Economists in Favor of Smart Deficit Reduction

A recent op-ed from Joe Scarborough in Politico has brought back attention to the stimulus vs. deficit reduction debate.

Some commentators like Paul Krugman have suggested that we do not need to be worrying about debt and deficits right now. Furthermore, he suggested that attempting to put the deficit on a sustainable path in the medium-term would require short-term austerity and run contrary to the goal of reducing unemployment. Wonkblog's Neil Irwin and Business Insider's Joe Weisenthal have joined the conversation, commenting on a divide between perceived divide economists and those in favor of deficit reduction.

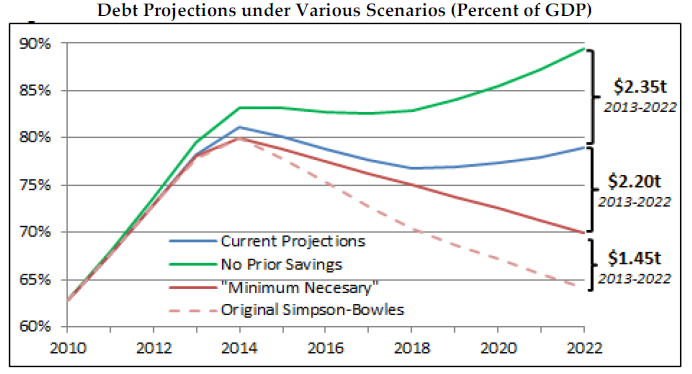

This conversation doesn't focus on the real debate. Many of the economists referenced in the Irwin and Weisenthal pieces warn of implementing spending cuts or tax increases now but still would like to see a plan to reduce the deficit over the medium and long term passed now, with the deficit-reducing policies phased in slowly over time. We have said before that not only should lawmakers seek to "Go Big" with a comprehensive plan, but also to "Go Smart" and use a plan that would slowly phase in many provisions, like in Simpson-Bowles and Domenici-Rivlin. Not only would that allow ample time for business and households to prepare for these changes, but it would also ensure that most savings take place when the economy has recovered. There is reason to believe that just announcing a plan that would get our fiscal house back in order could boost confidence among businesses and households and contribute to economic growth in the meantime without the negative effects of upfront fiscal retrenchment.

To some extent, the debate on our need to create more jobs and ensure fiscal sustainability is a matter of emphasis, rather than of direction. Lawmakers can easily do both. Federal Reserve Chairman Ben Bernanke advocated a dual approach in a December press conference, both avoiding creating economic headwinds and agreeing upon a framework that would demonstrate that lawmakers are serious about our unsustainable longer-term debt problem. It wasn't so long ago either that ten former chairs of the Council of Economic Advisors under both Republican and Democratic administrations authored an op-ed on the need to deal with the unsustainable deficit. They wrote:

There are many issues on which we don’t agree. Yet we find ourselves in remarkable unanimity about the long-run federal budget deficit: It is a severe threat that calls for serious and prompt attention.

Chairman Bernanke is not the only economist who has suggested the benefits of phased-in debt reduction. In an op-ed by Christina Romer, a former chair of the Council of Economic Advisors under President Obama, she writes:

What about the United States, which faces a terrible long-run budget problem, but no immediate threats from the bond market? The best policy here is to combine the backloaded consolidation I’m recommending for troubled countries with the short-run stimulus I’m advocating for countries like Germany. We could enact something like the Bowles-Simpson plan to reduce the deficit sharply over 10 years, and include in it more near-term investment in infrastructure, education and scientific research.

Kenneth Rogoff of Harvard University agrees that it is important to be mindful of the business cycle, but also cautions those who say we can afford to forget about deficits right now:

We aren't arguing that there needs to be immediate austerity to balance the budget now. The focus of deficit reduction should be putting debt on a downward path at the end of the decade, and to do this will require certain structural changes that should be phased in over time -- giving the economy time to recover. As we show in our paper, Our Debt Problems Are Far From Solved, an ideal plan would not make dramatic changes right away, but rather phase in specified changes over time that are agreed to now.They see lingering post-financial-crisis unemployment as a compelling justification for much more aggressive fiscal expansion, even in countries already running massive deficits, such as the US and the United Kingdom. People who disagree with them are said to favor “austerity” at a time when hyper-low interest rates mean that governments can borrow for almost nothing.

But who is being naïve? It is quite right to argue that governments should aim only to balance their budgets over the business cycle, running surpluses during booms and deficits when economic activity is weak. But it is wrong to think that massive accumulation of debt is a free lunch.

Source: CRFB calculations

There is a legitimate debate on how deficit reduction should proceed -- the pace, the composition, and the enactment of a final plan. But this, as Michael Kinsley noted in a recent Bloomberg column, is a more nuanced conversation, and there are many areas where deficit hawks and doves agree. Tomorrow, we will further explain why the "how and when" of deficit reduction can be just as important as "how much."

Update (2/1/2013): A previous version of this post may have mischaracterized Irwin's article. This has since been clarified.