Why Lawmakers Should Fix the Budgetary Treatment of the Highway Trust Fund

Continuing our series of transportation-focused blogs, this blog discusses the budgetary treatment of the Highway Trust Fund (HTF). While most of the attention regarding the HTF has focused on proposals to address the impending exhaustion of the HTF, the need to reauthorize highway programs by the end of September presents an opportunity to reform the budgetary treatment of spending from the HTF to provide greater transparency in highway spending.

The current budgetary treatment of the HTF effectively exempts HTF spending from most budget enforcement rules and creates the potential for numerous budget gimmicks and hidden costs. The special budgetary treatment of the HTF arose in part from its structure as a self-financed program with its own internal fiscal limits. But with highway spending increasingly funded by general revenue transfers allowing spending in excess of the limits imposed by the HTF, it should be subject to the same checks and balances as other federal spending.

Current HTF Budget Treatment

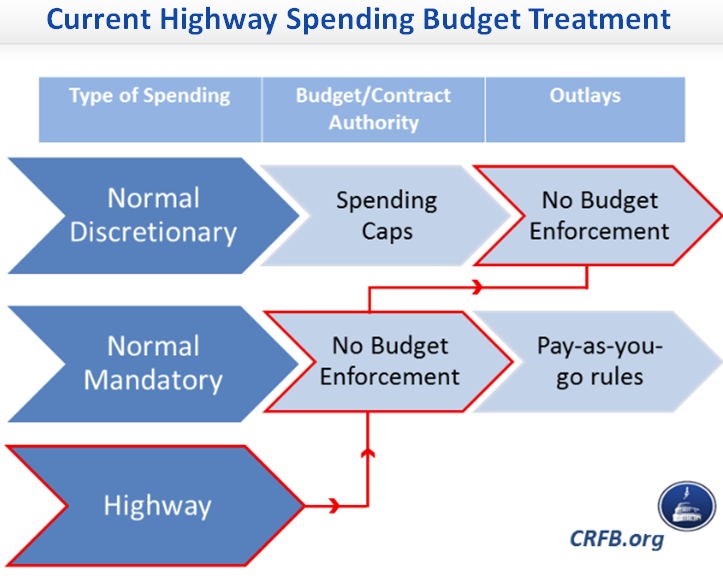

Highway spending is subject to a unique hybrid discretionary/mandatory budget treatment which effectively allows it to evade current budget rules. In addition, this hybrid treatment, when combined with the way the Congressional Budget Office (CBO) projects future highway spending, allows intergovernmental transfers into the HTF to be scored without a cost.

Currently, budget rules limit new discretionary spending through statutory caps on budget authority and limit new mandatory spending by applying pay-as-you-go rules to mandatory outlays. However, highway spending evades both these limits since its contract authority counts as mandatory while its outlays count as discretionary.

In addition, CBO uses scorekeeping conventions that assume that spending on highway programs will continue at current levels (adjusted for inflation) regardless of whether the HTF has sufficient funds to allow such spending, even though current law dictates that spending cannot exceed revenue and trust fund balances. This convention implies that depositing more money in the HTF to allow spending above what current law allows does not increase spending relative to the CBO baseline. The result is that general revenue transfers into the HTF are not scored with a net cost to the government, even though they allow highway spending to be higher than what would otherwise be allowed if the HTF were exhausted. This loophole, among the budget gimmicks we identified in a paper last year, allows lawmakers to take credit for extending the life of the HTF without being charged a cost for doing so or identifying new revenues or spending cuts to cover the shortfall.

It also lets policymakers double count savings to both finance the HTF and offset other priorities. For example, Chairman Dave Camp (R-MI), as well as Senate Majority Leader Harry Reid (D-NV) and Senator Rand Paul (R-KY), have put forward plans to deposit revenues from tax repatriation into the HTF while counting those revenues to offset other tax cuts. Similarly, under current scoring conventions the revenues from an increase in the gas tax deposited in the HTF could be used to offset other tax cuts in addition to closing the HTF shortfall.

Subjecting Highway Spending to Budget Enforcement

The report of the Co-Chairs of National Commission on Fiscal Responsibility (Simpson-Bowles), recommended that both highway contract authority and outlays be classified as mandatory spending and limit the amount of spending Congress could authorize to the funds available in the HTF. Under this approach, any increases in highway funding above funds in the HTF (including increased spending from legislation avoiding HTF depletion) would be subject to PAYGO rules which require all new spending (or tax cuts) to be fully paid for.

The President’s highway proposal took a similar approach, classifying all highway contract authority and outlays as mandatory spending with any increases in transportation contract authority above the current law baseline subject to PAYGO. The proposal also included a placeholder for possible changes in the treatment of general revenue transfers to the HTF, suggesting a willingness to subject to PAYGO the increased spending allowed by general revenue transfers to the HTF when HTF balances were not sufficient to fund the baseline level of spending.

Alternatively, both highway contract authority and outlays could be classified as discretionary spending, with discretionary spending caps adjusted upward to accommodate the reclassified HTF contract authority that can be supported by dedicated revenues. Under this approach, any increases in highway spending beyond the cap adjustment based on dedicated revenues into the HTF would have to be offset with cuts in other discretionary spending.

Preventing Double-Counting

The increased spending allowed by increasing trust fund balances should be scored as a cost requiring an offset to accurately reflect the impact of general fund transfers and avoid double-counting. This goal could also be achieved by requiring all general revenue transfers to be offset and banning the use of dedicated highway funds for other purposes.

The budget resolutions passed by the House of Representatives for fiscal years 2014 and 2015 both contained a special rule providing that transfers from the general fund to the HTF should be scored as a cost equal to the amount of the general revenue transfer, effectively requiring any general revenue transfers to the HTF to be offset. This rule would also prevent revenues that are being used to offset other spending increases or tax cuts from being used to shore up the HTF as well. The provision in the fiscal year 2014 budget resolution was incorporated by the Ryan-Murray budget agreement and currently applies in the House of Representatives to any legislation providing a general revenue transfer to the HTF.

The President’s highway proposal addressed the other potential source of double counting by providing that increases in dedicated revenues (such as an increase in the gas tax) to fund current spending levels would not count as an offset for purposes of PAYGO, ensuring that increased revenues would go to trust fund solvency and not offsetting other spending or tax cuts.

These special rules to count costs of transfers to the HTF and prevent double counting revenues deposited in the HTF would not be necessary in the future if the budgetary treatment of HTF spending was changed to subject spending to PAYGO rules or discretionary spending limits, with any increase in spending above HTF balances subject to offsets under PAYGO or discretionary spending caps. Nonetheless, lawmakers should apply these principles to any proposals providing additional revenues to close the existing shortfall facing the HTF.

Conclusion

The reauthorization of highway programs provides an opportunity to reform the budgetary treatment of these programs to provide for greater transparency and accountability in spending on these programs. In the interim, any proposals providing a short-term fix for the HTF shortfall in advance of a reauthorization bill should avoid exploiting loopholes under current budgetary conventions that allow lawmakers to avoid paying for the costs of continuing highway spending beyond existing revenues or double counting new revenues credited to the HTF.