Why It Is Important to "Go Smart" on Deficit Reduction

Some commentators have pointed out that the fiscal cliff itself is a large deficit reduction package, one that would put the debt on a downward path as a share of GDP. But just because the cliff would reduce the deficit does not mean that it is good fiscal policy. Going over the cliff would also likely send the U.S. into another recession, seeing how the cliff would be among the largest single years of deficit reduction in the past 75 years. When compared with a comprehensive plan that would gradually put debt on a downward path, it is very frontloaded and often across-the-board in nature, eschewing the kind of targeted changes that a fiscal plan would make.

The CBO has previously estimated that the economy will contract by 2.9 percent in the first two quarters of 2013, but recent multiplier estimates from the IMF suggest that the contraction could be even greater. The IMF finds much larger fiscal multipliers for economies with interest rates that have reached the zero lower bound (as the currently the case for the U.S.), implying that the combined sudden tax increases and spending cuts could have a much larger impact on the economy than CBO's estimate anticipates.

Economist Barry Eichengreen tells The New York Times that it might be more realistic to double the CBO's 0.5 percent negative contraction projected for next year. Eichengreen argues that a large fiscal contraction could create more damage than normal because the economy is still weak, and the Federal Reserve is unlikely to be able to fully offset the cliff's economic impact. Countries that have been successful in substantial reducing their debt have strategically timed their deficit reduction with otherwise favorable economic conditions to minimize the damage.

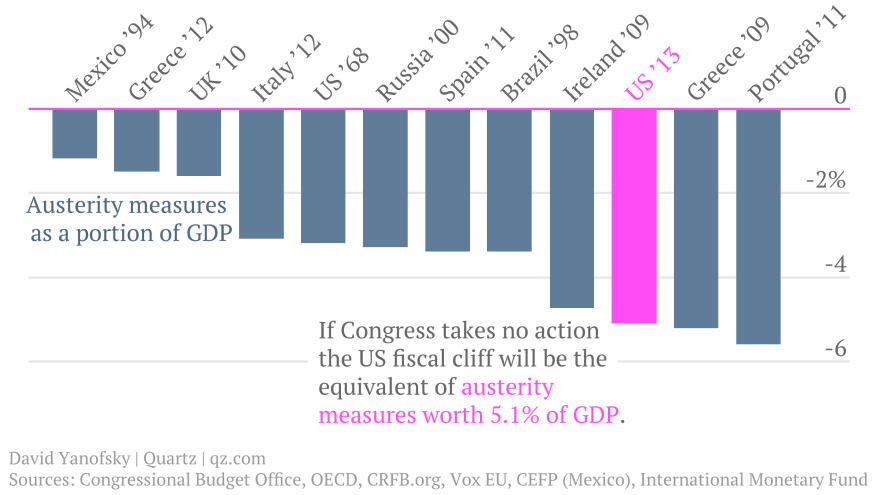

As this chart from Tim Fernholz at Quartz shows, the fiscal cliff is quite large compared to other austerity measures--far greater than what was done by the U.K., and only slightly less than what Greece was forced to do a few years ago. As long as lawmaker's plans to reduce the debt are credible, they can backload the deficit reduction while giving confidence to the public and credit markets. The near-term pain caused by the fiscal cliff is not needed to make the budget sustainable over the long term.

This is why comprehensive plans like Simpson-Bowles and Domenici-Rivlin gradually phased in cuts, delaying much of the deficit reduction until when the economy has had more time to recover. Simpson-Bowles specifically put off cuts for a year and phased them in very gradually beyond that--and even then, most of the cuts that took place upfront were discretionary spending cuts which have already taken place. Domenici-Rivlin even included some additional stimulus in the form of a full payroll tax holiday. We have pointed out before that going big on longer-term deficit reduction allows room for short-term stimulus measures or at least slowly phased-in cuts.

We need to address our unsustainable deficits and we cannot wait to come up with a plan to do it. Repealing the sequester and extending the Bush tax cuts would almost assure the U.S. of another credit downgrade and leave us with an increasingly bigger problem. However the sudden cuts under the fiscal cliff are not an effective way to deal with the debt. If we enact a comprehensive plan, we can both put debt on a downward path and protect the economy as it recovers.