CRFB Looks Toward the Upcoming Fiscal Discussions

On May 19, the debt ceiling was reinstated as the Treasury Department began to use extraordinary measures to prevent running up against the debt limit. Extraordinary measures are expected to be exhausted sometime this fall, also when the current continuing resolution (CR) funding the government is due to expire. In addition, both parties are looking to alter the sequester in some form for future years and will have to figure out what to do with it then. In a new paper, "What We Expect From the Upcoming Fiscal Discussions," we lay out what we expect from the upcoming fiscal discussions surrounding both the debt limit and the FY 2014 budget.

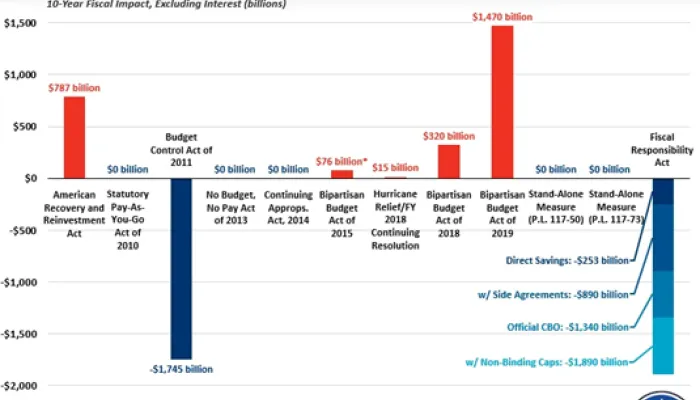

The last debt ceiling debate lead to the Dow Jones Industrial Average falling by over two thousand points and a credit rating downgrade by S&P from AAA to AA+. While some deficit reduction was achieved in the Budget Control Act, most address the short-term deficit with little progress made on the long-term problem. Instead of the increasing uncertainty that comes with an eleventh hour effort, we favor a proactive approach that:

- Raises the debt ceiling well before extraordinary measures run out

- Addresses the sequester by agreeing to defense and nondefense levels for 2014 and sustainable levels thereafter, without increasing long-term debt

- Agrees to a comprehensive fiscal framework which sets future discretionary spending levels and calls for mandatory spending and revenue changes sufficient to put the debt on a clear downward path relative to the economy

- Enacts some combination of specific changes and a credible process to implement the agreed-to framework

There is no question that waiting to make changes until the last minute will do unneccessary harm to the economy and lead to hastily designed deficit reduction measures, like sequestration. The debt ceiling and expiration of the continuing resolution will require Washington to turn its attention to the budget, and while waiting until then might be a tempting option for some lawmakers, it would be a major mistake. As we conclude in our paper:

In many ways, the approaching debt ceiling and appropriations deadlines represent a microcosm for the larger long-term fiscal issues. The longer we wait to address these issues, the harder it will be to do so, and the more economic risks we will be taking in the process.

Click here to read the full report.