Republican Study Committee Publishes Alternative Budget

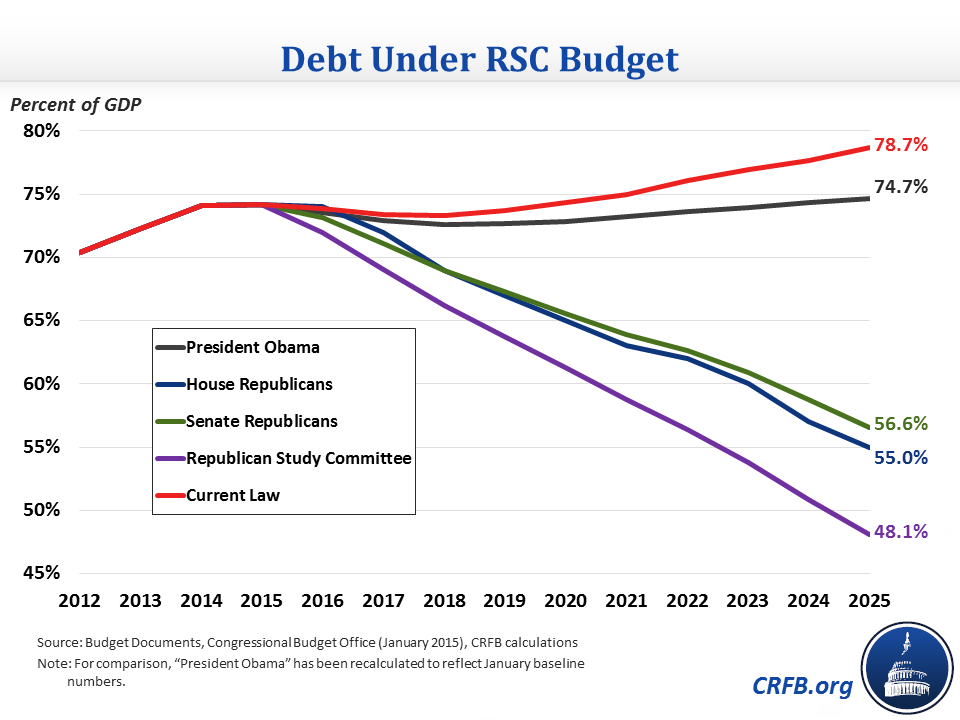

The Republican Study Committee (RSC) has released an alternative budget proposal that outlines their vision for the country’s fiscal future. Their plan aims to balance the budget after only six years and reduce the ten-year deficit by almost $7 trillion. As a result, debt would decline faster than under any of the other budget resolutions, with debt at 48 percent of GDP by the end of the 10-year window, down from nearly 74 percent today.

By their own estimates, the plan would cut spending from 19.4 percent of Gross Domestic Product (GDP) in 2016 to 17.5 percent by 2025. Revenues would remain at current law levels, falling slightly from 18.4 percent in 2016 to 18.3 percent in 2025.

Tax Reform

The budget calls for the tax reform that drastically reduces tax rates. Their reform principles call for a top rate of 25 percent on wages (down from 39.6 percent today), 25 percent on corporations (down from 35 percent today), and 15 percent on capital gains and dividends (down from 23.8 percent today). It would also repeal the estate tax and the alternative minimum tax. According to the budget, though, these reforms would somehow be revenue-neutral using dynamic scoring. In other words, the budget assumes that tax cuts will grow the economy in a way that helps to pay for those tax cuts, which is concerning given the uncertainty of dynamically-estimated revenue and the lack of evidence indicating such large impacts from rate cuts.

Discretionary Spending

The budget would cap discretionary spending at $975 billion for the first two years, or about a 3 percent decrease from last year's discretionary total of $1.01 trillion, with all of the cuts coming from non-defense appropriations. The budget increases defense spending above sequester levels by $435 billion over the next 10 years, about $50 billion more than in the original House Republican budget. Non-defense discretionary spending would be cut by $1.3 trillion more than sequester caps. Several institutions would be eliminated under the plan, including the Economic Development Administration, the International Trade Administration, the National Labor Relations Board, and the National Endowment for the Arts, while the budget also cuts funding for the Environmental Protection Agency and the Internal Revenue Service.

Health Care

The RSC budget repeals the Affordable Care Act's coverage expansions and replaces them with a deduction for purchasing health insurance, an expansion of Health Savings Accounts, tort reform, and other reforms. Like the House budget, the RSC budget block grants Medicaid and combines it with CHIP. It also would convert Medicare to a premium support system starting in 2020 for new beneficiaries and would raise the Medicare retirement age to 67 starting in 2025.

Social Security

Similar to last year's RSC budget, this year's would address some of the Social Security shortfall by adopting the more-accurate chained CPI for annual cost-of-living-adjustments (COLAs) and gradually raising the retirement age to 70. The budget would also reduce benefits for wealthy earners while maintaining benefits for those who earned less during their careers.

Social Security Disability Insurance (SSDI), due to become insolvent next year, would see reforms under the budget, in the form of updated eligibility requirements, preventing double-dipping between SSDI and unemployment insurance (as the President proposed in his budget), and by funding anti-fraud reviews.

| Policy Changes in the RSC Budget | |

| Policy | 2016-2025 Savings/Costs (-) |

| Deficit Reduction Proposals | |

| Repeal the Affordable Care Act | $2,042 billion |

| Discretionary Spending | $1,135 billion |

| Medicaid/CHIP/Other Health Care | $1,168 billion |

| Other Mandatory Spending | $1,262 billion |

| Medicare | $216 billion |

| Social Security | $188 billion |

| Net Interest | $1,102 billion |

| Total Savings | $7.1 trillion |

Source: Republican Study Committee

The RSC budget aggressively tackles the debt, including very steep cuts in spending to balance the budget after only six years, although traditional scoring would likely offset some of these reductions with a large tax cut. You can compare this budget with the other major budget proposals here, and you can read more about our coverage of the 2016 budget process here.