Another Potential Bipartisan Health Care Reform

While reforming entitlement programs continues to be a critical challenge for policymakers, recent developments suggest that bipartisan support for addressing rising Medicare spending may be growing. Yesterday, Senators Tom Coburn (R-OK) and Claire McCaskill (D-MO) unveiled The Medicare Fair Share Act, which would modify existing premiums so that higher-income seniors would pay a greater portion of program costs than they do under current law. Specifically, it would increase the amount that seniors subject to income-related premiums pay by 10 percent of program costs.

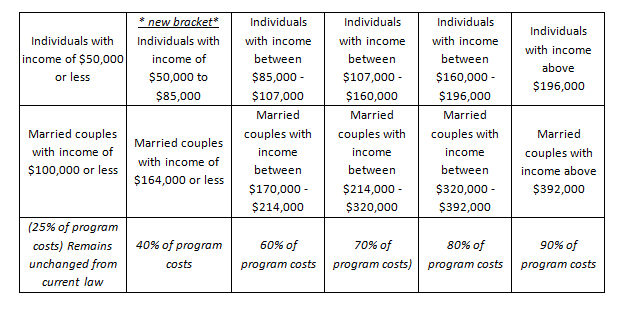

Currently, most Medicare beneficiaries pay 25 percent of Part B (physician’s offices) premiums, while those with incomes over $85,000 ($170,000 for couples) pay between 35 to 80 percent, depending on their income. Below are the changes Coburn and McCaskill recommend for increasing specific income brackets:

Coburn-McCaskill Income-Related Premium Reform:

Source: Senator Coburn and Senator McCaskill's

Not only does the bill have bipartisan sponsors, but it is similar to other proposals that have addressed income-related premiums. In fact, the bill is very similar to the proposal included in The Bipartisan Path Forward. That plan recommended increasing existing premiums by 15 percent, creating a minimum threshold so that 15 percent of the senior population would be subject to income-related premiums, and freezing thresholds through 2030. Savings through 2023 were estimated around $65 billion.

Earlier this year, President Obama also included additional means-testing of Medicare in his FY 2014 budget proposal, which CBO scored as saving $56 billion over ten years. Starting in 2017, the President's proposal would add more income brackets than the Coburn-McCaskill bill, but similarly would increase premiums with a maximum premium of 90 percent of the program costs for those making more than $196,000.

Comparison of Current Law and the President's FY14 Proposal:

Source: CMS

There is some concern that higher-income beneficiaries who are typically healthier would drop out of Parts B and D and simply buy less expensive coverage on their own or self-pay for medical care, thereby increasing risk in the program and making it more expensive. However, by limiting income related premiums to no more than 90% of program costs the bill would retain a government subsidy for the Medicare benefit which will make Medicare a better option for seniors than unsubsidized private insurance.

As we look to the upcoming budget negotiations, it is clear that income-related premiums may be one area where lawmakers may be able to achieve a bipartisan compromise, along with cost-sharing reforms and a raising the Medicare age with a buy-in. We commend Sens. Coburn and McCaskill for putting forward this proposal, and hopefully, the growing support for these bipartisan proposals can advance the entitlement reform conversation.