Comprehensive Deficit Reduction Need Not Slash Retirement Benefits to Control Spending

A recent report from Scott Lilly at the Center for American Progress (CAP) makes the case that policymakers have only two real choices to respond to the future growth in debt levels: slash retirement benefits or raise taxes. The CAP paper rightly identifies the source of debt growth as the continued growth in Social Security, Medicare, and Medicaid, not discretionary or other mandatory spending. However, the paper oversimplifies the possible solutions which need not come down to an "either/or" choice, but can instead involve a comprehensive mix of tax and spending changes which, if enacted soon, need not “slash” anything.

As the CAP paper points out, future growing debt is entirely attributable to our entitlement programs. As it shows, per-capita spending for Social Security, Medicare, and Medicaid will increase by more than one-third over the next decade, while per-capita discretionary spending will fall by 13 percent, even without the sequester. In addition to real per-capita costs rising as Social Security benefits track wage growth and Medicare benefits track health care costs, the aging of the population is putting significant additional pressures on these programs. According to the paper, the number of Social Security and Medicare beneficiaries will grow by about 15 million over the next decade and by 70 percent over the next two decades.

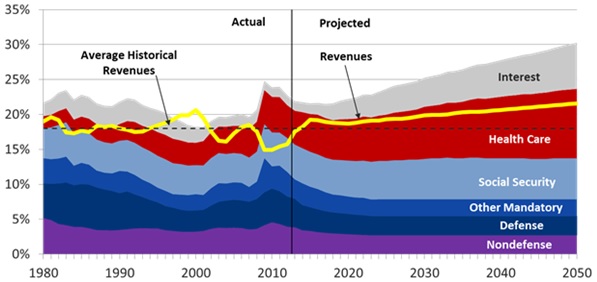

The fiscal implication of this growth in beneficiaries is central to our long-term fiscal outlook. Under the CRFB Realistic baseline, spending on health care and Social Security is projected to grow from 9.8 percent of GDP this year to 13.9 percent in 2035. If all other spending stays constant as a share of GDP after 2023 and revenue continues to grow as under current law, that would lead debt levels to grow from 75 percent of GDP in 2013 to 95 percent by 2035.

Yet while the CAP paper identifies the problem correctly, it vastly oversimplifies the solution. It is quite possible to put the debt on a sustainable path in a way that brings spending under control but does not "slash" retirement benefits. The Simpson-Bowles Bipartisan Path Forward, for example, proposes a mixture of different solutions that would make health care spending more efficient and "bend the health care cost curve," encourage longer worker lives, slow the growth of but not slash retirement benefits, raise revenue from comprehensive tax reform, and identify cuts in the mandatory and discretionary programs to pay down the mindless sequester currently in effect.

In fact, the Center for American Progress themselves have come up with a sufficient amount of policies in recent months and years to put debt on a downward path by achieving the $2.2 trillion in savings we have calculated are necessary. CAP’s Medicare reform plan would likely save more than $400 billion through 2023 with only a tiny fraction (about 6%) coming from beneficiaries through means-testing premiums. Adopting the chained CPI, as CAP has supported in the past, would save nearly $300 billion. Further deficit reduction could come from the proposed $1 trillion of revenue they've identified through tax expenditure reductions, along with the $100 billion each of defense and other mandatory cuts which they believe are achievable in a sequester-free world. Taken together, that totals $1.9 trillion, which would mean about $2.2 trillion with interest, and the package includes no "slashing" of anything.

To ensure additional long-term savings, policymakers could improve the solvency of Social Security (and so can you, with our interactive Social Security Reformer) while still allowing real benefit levels to increase over time and allowing beneficiaries to continue to collect for more years over time. Further health care reforms could come from payment reforms, reforming but not dramatically increasing cost-sharing, expanding means-testing of premiums, and gradually raising the Medicare age as the population gets older. Many of these changes, along with some additional mandatory and discretionary cuts, could even buy down some of the short-term revenue if policymakers were so inclined.

Ultimately, what we have is an entitlement growth problem - driven by a combination of growing health care costs and an aging population. But there are many solutions to address and finance this. The sooner and more comprehensively we act, the easier those solutions will be.