CBO Still Shows Unsustainable Debt in its August Baseline

The Congressional Budget Office (CBO) just released its August baseline, updating budget projections from March and economic projections from January. CBO continues to show debt on an unsustainable path, rising continuously as a percent of GDP after 2018. Combined with its long-term projections released last month, the agency shows the clear need to enact deficit reduction to avert a huge rise in debt over the long term.

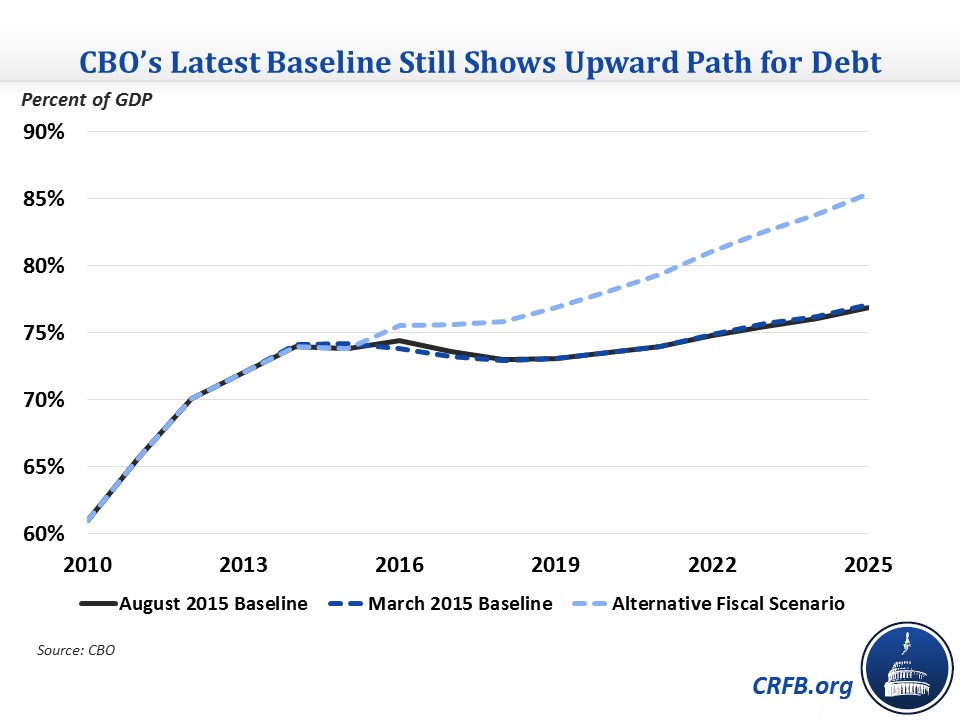

While debt will improve slightly in the near term, declining from last year's post-war record of 74 percent of GDP to 73 percent by 2018, it will then rise to 77 percent of GDP by 2025. Based on our calculations of the assumptions in CBO's Alternative Fiscal Scenario, debt will reach 85 percent of GDP by 2025. These estimates are very similar to the March projections.

Under CBO's current law projections, deficits will fall to $426 billion this year and a low of $414 billion in 2016, but then begin to rise with $1 trillion deficits returning in 2025. Over the course of the next decade, deficits will average 3.1 percent of GDP, including 3.7 percent of GDP deficits in 2025. By comparison, the 50-year historical average level for deficits is 2.7 percent of GDP.

Driving this rise in deficits is spending, which CBO projects will increase from 20.6 percent of GDP in 2015 to 22 percent by 2025. Meanwhile, revenue will remain between 18 and 19 percent of GDP, averaging 18.3 percent over the ten-year period and in 2025. By comparison, historical revenue levels average 17.4 percent of GDP and spending levels 20.1 percent.

In addition to updating their budget forecast, CBO has also updated its economic projections, revising down economic growth in 2015 but revising it up for 2016-2019 and lowering unemployment and interest rates throughout the ten-year period.

The economic forecast is one of the main sources of change in the budget projections between March and August. As a result of these economic changes, revenue is $53 billion higher through 2025 and outlays are about $716 billion lower. Technical revisions to budget estimates, changes not involving legislation or economic developments, increase deficits by $342 billion on net, largely from revenue and Medicare spending. Legislation increased deficits by $165 billion, almost entirely from the physician payment law passed in April. In total, the changes have reduced 2015-2025 deficits by $263 billion.

| Changes in CBO's August Baseline (billions) | |

| 2015-2025 Savings/Costs (-) | |

| March 2015 Deficits | -$7,695 |

| Revenue | -$110 |

| Legislative Changes | $2 |

| Economic Changes | $53 |

| Technical Changes | -$166 |

| Outlays | -$372 |

| Legislative Changes | -$167 |

| Economic Changes | $716 |

| Technical Changes | -$176 |

| August 2015 Deficits | -$7,433 |

Source: CBO

Note: Positive numbers denote lower deficits and vice versa.

With a largely similar picture as we have seen in CBO's baseline throughout 2015, it is clear that lawmakers must act to prevent the significant rise in debt that these projections show.

We'll be publishing a more complete analysis later today. Click here to read the CBO report.

Update: The blog initially stated that our calculation using CBO's assumptions for the Alternative Fiscal Scenario would have debt reach 86 percent of GDP by 2025. We have changed that to be 85 percent.