Maya MacGuineas: How to Improve the Tax Extenders Bill? Start by Paying for It.

Maya MacGuineas, President of the Committee for a Responsible Federal Budget, wrote a commentary that appeared in the Wall Street Journal Washington Wire. It is reposted here.

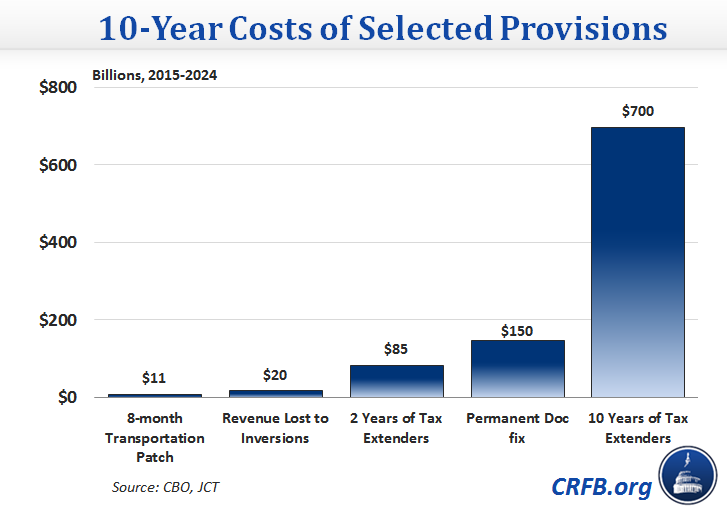

The best thing I can say about the tax-extenders bill passed by the House of Representatives is that it costs far less than the $450 billion bill lawmakers had previously considered. The price tag for a one-year extension would be $42 billion–no drop in the bucket, but much less than half a trillion.

It’s damaging in a number of ways that lawmakers waited a full year after the tax breaks expired to get this done. Retroactive legislation leaves policymakers governing in the rear-view mirror instead of dealing with what’s ahead. It’s impossible for businesses to plan when they go an entire year without knowing what tax laws will apply to them—and now they are in the same situation for the coming year.

What we should have done since the last time these tax breaks were extended is tackle tax reform. The argument that there wasn’t time rings hollow since we’ve known the deadline for the tax breaks’ expiration for the past two years. And Congress’s stop-gap measure doesn’t address the need for reforms.

Assuming that the Senate passes the House’s extension, lawmakers should add a fast-track process to ensure that Congress and the president spend the next year working on a plan for substantive reforms–a goal that lawmakers and the president have said is a priority.

The other issue the Senate should address is actually paying for the bill. The plan flew through the House with nary a peep about cost, which is alarming since our debt remains at record highs and surprising because earlier this year lawmakers insisted on fully offsetting the “doc fix,” which cost $21 billion, and refused to extend unemployment benefits ($6 billion) because they were not paid for.

There are many ways to pay for a one-year extension of these tax breaks. A straightforward and sensible approach would be increasing tax enforcement and compliance; over 10 years, that could save $35 billion. We should also close loopholes that allow taxpayers to classify income in ways that are hard to justify. Two such candidates–one known as the John Edwards or Newt Gingrich loophole, and another known as carried interest–let some self-employed and hedge fund managers reduce their tax bills significantly by defining their income as something other than wages, which allows them to pay lower rates. Eliminating these two loopholes would save an additional $25 billion.

There are many ways this tax bill could be paid for, including dropping some of the tax breaks to shrink the cost of the total package. A simple principle of budgeting is that if something is worth doing, it’s worth paying for. If we are unwilling to cover the cost, each of us should look across the dinner table at our children and explain to them why we have just handed them a $45 billion bill.

"My Views" are works published by members of the Committee for a Responsible Federal Budget, but they do not necessarily reflect the views of all members of the committee.