Congress Must Abide by PAYGO for Upcoming Legislation

Congress returns from its July 4th recess this week, and it will have plenty of work to do. Most pressing is the looming insolvency of the Highway Trust Fund (HTF). In less than a month, federal disbursements for highway projects will be disrupted if nothing is done. In addition, the House will take up a bill to permanently extend bonus depreciation, a business tax break enacted as stimulus in 2008. Also, the conference committee on a bill to reform veterans' health benefits in response to the unfolding scandal at the VA is expected to resume, and the President has called for a $3.7 billion supplemental request for funds to secure the southern border in response to an influx of child migrants.

The first three issues, in particular, all have the potential to significantly impact the federal budget. First, the Highway Trust Fund faces a nearly $170 billion shortfall over the next ten years, an issue that has been addressed in recent years by mostly unpaid for general revenue transfers. Because of budget conventions, these transfers don't count as increasing the deficit, even though the transfers allow greater levels of spending than would otherwise be the case. The Senate Finance Committee is looking to transfer $8 billion to the HTF to extend it through the end of the year, offsetting the cost with other revenue provisions. Closing the ten-year shortfall within the HTF through various options available to lawmakers or fully offsetting a general revenue transfer would reduce debt by about 1 percentage point of GDP by 2024; put another way, it would avoid the 1 percentage point of GDP being added to the debt that would occur if lawmakers transferred general revenue without offsets.

Second, the House is expected to vote this week on bonus depreciation, a business tax break enacted as stimulus in 2008. The House bill not only permanently extends the current provision to allow 50 percent of many new business investments to be written off in year one but also expands the tax break by making eligible new categories of investments. In total, the bill would cost $360 billion through 2024 including interest, increasing debt as a percent of GDP in 2024 by 1.5 percentage points of GDP. We've written before on how bonus depreciation has already cost $220 billion since 2008, and should not be treated as a normal tax extender because it interacts with other parts of the tax code.

Third, the veterans' health care conference committee could report an agreement that would have a substantial effect on the budget if the policies in either piece of original legislation were extended. Both House and Senate bills would allow veterans to receive care outside the VA system if they have experienced wait times of a certain length or live a certain distance from a VA facility. CBO estimated that the costs could exceed $50 billion per year once the authority was fully implemented, although the bills would allow the authority only for the next two years. The bills differ in that the Senate bill provides an open-ended mandatory appropriation, while the House bill requires the bill to be funded through the appropriations process; however, either bill could cost over $500 billion, or an increase in 2024 debt of 2.2 percentage points of GDP, if funds are fully appropriated without offsetting reductions in other spending and if the authority to contract with private providers is extended past 2016.

The supplemental request for border security funding could add $3.7 billion to this total, depending on how it is approached. Lawmakers should offset the cost by incorporating the funds into the appropriations process and fitting it under the spending caps, or by saving money elsewhere. They should not use the emergency designation, as the President has requested, to breach the discretionary spending limits.

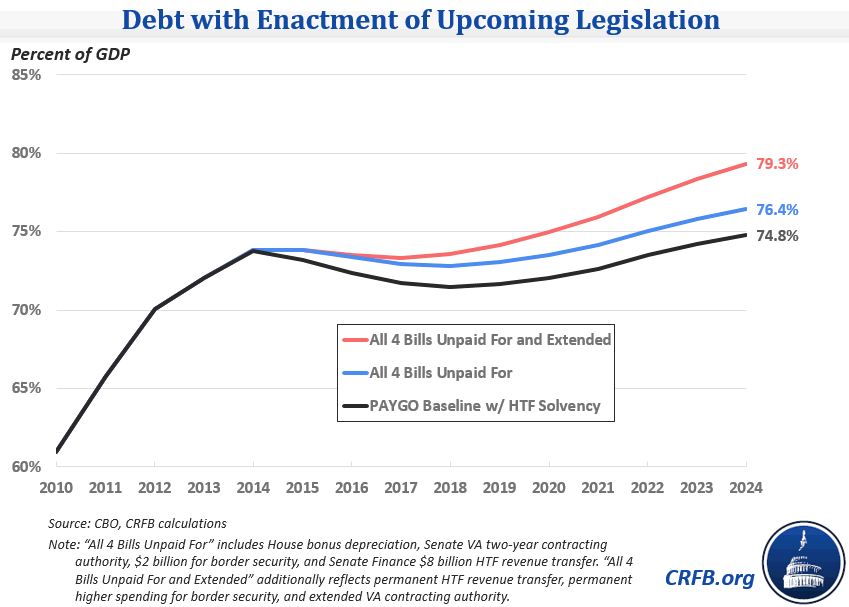

The graph below shows the potential cost of unoffset legislation. We compare debt under a PAYGO baseline -- with lawmakers also making changes to keep the Highway Trust Fund solvent -- to debt with the enactment of the bills/requests being discussed without offsets and the potential added cost if the temporary provisions are extended.

If lawmakers took the most irresponsible approach to all four issues, lawmakers could increase ten-year deficits by more than $1 trillion. It is important that lawmakers abide by PAYGO and find offsetting savings to pay for any changes they adopt.