Doing More Than Just Hitting the Target

Our blog yesterday noted that the debate over stimulus versus deficit reduction is much more nuanced than is often portrayed. Although these positions are sometimes characterized as directly opposing, there is often a lot of overlap. We described the difference as more about emphasis rather than direction.

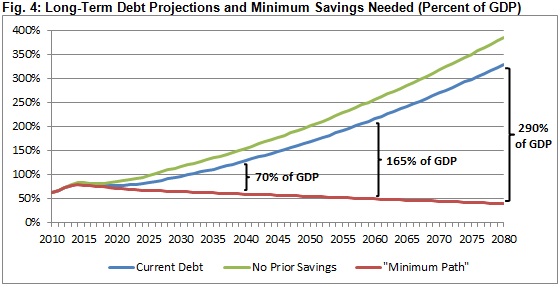

Such nuance can be applied to our position in the next round of deficit reduction. We said in a recent policy paper that lawmakers should aim to enact at a minimum $2.2 trillion of additional deficit reduction over ten years, an amount that would likely put the debt on a sustainable downward path. Still, this target is not necessarily ironclad. A box in the paper noted that although the "minimum necessary savings" path would put debt at 70 percent of GDP in 2022, there was nothing special about that target. What is important is the trajectory -- debt should be on a clear downward path. A plan which included large upfront savings and had debt at 70 percent but on an upward path would not be preferable to a plan which, for example, included substantial upfront stimulus and had debt above 70 percent but on a clear downward path over the long-term.

While the trajectory is critical, it is also important for policymakers to focus on the timing and composition of a deficit reduction plan -- as we have discussed in the past.

We mentioned yesterday that most economists and commentators participating in the stimulus versus deficit reduction debate agree on the timing element -- that the majority of deficit reduction should take place when the economy is on a stronger footing. While there may be some disagreement as to what that "stronger footing" would mean, there is general bipartisan and expert consensus that deficit reduction works best when it is phased in gradually. Note that passing deficit reduction now is not the same as implementing it now. Putting in place a plan now can have economic benefits by providing more certainty about our future fiscal path without the downside of immediate fiscal changes hurting the recovery. Lawmakers would be wise to take advantage of the opportunities over the coming weeks and months to focus on fiscal reforms.

The composition of a plan also matters. For example, the sequester is not only bad policy because it does not phase in its large savings, but also because it cuts spending across-the-board for most programs. By doing so, it cuts wasteful or low-priority spending the same as spending that can help long-term growth prospects, such as high-value infrastructure, research projects, and education programs.

Tax reform is a great example of more targeted reform. Because of the numerous tax expenditures and other complexities in the code, it is quite possible to raise revenue and make the code more progressive while lowering statutory tax rates. Doing so would greatly improve economic efficiency by not having the tax code distort economic incentives.

Tax reform is just one area where lawmakers can "Go Smart" in a way that promotes growth. There are numerous other examples of smart, pro-growth deficit reduction policies that lawmakers should pursue. Policies we have mentioned previously include increasing spending on infrastructure and increasing Medicare and/or Social Security eligibility ages. Improving growth would greatly help the deficit reduction effort by increasing revenues, reducing spending on automatic stabilizers, and increasing the denominator in the debt-to-GDP ratio.

In short, hitting the target for deficit reduction is important, but doing so in a smart way through gradual reforms is the ideal.