Restoring Highway Solvency by Increasing Current Revenue

Without a fix soon, the Highway Trust Fund (HTF) will run out of money this summer, slowing down infrastructure projects across the nation. Our recent paper, Trust or Bust: Fixing the Highway Trust Fund, outlines the problem at hand and posits a host of options to get highway funding and spending back in line, which will require roughly $170 billion of tax increases or spending cuts over the next decade.

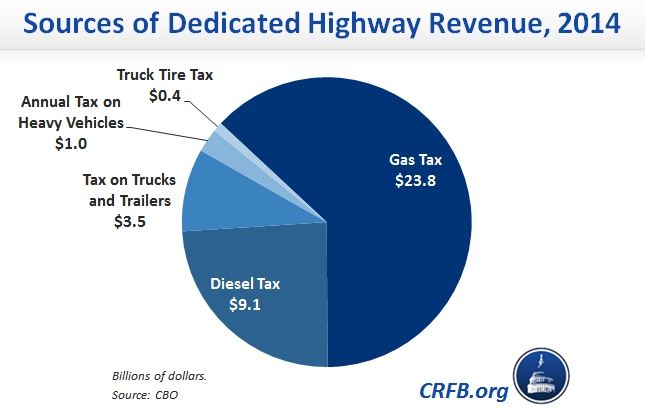

In a series of blogs, we'll explain some of these options in more detail. This blog will delve deeper into the existing funding sources and how they can be enhanced to make the HTF solvent. Current revenues, which come from gas taxes, diesel taxes, and taxes on heavy vehicles, only cover approximately three-quarters of current highway spending.

Gas Tax

One of the most straightforward fixes would be to simply increase the gas and diesel fuel taxes, currently set at 18.4 cents/gallon and 24.4 cents/gallon respectively, that already comprise almost 90 percent of dedicated HTF funding. As fuel efficiency continues to improve, gas tax revenue is expected to remain roughly flat in the coming years, opening wider the structural gap between highway spending and revenue. Neither tax has been increased since 1993, and had they simply been indexed to inflation at the time, the HTF would not currently be facing a shortfall.

To make the HTF solvent for the next 10 years would require raising the gas and diesel taxes by 11 cents and then indexing them to inflation, or by 15 cents without indexing. Alternatively, smaller increases could be used in conjunction with other revenue and spending options to bring revenue and spending in line. Senators Corker and Murphy have a bipartisan proposal along this line, eliminating the HTF shortfall by raising the gas tax by 12 cents and indexing it to inflation.

Funding could also be increased by un-exempting certain entities from the existing fuel taxes, such as states, government entities, or the District of Columbia government. Removing these exemptions would close roughly 10 percent of the 10-year funding gap.

Heavy Vehicle Taxes

Because of their weight, heavy trucks cause more damage to highway pavement, increasing the need for maintenance. As GAO noted in 2012, "although commercial trucks represent 4 percent of the U.S. vehicle fleet, they are responsible for 40 percent of the costs that the federal government spends on highway preservation and maintenance." GAO notes that heavy vehicles pay more taxes but still less than their share of damage costs.

Currently, a tax of 12 percent is imposed on the sales price of heavy trucks, trailers, and tractors intended for highway use. Increasing this tax to 20 percent could solve around 15 percent of the HTF shortfall, or $25 billion over 10 years.

Additionally, an annual fee between $100 and $550 is assessed on especially heavy vehicles above 55,000 pounds operating on public highways, called the Heavy Vehicle Use Tax. Doubling this fee could close about 6 percent of the HTF funding gap, raising $10 billion over 10 years.

The government also collects a tax on each truck tire manufactured with a maximum load over 3,500 pounds, raising $400 million per year to support highway maintenance and construction. Doubling this tax could add around $4 billion to the HTF over ten years, closing 2 percent of the existing funding gap.

Repeal Special Lower Rates on Certain Fuels

Certain fuels are subject to a lower tax rate than gasoline. The most commonly used, propane, has a federal tax of 13.6 cents per gallon, almost a nickel less than the tax on gasoline. Raising rates on these “special” fuels to match gasoline would fill approximately one-eighth of the HTF shortfall, raising approximately $20 billion over 10 years.

The following table summarizes these options:

| Options To Increase Current Sources of Highway Revenues | ||||

| Policy | Ten-Year Savings | Percent of Shortfall Closed | ||

| 4-Year | 6-Year | 10-Year | ||

| Index gas and diesel fuel taxes by inflation | $35 billion | 9% | 14% | 20% |

| Raise gas and diesel fuel taxes by 15 cents | $170 billion | 115% | 110% | 100% |

| Raise fuel taxes by 11 cents and index to inflation | $170 billion | 95% | 100% | 100% |

| Raise gas tax to match diesel tax | $55 billion | 35% | 35% | 30% |

| Eliminate special exemptions from the gas tax | $15 billion | 10% | 10% | 9% |

| Increase truck and trailer tax from 12% to 20% | $25 billion | 15% | 15% | 15% |

| Double heavy vehicle use tax | $10 billion | 7% | 7% | 6% |

| Double truck tire tax | $4 billion | 3% | 3% | 2% |

| Repeal special tax rates on certain fuels | $20 billion | 13% | 12% | 12% |

Sources: CBO, National Surface Transportation Infrastructure Financing Commission, and CRFB calculations

In future blogs, we'll describe options to restore HTF solvency by reducing spending, finding new sources of transportation-related revenue, or finding short-term savings from other parts of government to pay for a general fund transfer.