CAP's Proposal to Improve Retirement Accounts

With President Obama set to give a speech in the coming weeks on retirement security, the Center for American Progress (CAP) has released a report describing a new retirement account that intends to improve on current 401(k)-type plans. Their report discusses their Secure, Accessible, Flexible, and Efficient Retirement Plan (SAFE), and focuses primarily on the potential merits of collective defined-contribution (CDC) plans, as compared to traditional defined-contribution or defined-benefit plans. The report analyzes how such plans would outperform traditional 401(k)s and thus benefit retirees.

CAP first describes some of the shortcomings of current defined-contribution plans and how CDCs would address them. In short, current 401(k)s put the financial risk on the workers and rely on those individuals to make investment decisions. CAP argues that the latter point often results in adverse economic decisions, generally as a result of participants not weighting the riskiness of their portfolio in the optimal way. In addition, individual 401(k)s have higher management fees than would be the case under a CDC plan.

CAP's SAFE Retirement Plan would instead pool contributions to spread risk around, in addition to having the plan be professionally managed so as to take advantage of better investment strategies than may be the case if individual investors were managing it. In addition, the fund would manage risk by having a flexible reserve fund; one added to when returns exceed a certain amount and depleted when returns are negative.

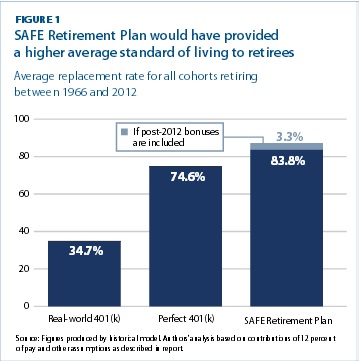

The report's actuarial analysis shows that the CDC plan would hypothetically have provided a much higher replacement rate for retirees than a "real-world" 401(k) and a slightly higher replacement rate than a theoretical perfectly managed 401(k). They also show that the CDC plan would be less risky, showing that it would have much better protected workers who retired during the Great Recession.

The CAP report is a good reminder that while the three legs of retirement security -- Social Security, pensions, and individual savings -- are affected by different parts of the government, policymakers should keep in mind how the three could best work together when making changes to any individual one. Although the most important thing we can do for retirement security is to make Social Security solvent, it is important to consider all parts of the retirement system.