The Long-Term Outlook Could Be Even Worse Than CBO Says

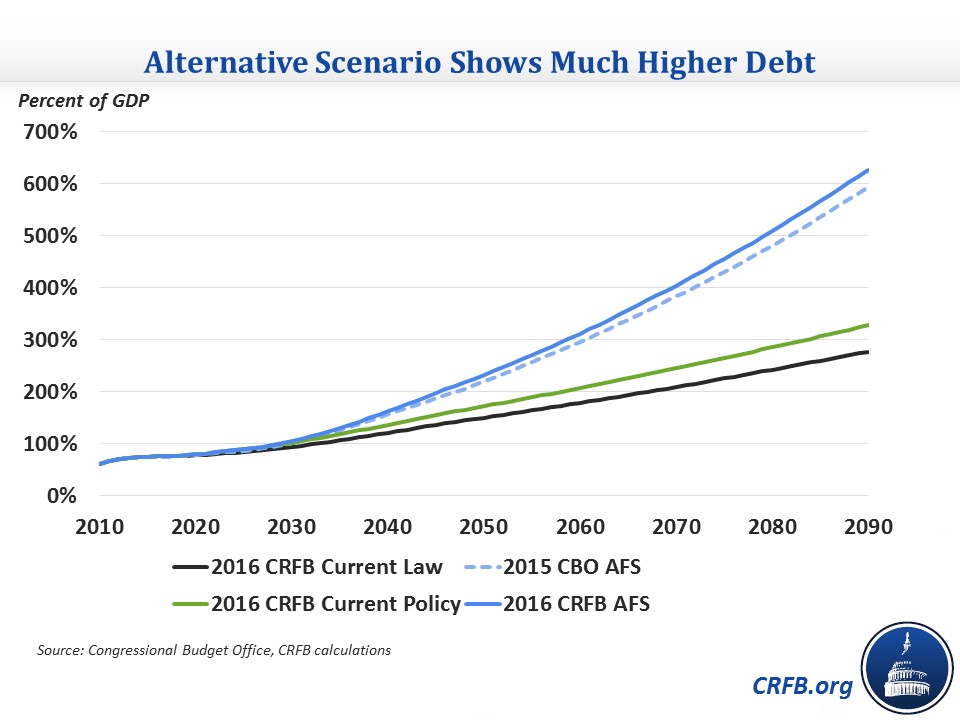

The Congressional Budget Office's (CBO) long-term outlook shows debt nearly doubling as a percentage of Gross Domestic Product (GDP) over the next 30 years, but that projection may rely on optimistic assumptions. In general, CBO's current law baseline assumes that policymakers will break with typical historical experience in some cases. In the past, they had constructed an Alternative Fiscal Scenario (AFS) that changed some of these assumptions to better fit past legislative experience and showed much higher debt, but this year they only show a $2 trillion deficit increase scenario that roughly replicates the short-term impact of the AFS. In this blog, we replicate the past AFS, showing that it will reach about 205 percent of GDP by 2046 – 65 percentage points higher than current law – and much higher beyond that.

The AFS makes a few policy adjustments to current law that may be more realistic. Specifically, it assumes that policymakers:

- Permanently extend tax provisions that were extended only temporarily in last year's tax deal (including 30 percent bonus depreciation)

- Permanently repeal health-related tax provisions that were temporarily delayed in the tax deal

- Repeal the sequester without offsets

These short-term policy adjustments add $1.7 trillion to ten-year deficits and result in debt by 2026 in this "current policy" baseline being 92 percent of GDP instead of 86 percent under current law. Debt would climb further to a record-high of 108 percent of GDP by 2032, nearly 160 percent by 2046, 230 percent by 2066, and 332 percent by 2091. By contrast, we estimate debt would reach about 140 percent in 2046 and 280 percent in 2091 under current law (excluding the macroeconomic feedback of high debt). This higher debt shows the need to adhere to pay-as-you-go (PAYGO) rules for current policies.

In addition, the AFS as CBO constructed in 2015 made a few long-term adjustments to keep some budget categories more in line with their historical averages. It assumed:

- Revenue remained constant at its 2026 share of GDP beyond 2026, in contrast to current law that allows certain features of the tax code and other long-term developments to gradually increase revenue over time

- Spending other than Social Security and health care remained at its 20-year historical average of 9.9 percent of GDP in contrast to current law that has those categories of spending be much lower and slightly decline as a share of GDP over time

These assumptions make a bigger difference over the long term than the short-term policy changes. By our estimate, the AFS would result in debt increasing from 75 percent of GDP this year to a record-high of 109 percent by 2031 and about 205 percent of GDP by 2046, compared to 141 percent under current law. From there, debt would continue to increase astronomically to about 365 percent by 2066 and nearly 640 percent by 2091. Our AFS estimate is slightly higher than CBO's estimate last year, a change that apparently is due to lower GDP.

The even more dramatic growth of debt in our AFS shows the fiscal danger of enacting deficit-increasing policies without offsets. It also shows the trade-offs inherent in budgeting: just to stick to the more manageable but still unsustainable current law path would require historically high levels of revenue and low levels of spending on non-Social Security/health care programs – unless lawmakers are willing to reform the major entitlement programs.