Newest President's Budget Estimate Shows Stable Debt

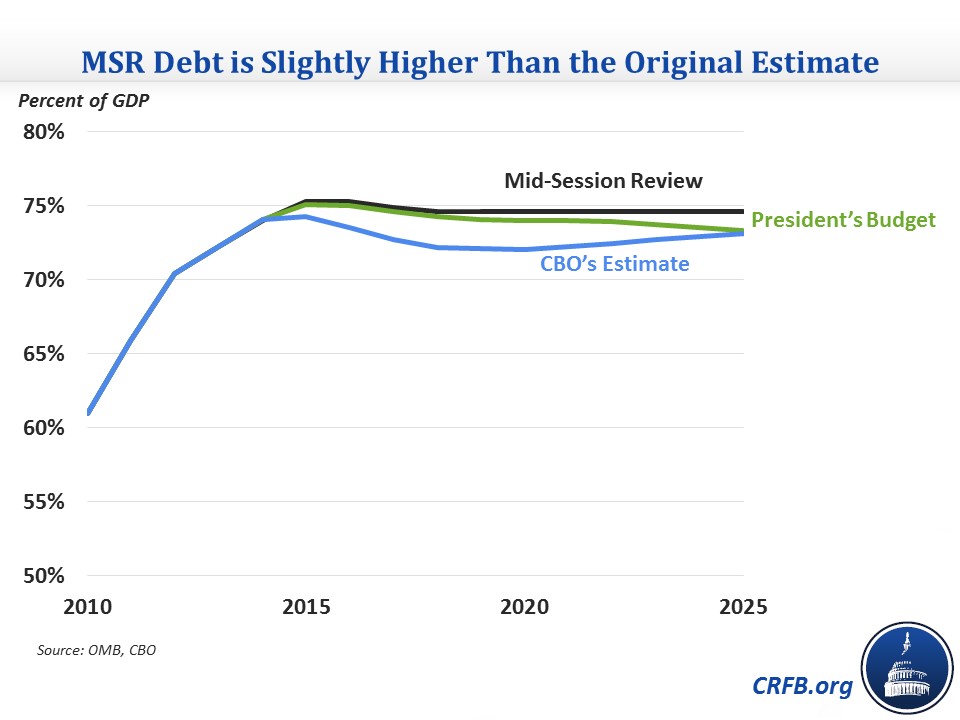

The Office of Management and Budget (OMB) today released the FY 2016 Mid-Session Review (MSR), which updates the President's budget for new data and assumptions. The MSR shows a very similar picture to the budget's estimate in February, with debt stabilizing at just under 75 percent of the economy for much of the next ten years. The MSR shows 2015-2025 deficits that are very similar ($9 billion higher) to the President's budget, although lower economic growth means that 2025 debt is about 1 percentage point higher than OMB projected in February.

In the MSR, deficits would total $5.8 trillion over the 2016-2025 period, or 2.5 percent of Gross Domestic Product (GDP), and would stabilize at 2.7 percent of GDP for the last five years. Debt would fall slightly from 75.3 percent of GDP in 2015 to 74.6 percent by 2018, where it would remain through 2025. This is in contrast to the February estimate that had debt on a very slight downward path to 73 percent by 2025.

The changes since February include $467 billion of lower revenue and $458 billion of lower outlays. Although the physician payment law had a significant impact on the current law baseline, it had little effect on the President's budget since most of its policies were already included. The biggest differences come from non-legislative sources and include:

- $612 billion of lower revenue from worse economic projections.

- $412 billion of lower interest spending, mostly from lower interest rates.

- $229 billion of lower Social Security outlays due to lower inflation and beneficiaries claiming benefits at a later age.

- $97 billion of higher Medicare outlays from higher Medicare Advantage enrollment, the incorporation of recent data, and higher expected spending on prescription drugs.

- $51 billion of higher costs from the health exchange subsidies due to the incorporation of more recent data.

Like the President's budget, the MSR overstates its actual savings (claimed at $1.75 trillion) by excluding certain costs from the total and using an inflated baseline for 2022-2025 discretionary spending by having spending revert to pre-sequester levels (rather than continuing from post-sequester levels as the Congressional Budget Office [CBO] does). On the latter issue, the Better Budget Process Initiative recommended that Congress clarify that current law discretionary spending be constructed using the lower CBO method.

Overall, the MSR doesn't really change the outlook for the President's policies. They are an improvement over the status quo but don't do enough to ensure debt is on a clear downward path as a share of GDP over the long term. The budget would need to go further, particularly on entitlement reform, to accomplish that.