Johnson Introduces Social Security Solvency Legislation

Chairman Sam Johnson (R-TX) of the Ways and Means Subcommittee on Social Security introduced a bill yesterday to make Social Security sustainably solvent for the next 75 years and beyond. According to the Social Security Administration's Office of the Chief Actuary, the Social Security Reform Act of 2016 would eliminate Social Security's 75-year imbalance and close 104 percent of the deficit in the 75th year. The bill represents a thoughtful and comprehensive plan to address Social Security's financing challenge that should encourage other lawmakers to to explain how they would preserve the program.

Johnson's plan would enact a number of changes that slow the growth of Social Security costs while enhancing benefits for certain vulnerable groups. The improvement in solvency would come entirely on the spending side, and the plan would actually reduce taxes modestly (by reducing the taxation of benefits) in later years.

Nearly half the solvency improvement in the legislation would come from progressive changes to the initial benefit formula that increase the "PIA factors" for low earners, reduce them for middle- and especially high-earners, and calculate benefits based on wages on an annual basis (rather than lifetime basis) through something called a "mini PIA." The other half of the solvency improvement would come from changes to the annual cost-of-living adjustment (COLA) – Johnson would use the more accurate chained CPI to calculate COLAs for most beneficiaries and would eliminate the COLA altogether for those with annual incomes above $85,000 ($170,000 if married) in a given year. The plan would also improve solvency by an additional third of the existing gap by raising the normal retirement age from 67 to 69, with these extra savings used to establish a strong minimum benefit for low-earners, increase benefits for the oldest beneficiaries, and phase out income taxation of Social Security benefits. The plan also makes a number of changes to family benefits and work incentives, which have relatively small solvency impacts but in some cases represent substantial improvements to the program.

| Provision | % of Solvency Gap Close | % of Structural Gap Closed |

|---|---|---|

| Change the benefit formula to increase progressivity and slow cost growth | 32% | 35% |

| Use an annualized "mini-PIA" to calculate benefits | 13% | 14% |

| Increase the normal retirement age to 69 by 2030 | 32% | 31% |

| Adopt Chained CPI and eliminate COLA for high-income beneficiaries | 47% | 53% |

| Cap auxiliary benefits and require full-time school enrollment for child beneficiaries | 3% | 3% |

| Provide a new minimum benefit for low earners based on years in the workforce | -9% | -9% |

| Provide a 20 year benefit bump-up | -3% | -2% |

| Phase out taxation of Social Security benefits after surpluses emerge | -15% | -22% |

| Additional provisions and interactions | <1% | 2% |

| TOTAL | 100% | 104% |

Note: Numbers may not add due to rounding.

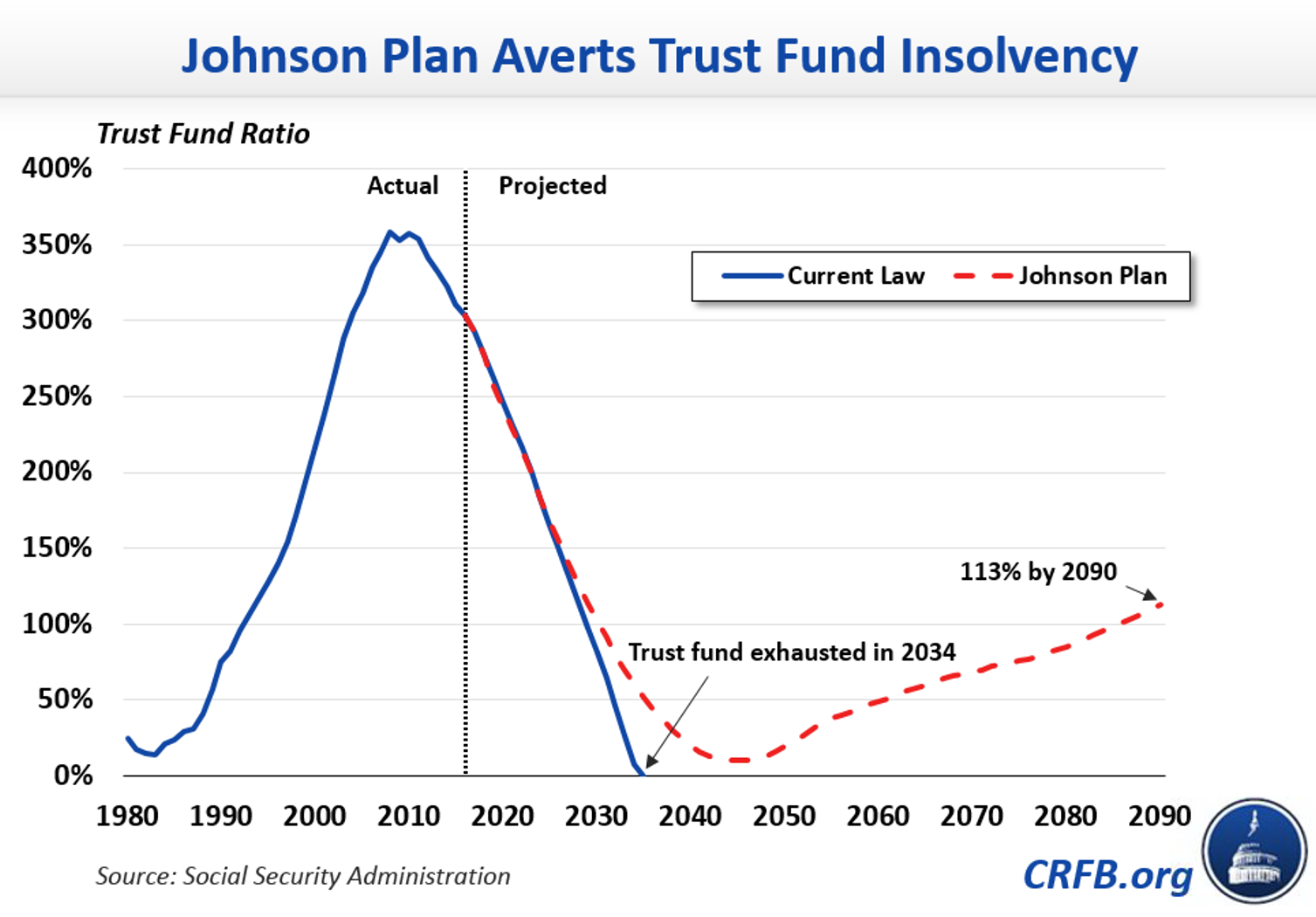

Under current law, Social Security's combined trust funds are projected to run out of reserves by 2034 (or 2029 according to the Congressional Budget Office), at which point all current and future beneficiaries will see an abrupt 21 percent reduction in benefits (find out how much you stand to lose). The Social Security Chief Actuary estimates Johnson's proposal would avoid this abrupt cut by preventing trust fund depletion and ensuring solvency for the next 75 years and beyond. Under the proposal, Social Security's existing trust fund reserves would be stretched to last through 2045, at which point surpluses would emerge and begin rebuilding the trust fund. Small but sustained surpluses under the plan would ensure that by 2090, the trust funds will have enough assets to pay more than a full year's worth of benefits – which is what most actuaries have recommended.

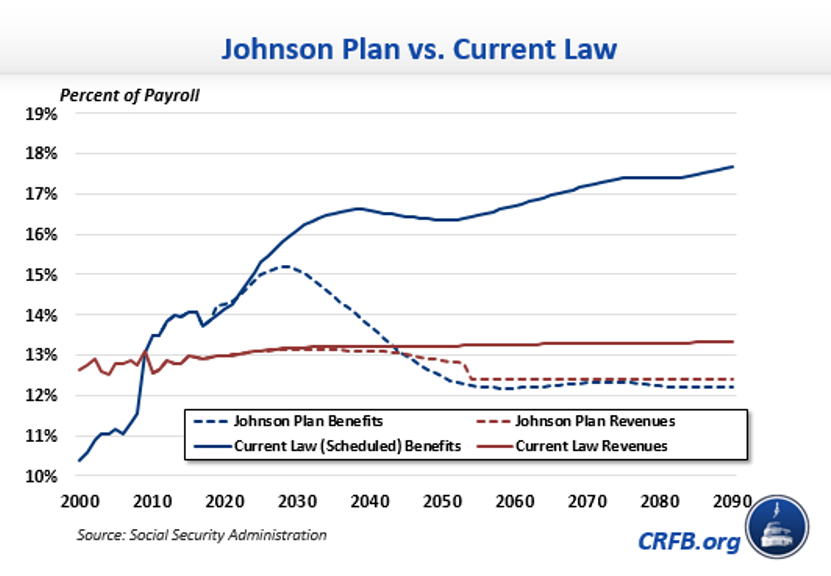

Social Security benefits under the current formula will rise in cost from 10.4 percent of taxable payroll in 2000 and 14.1 percent of payroll today to 16.6 percent of payroll by 2040 and 17.7 percent by 2090. Because benefits cannot be paid in excess of revenue upon trust fund depletion, under current law benefit costs would fall abruptly to 13.2 percent of payroll in 2034 and remain near that level thereafter.

Johnson's plan would slow the growth of benefits over the next decade and then gradually put benefits on a glide path to bring them below payable benefits so they could be financed entirely with the program's 12.4 percent payroll tax. As surpluses reemerge, the Johnson plan would phase out income taxation of Social Security benefits – effectively increasing the size of benefits for many seniors.

While overall benefits under the Johnson plan would ultimately fall significantly below scheduled levels and modestly below payable levels, those reductions would fall largely on higher earners. In fact, low- and very-low earners with full work histories would see their scheduled benefits increase by 10 to 22 percent. Meanwhile, medium-earners would ultimately face benefits somewhere between what is currently scheduled and what is payable under current law. And the very highest earners would see significant reductions in their benefits.

Johnson should be commended for putting forward a serious plan to make Social Security financially sustainable. As CRFB president Maya MacGuineas said of the plan:

Congressional leaders and the incoming Trump administration should follow Chairman Johnson's lead, treating his proposal as a possible starting point for discussion. Members who may disagree with his approach should put forward their own ideas to guarantee the program’s continued solvency—doing nothing is not an option. Revenue and benefit changes both need to be on the table.

After a year of Social Security myths and misdirection, it's time to focus on real solutions. The Social Security Reform Act offers one approach, but many other serious plans also exist. You can even create your own plan with our Social Security Reformer.

One option to reconcile differences would be to establish a bipartisan Social Security commission like the one proposed by Representatives Tom Cole (R-OK) and John Delaney (D-MD). 35 years after the Greenspan Commission, perhaps this a could help lawmakers develop a new plan with enough political support to become law. Another would be to work through the normal legislative process, working in committee to develop a comprehensive solvency plan with enough support to pass both chambers of Congress.

Either way, action should be taken soon. The cost of waiting is high. As MacGuineas said, "It’s time to stop fighting over whether we need to fix Social Security, and start negotiating over how."