Enzi-Whitehouse Budget Process Bill Includes Important Reforms

The Senate Budget Committee recently marked up and reported bipartisan legislation to reform the budget process. The Bipartisan Congressional Budget Reform Act, introduced by Chairman Mike Enzi (R-WY) and Senator Sheldon Whitehouse (D-RI), would improve transparency and accountability in the budget process. It would make the budget resolution into a more effective governing tool by making it easier for policymakers to choose fiscal targets and stick with them. That, we hope, would mean putting the debt on a more sustainable path. The Senate Budget Committee approved the legislation by a vote of 15 to 6, and it currently has 19 bipartisan cosponsors in the Senate.

While there may be room to make improvements and adjustments to the bill and some amendments were adopted in committee, the legislation is a thoughtful, realistic, and helpful approach to improve the budget process on a bipartisan basis. Congress should build on and enact some version of this proposal.

What's In the Bipartisan Congressional Budget Reform Act?

The Bipartisan Congressional Budget Reform Act is the result of years of effort, building on several past proposals including those from Chairman Enzi, Senator Whitehouse, the recent Joint Select Committee on Budget and Appropriations Process Reform (JSC), and even our own Better Budget Process Initiative recommendations.

The proposal would incorporate debt-to-Gross-Domestic-Product (GDP) targets into the budget resolution and the budget process, adopt biennial budgeting while keeping annual appropriations, link debt limit increases and discretionary spending caps to passage of a budget resolution, and add transparency requirements such as including interest costs in Congressional Budget Office (CBO) scores.

A brief summary of the bill is available from the Senate Budget Committee.

How Might the Fiscal Targets in the Bipartisan Congressional Budget Reform Act Improve Fiscal Outcomes?

A key aspect is expanding the fiscal goals included in the budget process. Specifically, budget resolutions would set targets for the ratio of debt held by the public to Gross Domestic Product (GDP). Congress would set these targets in a joint budget resolution every odd-numbered year, and the Congressional Budget Office (CBO) would evaluate adherence to the target in even-numbered years. Adopting a budget resolution would automatically spin off debt-limit-increase legislation to be signed by the President as well as a special reconciliation process in some cases. Setting fiscal goals is an incredibly important first step toward achieving long-term sustainability, and integrating them into the budget resolution could give current members more ownership of those objectives and hopefully strengthen their ongoing commitment to meeting fiscal targets.

The proposal goes further than simply setting goals. It would establish a new, deficit-reduction-only reconciliation process if needed to achieve the debt-to-GDP levels agreed to in the earlier budget resolution. Under this process, the Senate Budget Committee, renamed the Committee on Fiscal Control and the Budget, would report a simple resolution with reconciliation instructions to the full Senate, where it would be open for amendments. If approved by the Senate, it would instruct applicable committees to produce deficit-reducing legislation to achieve compliance with debt targets. Senate procedures for regular reconciliation legislation would apply to the new reconciliation process, including the Byrd Rule that, among other provisions, prohibits changes to Social Security. When marking up the legislation, however, many members expressed a desire to understand this process more completely before floor consideration.

While some have criticized this new tool as a threat to low-income programs, we believe this concern is largely misplaced. The tool would not automate any changes to spending or revenue, but would instead establish a process to consider deficit reduction measures. These measures would have to pass the Senate and the House and be signed by the President (a veto override is also possible). Unlike current reconciliation rules, which have been used to pass deficit-financed tax cuts, this process is limited to deficit reduction and could help policymakers agree to new revenue and to reforms to improve health care programs. And long-term deficit reduction can easily co-exist with near-term measures to counter a recession.

What Other Provisions Might Improve Fiscal Outcomes?

In addition to improving outcomes through this special reconciliation, the bill would establish a new pathway for a bipartisan budget resolution, previously championed by Sen. Whitehouse during the JSC last year and introduced separately as S. 63, the Bipartisan Budget and Appropriations Reform Act of 2019. A majority of both parties in the Senate Budget Committee and at least 15 members of the minority party on the Senate floor would be needed for a budget resolution to qualify for this new pathway. Under it, subsequent appropriations legislation would be easier to consider on the Senate floor, and the budget resolution would automatically spin off legislation with enforceable caps on discretionary spending in addition to increasing the debt limit. This process could help the parties to work together toward reasonable deficit reduction measures. Folding the debt limit and spending caps into the bipartisan pathway for the budget resolution would also reduce opportunities for isolated brinkmanship.

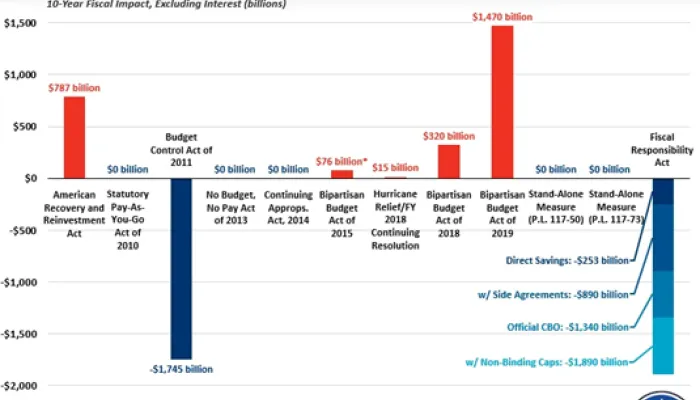

Other aspects of the bill – like asking CBO to estimate interest costs associated with legislation and restricting phony spending cuts known as changes in mandatory spending programs (CHIMPs) – could also improve budget outcomes. Adopting portfolio budgeting is another positive step, as it would provide a more holistic review of major program areas regardless of the committees of jurisdiction and thus help lawmakers coordinate related authorities.

To be sure, the Bipartisan Congressional Budget Reform Act would not fix the debt directly, nor does it include actual deficit reduction. Through improvements in the overall budget process, it would give lawmakers more opportunities to think seriously about the consequences of high and rising debt as well as more ability to budget comprehensively and mindfully.

What Amendments Have Been Proposed?

The Bipartisan Congressional Budget Reform Act was introduced on Oct. 31 and was ordered reported by the Senate Budget Committee on November 6. During the markup, the committee made the following changes:

- A manager's amendment by Chairman Enzi to enhance the consensus-oriented aspects for special reconciliation.

- An amendment by Senator Pat Toomey (R-PA) to create a new point of order intended to deter the use of the Crime Victims Fund to increase unrelated spending through CHIMPs.

- An amendment by Senator Tim Kaine (D-VA) to add tax expenditures to the scope of portfolio budgeting.

- An amendment by Senator Chris Van Hollen (D-MD) to restrict the ability of the President to use rescission authority near the end of fiscal years and to increase related reporting requirements.

In addition, the following amendments were considered but not adopted:

- An amendment by Senator David Perdue (R-GA) to align the fiscal year with the calendar year.

- An amendment by Senator Ron Wyden (D-OR) to remove the new reconciliation process to enforce debt-to-GDP targets.

- An amendment by Senator Jeff Merkley (D-OR) to require CBO to provide information on the distributional impacts of legislation. Nonetheless, Chairman Enzi pledged to work with Senator Merkley and other members to obtain the information they seek.

Lawmakers must continue to improve the budget process, which has contributed to many years of inaction on a budget resolution and even more missed deadlines. Process reforms alone cannot create the political will to have a functioning budget, but they may allow latent political will to accomplish more. This bill offers thoughtful ideas to make the process more effective and to improve the framework for lawmakers to consider budget matters more comprehensively.