The Very, Very Long-Term Budget Outlook

The Congressional Budget Office's (CBO) long-term outlook shows growing federal debt over the next 30 years, but we extended those projections to 75 years. Although we don't know for sure what a longer-term projection would look like, we can get a good idea based on last year's 75-year projection. By our rough estimate, debt would reach about 280 percent of Gross Domestic Product (GDP) in 75 years, about 100 points higher than was projected last year.

To construct the 75-year numbers, we used the long-term Social Security projections CBO already provides and assumed other programs grew as they did in either the first 30 years or last year's long-term outlook. Not surprisingly, our rough extrapolation shows debt continuing to rise beyond 2046, with debt rising from 75 percent of GDP this year to about 125 percent after 25 years, nearly 200 percent after 50 years, and about 280 percent after 75 years. Deficits would grow from 3 percent of GDP this year to 8 percent in 25 years, 11 percent in 50 years, and 15 percent in 75 years, with the latter two being the highest deficits as a share of the economy since World War II.

These numbers are clearly worse than last year's outlook, which showed debt rising to 104 percent by 2041 and 180 percent by 2090. A main culprit for this deterioration is last year's tax extenders law, which made several temporary tax provisions permanent and could become more costly if other temporary extensions in the bill are also made permanent. In addition, slower GDP growth than last year -- partly due to CBO incorporating economic feedback effects of higher debt in their 30-year numbers -- also hurts revenue growth and makes any nominal dollar total bigger as a share of GDP. Non-health care, non-Social Security mandatory spending is also expected to decline more slowly as a share of GDP than last year.

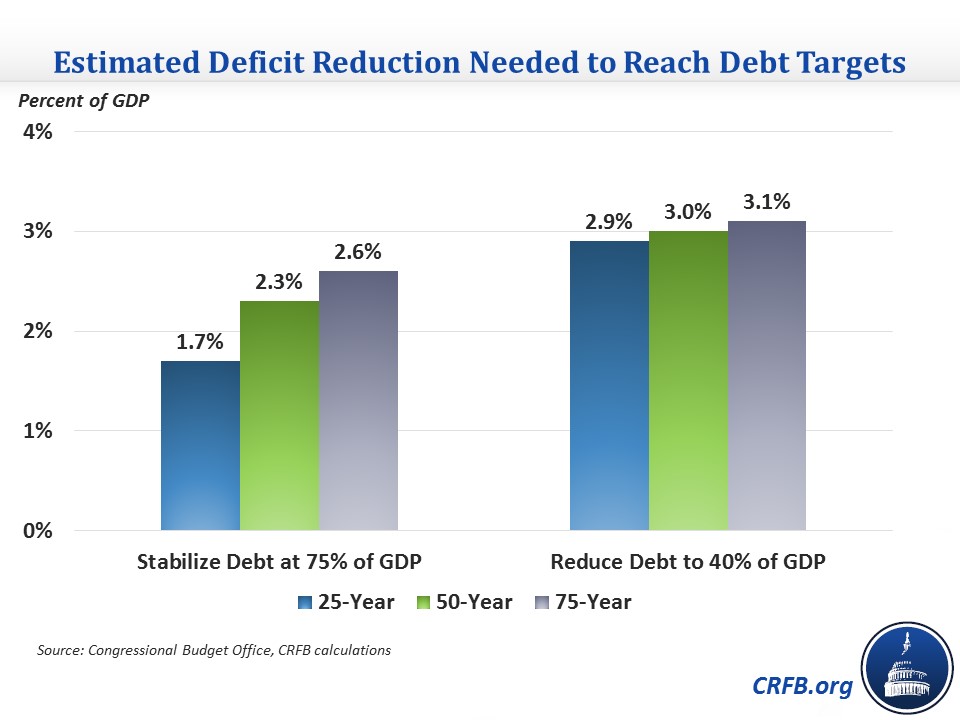

Another way to look at the growth of debt is by measuring the fiscal gap, or the amount of annual deficit reduction needed to reach certain debt targets. The 25-year fiscal gap to keep debt stable at its current level of 75 percent of GDP is 1.7 percent of GDP (the equivalent of $4 trillion over the next ten years), while the amount to bring debt to its historical average of about 40 percent is 2.9 percent ($6.7 trillion over ten years). Stretching out the timeframe further, the deficit reduction needed to keep debt stable at its current level in 50 years is about 2.3 percent of GDP ($5.3 trillion over ten years), and the deficit reduction to reduce debt to its historical average is about 3 percent of GDP ($7 trillion). Finally, to keep debt stable over 75 years would require 2.6 percent of GDP deficit reduction ($6.1 trillion over ten years), while reducing it to the historical average would require 3.1 percent ($7.1 trillion).

Considering that CBO already shows debt rising rapidly as a share of GDP over the next 30 years, it's not surprising that the trend continues over the following 45 years. To prevent this increase, lawmakers will need to enact significant deficit reduction.