovery, and employing new techniques made available by working papers from the Congressional Budget Office (CBO), we find that partial cancellation of federal student loans would also be extremely poor stimulus, producing only 2 to 27 cents of economic activity for every dollar of cost.1 Specifically, we find:

- Canceling $10,000 of debt results in an economic multiplier of 0.13x in our central estimate, with a range of 0.03x to 0.27x depending on the parameters.

- Canceling $50,000 of debt results in an economic multiplier of 0.10x, with a range of 0.02x to 0.25x.

These very low multipliers are driven by three factors:

- The small effect that student debt cancellation has on cash flow (exacerbated by Income-Driven Repayment plans)

- The poorly-targeted nature of student debt cancellation to those less likely to spend

- The current state of the macroeconomy given supply and demand constraints

Student Debt Cancellation Has Low Fiscal Multipliers

Partial cancellation of student debt would increase economic output in the coming years, but only by a small fraction of the overall cost.

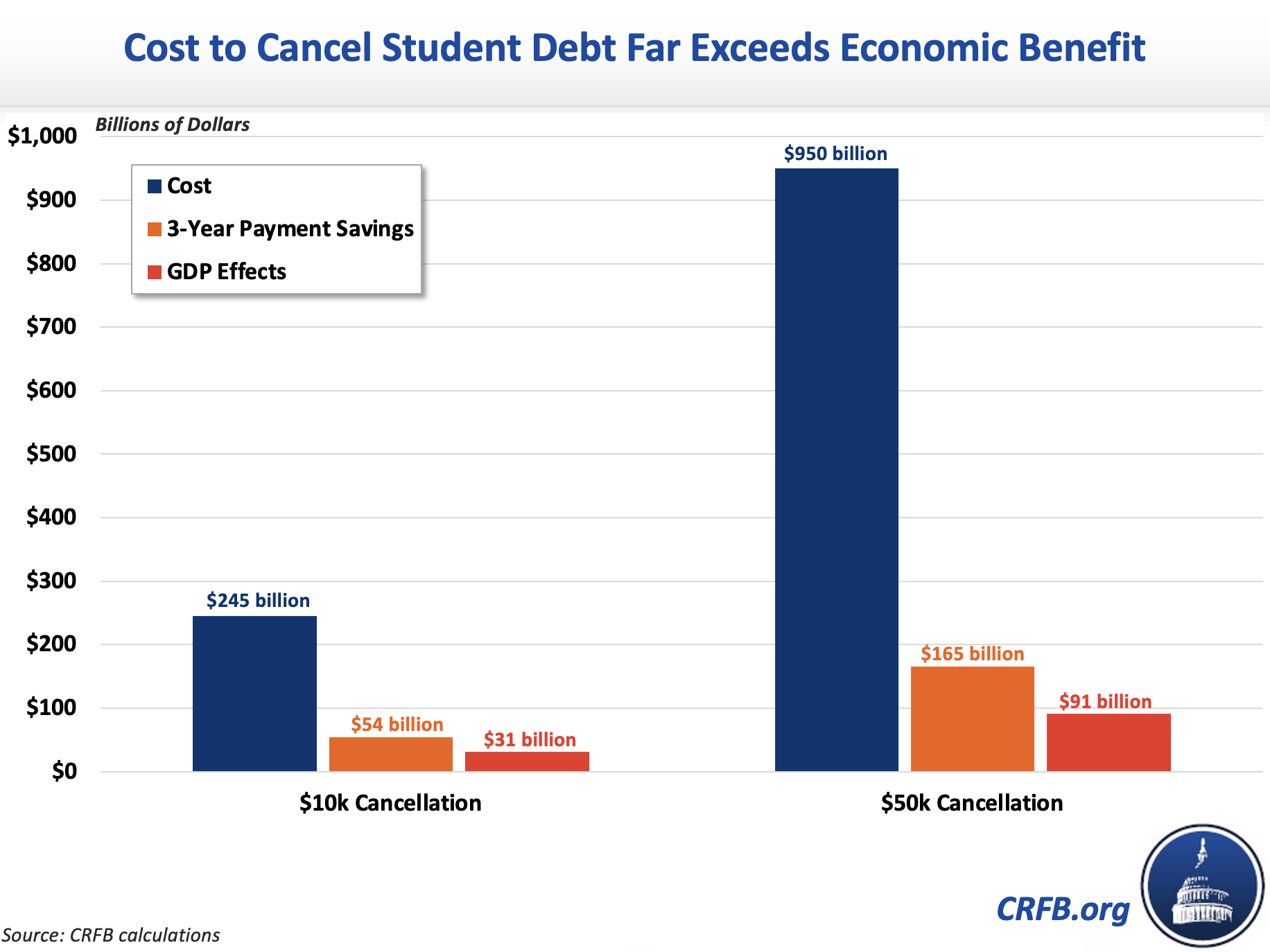

Canceling $10,000 of student debt per borrower would completely eliminate student debt for 15 million borrowers and partially reduce debt for 28 million more at a cost of between $210 billion and $280 billion. We estimate this would reduce annual loan payments by around $18 billion per year (once current automatic forbearance ends), or roughly $54 billion over three years. This means that even over a three-year period, less than a fifth of the total amount forgiven would translate into cash savings.2 Based on existing literature, we estimate these cash savings plus the added wealth from student debt cancellation would lead to $36 billion in increased consumption, resulting in roughly $31 billion in higher output over three years. The net fiscal multiplier in this case would be roughly 0.13x. Employing a broader range of assumptions, this multiplier could be as low as 0.03x and as high as 0.27x.

Canceling $50,000 would wipe out all student debt for around 36 million borrowers and reduce debt for 7 million more at a cost of $950 billion based on our estimates.3 This would reduce annual payments by $55 billion per year and $165 billion over three years. In our central estimate, we find the resulting increased cash flow and wealth would increase consumption by roughly $104 billion, resulting in roughly $91 billion in added output over three years. The net fiscal multiplier would total 0.10x. Employing a broader range of assumptions, this multiplier could be as low as 0.02x and as high as 0.25x.

These multipliers are extremely low. Even during periods of extreme social distancing, CBO estimated most COVID relief measures had a multiplier of between 0.4x and 0.9x. Historically, multipliers on most stimulus policies have ranged from 0.5x to 2.0x.

Why Are These Multipliers So Low?

The multipliers for partial student debt cancellation are low for three main reasons. First, partial cancellation boosts household cash flow very modestly relative to the cost. Second, the benefits are poorly targeted to those who are less likely to spend any additional cash they receive. And third, the combination of a strong economic recovery, excessive cash, and supply constraints in the current economy suggests limited room to further boost demand.

As we highlighted in last year’s analysis on full student debt cancellation, forgiving large amounts of this type of debt results in only modest reductions to annual repayment costs and thus frees up only a small amount of additional funds to be used for consumption in the short run. Student debt is generally repaid gradually over a 10-to-30-year period.

In fact, the majority of canceled debt would result in no improvement in cash flow this year. Roughly half of all student loan dollars are connected to non-repaying borrowers either in school, delinquency, forbearance (aside from the current automatic forbearance), deferment, or default.4 And among those in repayment, we estimate about 40 percent of the dollars come from Income-Driven Repayment (IDR) plans.5 Unless their debt was mostly or completely wiped out, those in IDR plans would continue to make the same monthly payments, based on their income.6 Almost 90 percent of IDR borrowers have balances above $10,000 and around 40 percent have balances over $50,000.

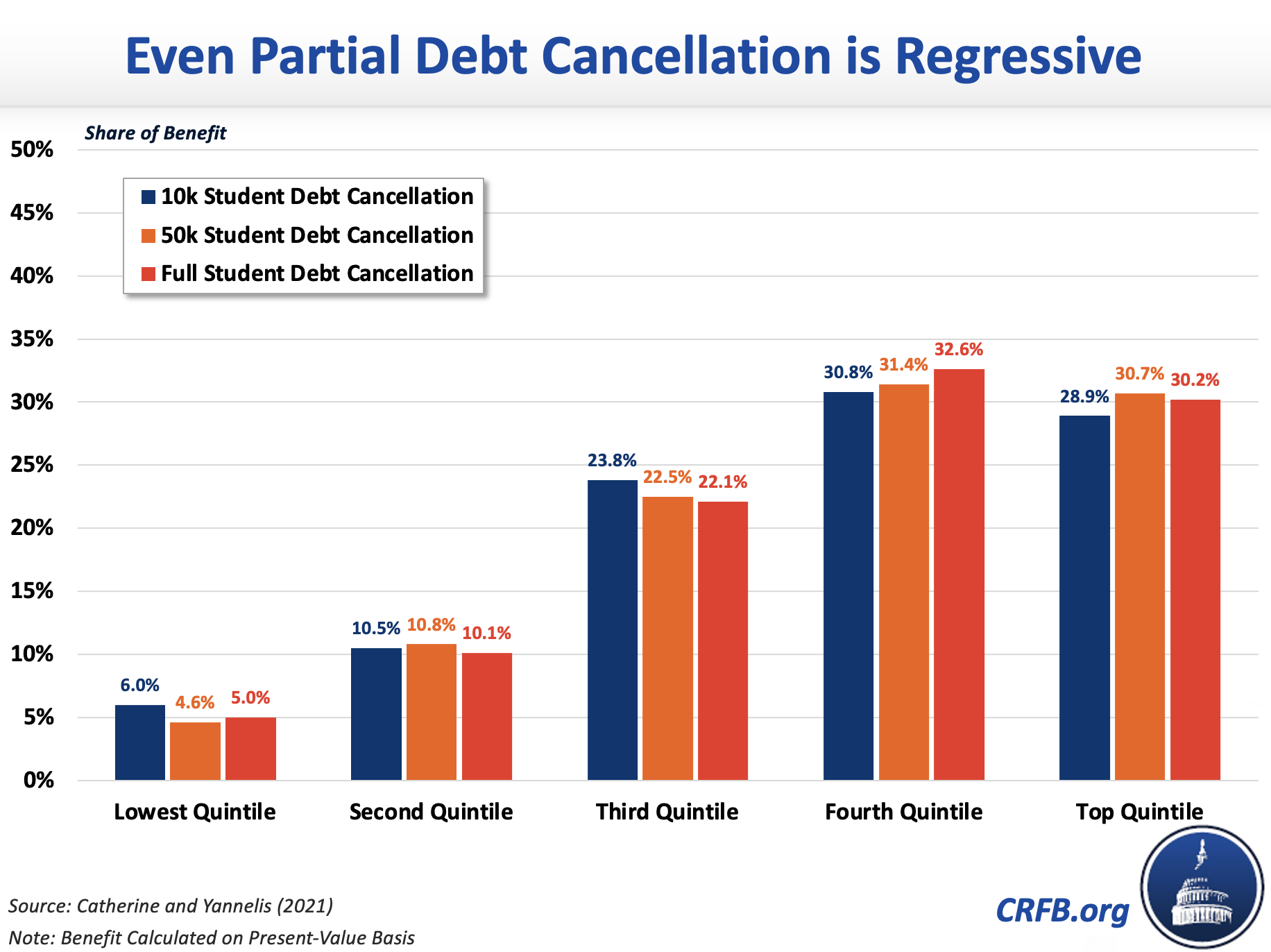

Borrowers are also unlikely to spend a large share of that cash-flow improvement. As we’ve shown before, full student debt cancellation is regressive and disproportionately benefits those with advanced degrees who are much less likely to be unemployed compared to those with less education. Indeed, canceling $10,000 or $50,000 of student debt has relatively similar distributional effects to full cancellation, according to an analysis by Sylvain Catherine and Constantine Yannelis, which shows that the top income decile receives more benefit than the bottom 30 percent of earners.

Fiscal stimulus is most effective when it goes to those most likely to spend, such as individuals with low incomes or those who recently experienced a loss in income. Student debt cancellation does the exact opposite, distributing funds mainly to those most likely to save and least likely to spend. Given the income distribution of borrowers, we estimate savings from lower debt repayment will only be about half as effective at boosting demand as expanded unemployment benefits and a fifth less effective than broadly-paid recovery rebates.7

Finally, the increase in demand that does result from student debt cancellation is likely to have a small effect on economic output in light of the current state of the macroeconomy. Given high levels of savings, massive stimulus in the pipeline, pent-up demand, supply constraints, inflation pressures, and expectations of a strong economic recovery, additional cash injected into the economy will have few places to go. To the extent that it leads to new spending – as opposed to saving – it is likely to result in additional inflation pressures (especially in the near term), which risks higher interest rates (especially once the economy has fully recovered) and thus tamped-down growth.

When the economy is well below potential and the Federal Reserve is constrained, CBO estimates each dollar of demand leads to about $1.50 of ultimate output. But when the economy is near potential and the Fed is able to respond, CBO believes $1 of demand will produce only 50 cents of net output.8 Despite current weaknesses in the economy, we expect further increases in demand would have a somewhat muted effect on economic output in late 2021 and 2022 and an especially muted effect once the economy has fully recovered.9 That makes any additional cash less stimulative at this stage in the economic recovery.

In summary, student debt cancellation would do little to increase cash flow available for spending, any increased cash flow would be directed more toward those less likely to spend, and any increased spending would do little to enhance overall output. This would be true for full student debt cancellation but also remains true for canceling $10,000 or $50,000 in debt as well.

Partial Student Debt Cancellation is Not Cost-Effective Stimulus

While there is no doubt that student debt cancellation would be a financial and psychological benefit to many borrowers who would receive forgiveness, canceling $10,000 or $50,000 in student debt would not be effective stimulus, especially in the face of a rapidly improving domestic economy. While some have argued that canceling $10,000 or $50,000 is more targeted than canceling all student debt, all of these proposals are regressive and suffer from low multipliers to stimulate the economy. Absent offsets, all student debt cancellation proposals would also worsen an already precarious fiscal situation given their substantial costs.

With a rapidly recovering economy experiencing supply (not demand) constraints, it’s time to retire the idea that the regressive cancellation of student debt is a cost-effective way to stimulate the economy.

***

Appendix: Uncertainty in Estimates

Our estimates come with a significant degree of uncertainty. While we estimate canceling $10,000 of student debt per person will have a multiplier of 0.13x, our estimates suggest the multiplier could be as low as 0.03x or as high as 0.27x. Similarly, the 0.10x multiplier we estimate for canceling $50,000 in student debt could be low as 0.02x or as high as 0.25x.

The ranges in these estimates reflect uncertainty over three components: the budgetary cost of forgiving the loans, the demand multiplier associated with reduced loans payments, and the reduction in the effectiveness of a multiplier in an economy operating at or above potential. There is also uncertainty about the decrease in repayment as a result of cancellation, though it does not contribute to the range of the estimates.

Uncertainty #1: The Budgetary Cost of Forgiving Student Loans

According to available data, $10,000 per person of cancellation would forgive $380 billion in loans while $50,000 of cancellation would forgive $1.04 trillion, but the actual cost could theoretically be lower depending on what share of these loans would have ultimately been paid back versus forgiven under existing programs. For $10,000 of forgiveness, we assumed costs of between $210 billion and $280 billion, with a central estimate of $245 billion. This is based on a rumored CBO score reported in Politico last year of the cost of forgiving $10,000 in federal and private student loans totaling between $250 billion and $300 billion. Since then, President Biden has proposed forgiving only federal loans, and since that is what we are estimating, we adjusted that CBO score to reflect that our estimate for canceling $10,000 per borrower of private student loans would have cost somewhere between $20 billion and $40 billion. Our central cost estimate of $245 billion is substantially lower than the face value of the loans, reflecting that a portion of these loans would likely be forgiven or defaulted upon anyway, so canceling that portion incurs no additional cost to the government. For $50,000 in forgiveness, we assume a budgetary cost of between $675 billion and $1.04 trillion, with a central estimate of $950 billion. The low-end estimate assumes this debt has a similar subsidy rate to debt up to $10,000, while the high end assumes the cost will match the full face-value of the loans. Our central estimate assumes that the subsidy to the full-face value of the loans decreases at a logarithmic rate until it hits zero for the full portfolio.10

Uncertainty #2: The Demand Multiplier

There is also some uncertainty over what share of improved cash flow will be spent – the so-called “demand multiplier” (demand multipliers must be modeled together with output multipliers to derive total economic multipliers). For our analysis, we estimate a range of 0.4x to 0.5x, with a central estimate of 0.44x for $50,000 in forgiveness and 0.45x for $10,000. These numbers are based off of CBO’s October 2020 estimate that the CARES Act recovery rebates would have a demand multiplier of 0.5x to 0.6x with no social distancing. We adjusted this multiplier based on the difference in distributional impact of the policies using Tax Policy Center and Catherine and Yannelis data. Relying on marginal propensity to consume figures from the Krusell-Smith model as estimated by Carroll, Slacalek, Tukuoka, and White, we found the multiplier for student debt cancellation should be about 20 percent lower than flat universal rebate checks based on the income distribution of debt alone. This is likely a conservative estimate since it doesn’t account for differences in employment.

Uncertainty #3: The Effect of the Overall Multiplier and the Economy

Lastly, there is uncertainty about how close the economy will be in the coming years to one where, as CBO puts in its multiplier estimates, “output is close to potential and Federal Reserve responses are typical." While the economy is growing rapidly and already appears to be close to its short-term potential, in light of near-term supply constraints, it remains far from a full recovery, and the Federal Reserve has signaled it is unlikely to raise interest rates prior to 2023 or 2024. In consultation with several experts, our analysis assumes spending in the fourth quarter of 2021 will affect output as if the economy were 75 percent “close to potential” and 25 percent “well below potential.” Between the beginning of 2023 and 2024, we assume conditions will gradually change to the point where the economy is fully at potential and the Federal Reserve is fully responsive by early 2024. In our low multiplier estimate, we assume multipliers consistent with an economy at full potential through our entire estimating window, while our high multiplier estimate assumes the economy remains 75 percent “close to potential” for the entire period. Of course, a wider array of assumptions could result in an even larger range of potential multipliers.

Uncertainty #4: The Decrease in Annual Student Loan Repayment

There is also uncertainty around our estimates of the decrease in annual payments in the event of student loan forgiveness. Starting with our estimate of $80 billion being repaid each year, we estimate about 40 percent of those dollars come from IDR plans while 60 percent come from fixed-repayment plans. From there we estimate repayment by debt size, with borrowers in each group estimated to pay roughly proportionally to the total outstanding dollars in each group (slightly adjusted for different interest rates and loan terms). For IDR borrowers, we also calculate repayment by debt size, with those who would see their debt wiped out no longer needing to pay while those above the forgiveness threshold would pay the same amount. While this is a simplifying assumption, stress-testing the model suggests little to no difference in the multiplier if certain borrowers in IDR saw their payments reduced. Importantly, the amount being repaid in each debt-size category in IDR is proportional to the number of borrowers in each group, as opposed to the total dollars, because IDR is more related to borrower income rather than debt size.

1 Our estimates only encompass canceling federal student loans. While some proposals in Congress include private student loans, President Biden proposed canceling only federal student loans, which makes the prospect of canceling private loans highly unlikely in the near term.

2 Beyond 2024, prices, interest rates, and other elements of the economy are likely to have adjusted sufficiently such that further cash savings would have a small and directionally ambiguous effect on total economic output.

3 We estimate a total of $1.05 trillion in debt would be forgiven. The cost of that forgiveness will depend on what share of that debt would have ultimately been paid back and at what interest rates. CBO's credit estimates of the loan programs appear to suggest the overall portfolio will be roughly cost-neutral; however, this reflects the net effect of some loans in the portfolio that are projected to lose money on net (under credit reform estimating rules) and others that are projected to raise money. We believe the first $50,000 of student debt per person is more likely to lose money for the federal government than remaining debt, but it is difficult to discern by how much. Our central estimate assumes costs of forgiveness will total roughly 90 percent of face value, with a wide possible range.

4 All loans that are in automatic forbearance will likely be considered current whenever the automatic forbearance period ends, which as of now will be October 1. We estimate the same number of people will not repay as before. In reality, the number could be higher, as it will be difficult for servicers to re-engage so many borrowers at once.

5 Just over 60 percent of total dollars in repayment were in IDR plans before the pandemic, but since IDR borrowers tend to pay less per dollar borrowed compared to those in fixed-payment plans, the percent of dollars being repaid each year out of IDR plans is definitely less. We use data from CBO on the different amortization rates between IDR and fixed-payment plans to arrive at the 40 percent estimate.

6 Certain versions of IDR cap monthly payments to the amount a borrower would pay under a standard ten-year repayment plan. It’s unclear how the Department of Education would deal with this component if a portion of a borrower’s debt was forgiven. We estimate no change in monthly payments for those above the forgiven amount. While some payments would likely decrease or people would finish paying within the three-year window, stress-testing the model shows different assumptions would not substantially change our multiplier estimates.

7 We estimate this demand multiplier by adjusting CBO’s estimates for rebate checks to account for the difference in distribution (using Tax Policy Center and Catherine and Yannelis) based on estimates of differences in the marginal propensity to consume from the Krusell-Smith model as estimated by Carroll, Slacalek, Tukuoka, and White.

8 More precisely, CBO estimates $1 of demand in a quarter will produce $0.50 to $2.50 of output over a one-year period when the economy is below potential and the Fed is limited, while $1 of demand in a quarter when the economy is at or near potential and the Federal Reserve response is typical will produce $0.17 to $0.83 of output over two years. In the latter scenario, CBO believes higher interest rates and inflation will mitigate the positive effects of demand in the first year and partially offset them in the second.

9 In the near term, the economy is likely to include features of an economy near potential and features of an economy far from potential. Based on consultation with experts, we assume the output response to demand is 75 percent like an economy near potential and 25 percent like an economy far from potential when the policy begins to take effect in Q4 of 2021. Between Q1 of 2023 and Q1 of 2024, we assume the economy gradually adjusts so that by 2024 it fully reflects an economy at potential. Implicit in our model is the assumption that economic gains from higher demand would be partially offset by higher inflation and higher interest rates. We expect inflation to play a greater role in the earlier periods and interest rates a greater role in the later periods.