Measuring Inflation Right Saves $375 Billion

According to the latest CBO Budget Options report, adopting the chained CPI – an inflation index that most economists believe is a more accurate measure of inflation than the current CPI – would reduce the deficit by $332 billion through 2024, or $375 billion including interest. Those savings include $150 billion of revenue, $116 billion from Social Security, $66 billion from other mandatory spending, and $45 of interest savings.

As we’ve explained before, the current method used to index most tax and spending provisions is flawed. The measure overstates inflation by failing to account for the fact that consumers substitute similar products based on relative prices – so that if the price of steak falls, they might buy more steak and less chicken. As a result, the federal government currently overspends and undertaxes relative to the intent of the law, which is to index various provisions to actual changes in cost of living (such as cost-of-living adjustments, or COLAs). The Moment of Truth Project paper "Measuring Up" more fully explains the economic rationale for switching to the chained CPI and which programs and tax provisions would be affected.

In addition to being more accurate, adopting the chained CPI also results in huge amounts of deficits reduction. The $116 billion of Social Security savings would eventually accumulate to 0.56 percent of payroll over 75 years, which is enough to close one-fifth of the combined solvency gap and is nearly twice as large as the entire disability insurance gap (though most of the savings would accrue on the old-age side).

| Savings from the Chained CPI (billions) | |||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2015-2024 | |

| Social Security | $0 | $2 | $4 | $7 | $10 | $13 | $16 | $19 | $22 | $25 | $116 |

| Other COLAs | $0 | $1 | $1 | $2 | $3 | $3 | $4 | $5 | $5 | $6 | $29 |

| Health Care | $0 | $1 | $1 | $2 | $2 | $3 | $4 | $5 | $7 | $7 | $32 |

| Other Spending | $0 | $0 | $0 | $0 | $0 | $1 | $1 | $1 | $1 | $1 | $5 |

| Revenue | $1 | $5 | $7 | $8 | $11 | $16 | $20 | $23 | $27 | $32 | $150 |

| Subtotal | $1 | $8 | $14 | $18 | $26 | $36 | $44 | $52 | $62 | $71 | $332 |

| Interest | $0 | $0 | $0 | $1 | $2 | $4 | $5 | $8 | $10 | $13 | $44 |

| Total | $1 | $8 | $14 | $19 | $28 | $39 | $50 | $60 | $72 | $85 | $376 |

Source: CBO

The remaining $216 billion of primary savings is enough to replace 85 percent of the PREP Plan we recently released to pay for Medicare physician payment reform and the tax extenders. It would be enough to fully fund the Highway trust fund for ten years and pay for almost all of the President's proposed infrastructure investments. It could pay for a 2 percentage point reduction in the corporate tax rate. Or it could allow policymakers to reduce the sequestration cuts in half for the next 5 years.

Alternatively, adopting the chained CPI would be enough to reduce the projected 2024 debt levels by one and a half percent of GDP. By the end of the second decade, it could reduce debt levels by as much as 5 percent of GDP.

Thought of another way, the budgetary consequences of continuing to measure inflation incorrectly are huge. Given the large structural deficits and fiscal constraints we face, it is difficult to justify the increased spending and lost revenues from using an incorrect measure of inflation.

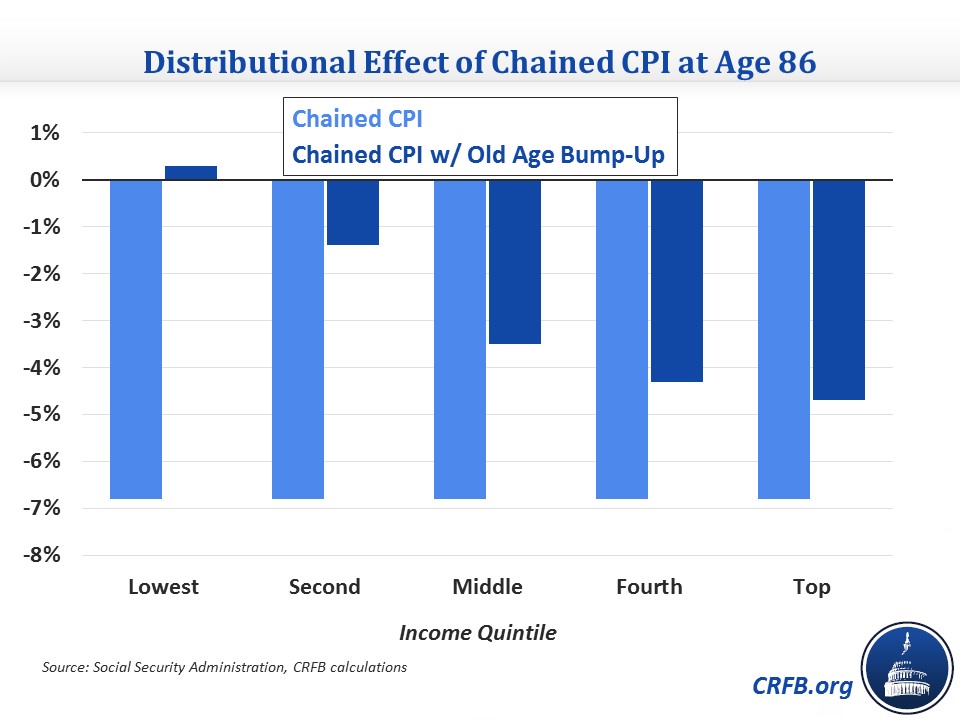

Moreover, most criticisms of adopting the chained CPI are quite weak. Claims that chained CPI is a simply an excuse to cut ignore the huge amount of evidence that it is more accurate than current measures of inflation. Arguments that adopting chained CPI unfairly picks on Social Security benefits ignore the $150 billion of the savings are on the revenue side. Suggestions that it is regressive are disproven by analysis that shows the consequences of the policy are roughly across-the-board on both sides of the ledger and can be made more progressive by adding a flat old-age bump-up and/or other targeted low-income protections instead of providing higher than justified cost-of-living adjustments for all beneficiaries.

And arguments that seniors face much higher costs are based on a flawed measure, that when put up to scrutiny folks like the non-partisan CBO conclude that “It is unclear, however, whether the cost of living actually grows at a faster rate for the elderly than for younger people.” (CRFB Senior Advisor Ed Lorenzen explained why in more detail in recent Congressional testimony).

Of course, adopting chained CPI is a heavy lift politically, since it results in Social Security changes the left doesn’t like and tax changes the right doesn’t like. But in reality, it is a sensible and modest reform that would simply measure inflation appropriately, and in doing so would substantially improve the fiscal situation. The measure has been supported by President Obama, the Center on Budget and Policy Priorities, the Simpson-Bowles plan, the American Enterprise Institute, the Heritage Foundation, and many others.

As we wrote in Measuring Up, "Addressing our fiscal challenges will require many tough choices and policy changes – but switching to the chained CPI represents neither." Policymakers should adopt it as soon as possible.

Read Measuring Up: The Case for the Chained CPI here.