The Health Spending Outlook Has Improved But Pick-Up in Growth Still Expected

In a highly anticipated release, the Centers for Medicare and Medicaid Services (CMS) this week released updated data and projections on National Health Expenditures (NHE) and its components. This release updates the last set of projections put out in January and extends the time period by a year to 2023. Overall, the latest projections show another year of slow health care spending growth in 2013, but a pick-up in growth starting this year.

NHE growth is projected to have been just 3.6 percent in 2013, similar to what it has been since 2009 and only slightly above the 3.4 percent economic growth rate for that year. Growth is then expected to pick up -- as it has in past projections -- to 5.6 percent in 2014 as a result of the coverage expansions in the Affordable Care Act kicking in. It will then decelerate to 4.9 percent in 2015 due to reductions in Medicare Advantage payments, the expiration of a temporary hike in Medicaid primary care physician payments, and stabilization in Medicaid enrollment. For the rest of the projection period, growth will hover around 6 percent. Over the 2013-2023 period, NHE growth is projected to average 5.7 percent, 1.1 percentage points higher than the 4.6 percent projected economic growth rate, but still roughly a percentage point slower than the recent historical average.

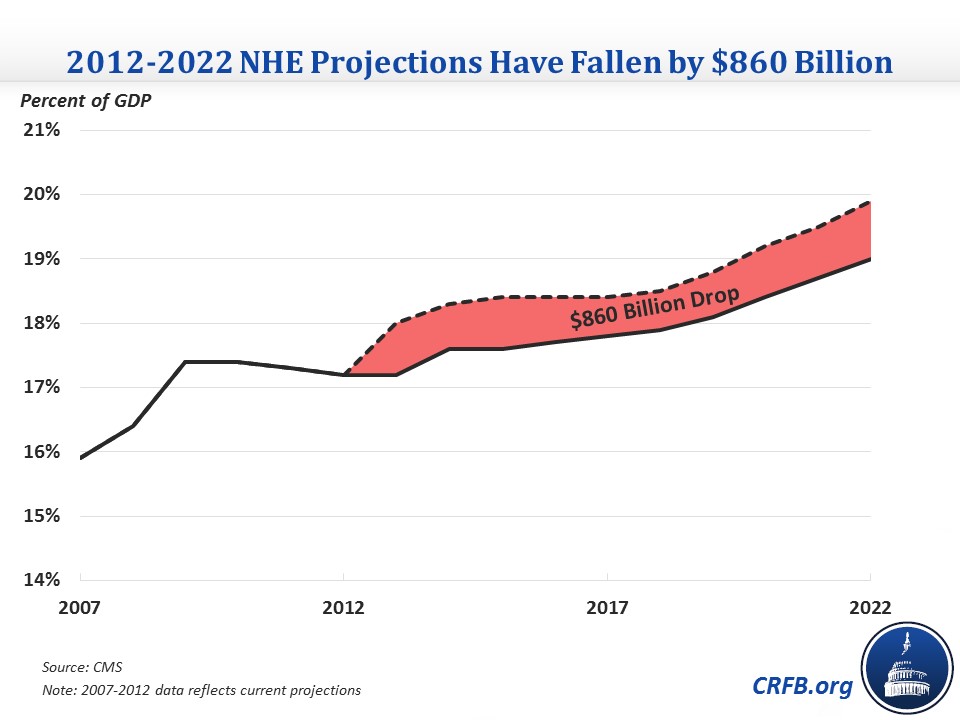

The newest projections represent an improvement over CMS's previous ones, as NHE spending has been revised down by a total of $860 billion over the comparable 2012-2022 window.

Spending is projected to be nearly $150 billion lower in 2022 alone than previously thought and almost a percentage point of GDP lower (with one-third of that difference due to higher forecasted GDP). Still, even with this improvement, NHE spending as a percent of GDP is expected to rise from 17.2 percent in 2013 to 19.3 percent by 2023.

Looking closer, CMS found Medicare spending growth slowing from 4.8 percent in 2012 to 3.3 percent in 2013 due to payment reductions in the Affordable Care Act and the sequester, among other factors. Its growth is expected to remain low for the next few years, reaching a low of 2.7 percent in 2015, before rising rapidly to 7 percent and higher for the rest of the projection period (including a peak of 7.9 percent in 2020). CMS attributes this later growth largely to the continued retirement of the baby boom generation and the aging of boomers within the program.

Meanwhile, Medicaid growth will double from 3.3 percent in 2012 to 6.7 percent in 2013 from the hike in primary care physician payments and changes in state policy. It will then nearly double again to 12.8 percent in 2014 as the coverage expansion kicks in, although per-capita spending will shrink that year, presumably because those joining the program will be relatively healthier. Beyond 2015, Medicaid spending is expected to settle into an annual growth rate of 6-7 percent through 2023.

Private health insurance spending growth will remain low at 3.3 percent in 2013, but then double to 6.8 percent in 2014 because of higher utilization from people gaining coverage in the health insurance exchanges. Growth will then settle in to a 5-6 percent range through 2023. Per-capita private health insurance spending is expected to grow somewhat faster than the major public programs, averaging 4.7 percent for 2013-2023 compared to 3.2 percent for Medicare and 4.4 percent for Medicaid.

Overall, the federal government's role in health care spending will increase somewhat over time as the Affordable Care Act coverage expansions ramp up and the population ages, putting more people on Medicare. The total share of health spending coming from government will increase from 44 percent in 2013 to 48 percent by 2023 as the federal government's share rises from 26 percent to 31 percent.

There are a few interesting notes from the sector data. Prescription drug spending growth bounced back from its very low level of 0.4 percent in 2012 to 3.3 percent in 2013 as the effect of patent expirations faded. Growth will further accelerate to 6.8 percent in 2014 and 6.4 percent in 2015 due to the ACA's coverage expansions and the rise in specialty drugs, particularly for Hepatitis C, and remain around 6 percent through 2023. This growth, averaging 5.9 percent for 2014-2023, is much faster than the 2.4 percent growth we've seen between 2008 and 2013. Considering the role that the prescription drug slowdown played in lower health care spending projections in recent years, this finding could prove important.

Also, the rates of growth of hospital services and physician and clinical services will diverge significantly in the short term, reflecting how different health care policies factor into each category's growth. Both categories have decelerated between 2012 and 2013 -- from 4.9 to 4.1 percent for hospitals and 4.6 to 3.3 percent for physicians. However, the coverage expansion and other factors will only push up hospital growth by 0.4 percentage points to 4.5 percent in 2014, but they will increase physician spending growth by 2.6 percentage points to 5.9 percent since the newly insured are expected to take more advantage of physician services when they gain coverage. In 2015, hospital growth is projected to increase to 5.1 percent while physician growth will revert to a 3.8 percent rate due to the expiration of the Medicaid payment hike and lower Medicare Advantage payments. Beyond 2015, growth for the two categories will be very similar, with hospital spending growing slightly faster as the population ages.

The CMS report has been billed as showing the end of the health care slowdown, and the projections do show a pick-up in growth despite the downward revisions since the last report, but the analysis also expects growth to remain slower than it historically it has been. That growth will pick up in the short term as millions of people gain coverage is no surprise, so it will take more than a few years to see whether the acceleration is just a temporary shift or a return to normal.