‘Line’ Items: Deadlines, Deadlock and Deals Edition

Breakthrough? – There were tough negotiations. Deals were made. Big names were moved. It wasn’t just the MLB and NFL that saw frenetic action ahead of deadlines. The approaching August 2 debt limit deadline has had policymakers scurrying to reach an agreement as nervous voters and markets watch. Yet, unlike Donovan McNabb and Albert Haynesworth, the debt ceiling remains a presence in DC as the deadline nears. However, a resolution to the legislative gridlock appears in sight as leaders moved towards each other over the weekend and agreed to a deal late Sunday. Votes are expected today on legislating the agreement.

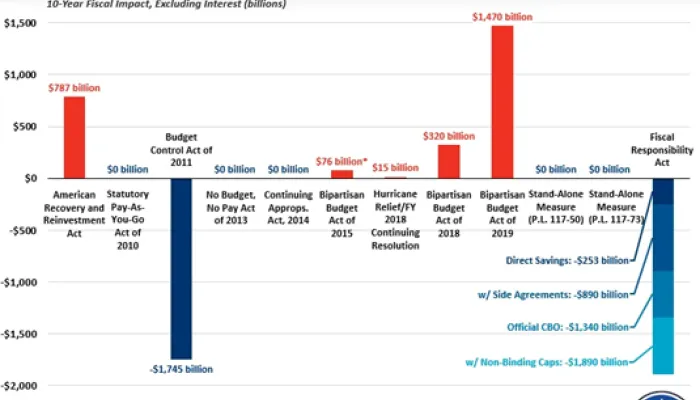

The Deal – The deal includes raising the debt limit by up to $2.4 trillion in increments, which should last through 2012; 10-year discretionary spending caps split between security and domestic spending that will save about $1 trillion; creating a joint congressional committee to identify an additional $1.5 trillion in deficit reduction to be enacted via a fast-track process by the end of the year; establishing an enforcement mechanism triggering spending cuts evenly split between domestic and defense spending if the joint committee process fails to produce deficit reduction; and requiring both chambers of Congress to vote on a balanced budget amendment to the Constitution by the end of the year. Read the White House fact sheet and see the full text of the legislation implementing the deal.

The Committee – The joint committee formed by the deal, dubbed a “super committee” by some and officially titled the Joint Select Committee on Deficit Reduction, will consist of 12 lawmakers evenly divided by party and chosen by congressional leaders. It will be tasked with recommending deficit reduction of at least $1.5 trillion over the next decade. Entitlement and tax reform could be included in the joint committee’s recommendations. Each committee of Congress can submit recommendations to the joint committee by October 14, 2011. The joint committee is to vote on detailed recommendations by November 23, 2011 and submit a report and legislative language with the recommendations, approved by a majority of its members, by December 2. Congress must then vote up or down on the recommendations by December 23, 2011. The joint committee will become a focal point for deficit hawks looking for a comprehensive fiscal plan and special interests seeking to defend favored spending and tax breaks.

The Votes – Congress is expected today to take up legislation enacting the deal. The House is expected to go first with a floor vote later today. Finding enough votes in the House appears to be the biggest hurdle to enacting the deal.

Plans, Slams and Jams – House Speaker John Boehner (R-OH) and Senate Majority Leader Harry Reid (D-NV) pushed competing plans last week as each side slammed the other’s plan and the Senate accused the House of trying to jam through its preferred approach. However, for all the posturing, the two plans had a great deal in common (see here for a comparison of the numbers and here for a side-by-side of provisions). The trigger mechanism to enforce deficit reduction if a plan did not emerge from the joint committee or was rejected by Congress was one of the final sticking points among negotiators. CRFB offered ideas for triggers that could ensure significant savings such as across-the-board spending reductions. The debt ceiling has to be raised for the sake of the economy, but politicians cannot lose sight of the need to develop a long-term comprehensive fiscal plan, as CRFB reminded them. CRFB all along called for a deal that couples a debt limit increase with substantial deficit reduction. Specifically, we recommended a significant down payment and a credible process to produce further savings. However, the $2.5 trillion deficit reduction goal falls short of the $4-5 trillion CRFB called for. We hope that the joint committee goes above and beyond the minimum $1.5 trillion in deficit savings in order to stabilize the debt at a reasonable level over the medium term while putting the country on a course to further reduce the debt over the longer term.

Beige Book Cites Red Ink – The Federal Reserve last week released its report of current economic conditions based on anecdotal evidence. The report cited uncertainty over the national debt and the U.S. fiscal outlook as one of the factors contributing to slower growth. CRFB’s “Announcement Effect Club” highlights those who contend that developing a credible fiscal plan will help boost the economy not just in the long run, but also in the shorter term.

IMF Wants US Fiscal Reform ASAP – The International Monetary Fund (IMF) issued a report last week stating that it is urgent that the US raise the debt limit while agreeing on a medium-term deficit-reduction plan. The plan should include entitlement reform and revenue increases and must begin in fiscal year 2012. The sentiment was largely backed up by new IMF Managing Director Christine Lagarde, who said the US must raise the debt limit and also develop a credible fiscal plan to reduce the national debt.

Business Titans Weigh in on Tax Reform – At a Senate Finance Committee hearing last week on CEO perspectives on tax reform, the heads of Wal-Mart and Kimberly-Clark both testified that they would accept elimination of some tax breaks in exchange for lower corporate tax rates. That is essentially the Zero Plan for tax reform proposed by the Fiscal Commission, which reduces or eliminates tax expenditures in exchange for lower tax rates (see here for more tax expenditure reform ideas).

Fiscal Rules Examined – A hearing of the Joint Economic Committee last week looked at how fiscal rules could help improve the budget outlook. Budget process tools like spending caps, debt triggers and balanced budget amendments have received a great deal of attention lately as potential ways to put the country on a sustainable fiscal course. The Peterson-Pew Commission on Budget Reform has maintained that budget process reform can play a key role in reducing the deficit, offering a detailed blueprint in Getting Back in the Black -- though process is not a substitute for a comprehensive fiscal plan with specific deficit-reduction policies. The Commission also provided a Fiscal Toolbox summarizing and comparing various fiscal tools, which is a part of its one-stop budget process resource.

Key Upcoming Dates

August 2

- Treasury Secretary Geithner says that the U.S. will default on its obligations by August 2 if the statutory debt ceiling is not increased before then.

August 3

- Senate Finance Committee hearing on Medicare-Medicaid dual eligibles and lowering health care costs at 10 am.

October 1

- Fiscal Year 2012 begins for the federal government.