Debt and Deficits Under the FY 2016 Budgets

With budget consideration underway this week, the House has passed its own resolution and rejected several proposed alternatives, while the Senate budget is still in the debate and amendment process. So far, different FY 2016 budgets have been proposed by President Obama (and scored by CBO), the House Republicans (from Chairman Price), the Senate Republicans (from Chairman Enzi), the House Democrats (from Ranking Member Van Hollen), the Congressional Progressive Caucus (CPC), the Republican Study Committee (RSC), and the Congressional Black Caucus (CBC). Each budget offers a variety of different plans for funding the government over the next decade.

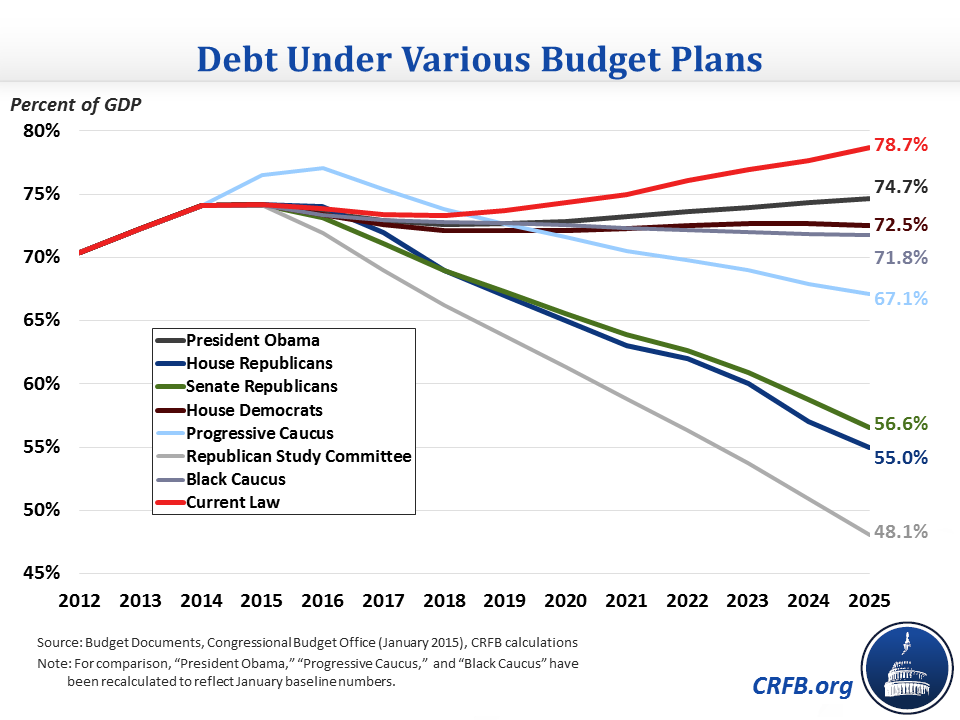

Importantly, each budget goes to varying lengths to at least temporarily reduce our debt as a share of the economy in the next 10 years, though some go farther than others. On one hand, the President's budget, the Van Hollen budget, and the Black Caucus budget leave debt stable or on a slight upward path after 2020. The Price, Enzi, Progressive, and Republican Study Committee's budgets all put debt on a clear downward path, with the RSC budget reaching 48.1 percent of Gross Domestic Product (GDP) by 2025.

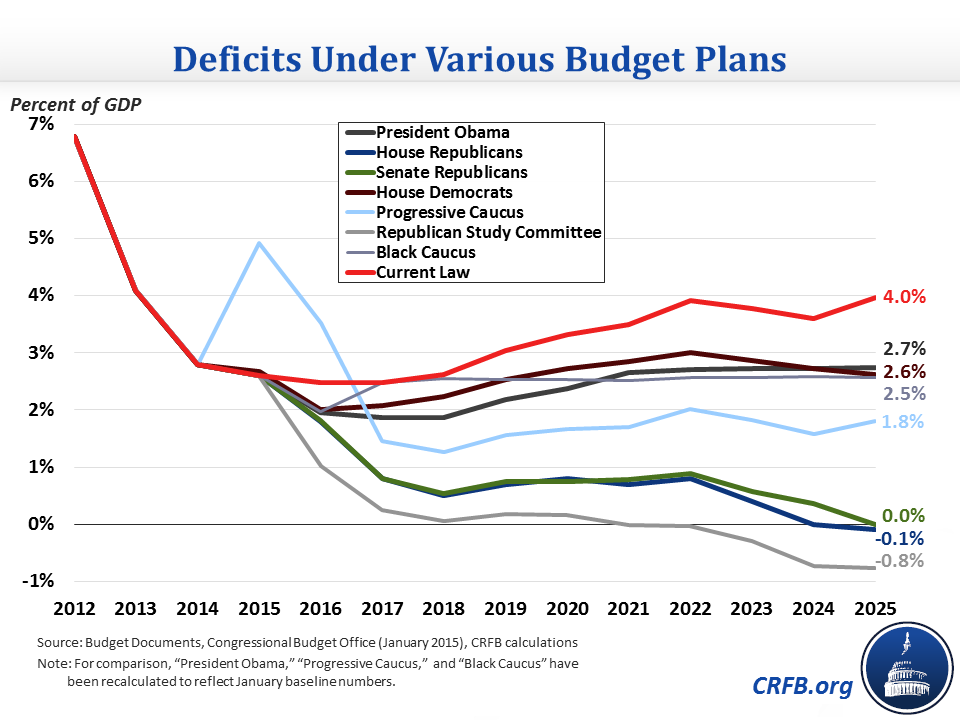

Similarly, each budget reduces deficits over the ten-year period, though they use very different methods. The Progressive Caucus budget takes the most unique path by calling for significant stimulus that makes this year's deficit grow to nearly 5 percent of GDP before falling to 2 percent after 2016. At the other end of the spectrum, the Republican Study Committee budget runs a 0.8 percent of GDP surplus in 2025.

Both Republican budgets in the House and Senate achieve their stated goal of balance, though each uses a "fiscal dividend" to ensure total balance. Of each of the proposed budgets released so far, the CPC and RSC budgets include the most gross savings (over $7 trillion), which the CPC achieves largely due to large increases in revenues by raising rates and closing loopholes and the RSC achieves by large spending cuts to mandatory and non-defense discretionary programs. Both the Republican House and Senate budgets (as well as the RSC budget) are stated to be revenue-neutral, but they find significant savings by cutting spending by about $4.9 trillion and $5.7 trillion, respectively.

| Deficit Reduction in FY 2016 Budgets (2015-2025) | |||

| Budget | New Savings | New Costs | Net Deficit Reduction |

| President Obama | $2.3 trillion | $1.7 trillion | $0.6 trillion |

| House Republicans | $5.9 trillion | $0.4 trillion | $5.5 trillion |

| Senate Republicans | $4.9 trillion | $0.0 trillion | $4.9 trillion |

| House Democrats | $2.1 trillion | $1.7 trillion | $0.4 trillion |

| Progressive Caucus | $7.4 trillion | $5.1 trillion | $2.3 trillion |

| Republican Study Committee | $7.3 trillion | $0.4 trillion | $6.9 trillion |

| Black Caucus | $2.9 trillion | $1.7 trillion | $1.2 trillion |

Note: Excludes savings from economic growth and "fiscal dividends" from deficit reduction.

Measures all proposals against a January 2015 baseline including a drawdown of overseas war spending.

Savings represent either new tax revenue, lower spending, or reduced interest costs. Costs represent either tax cuts or higher spending.

We will continue to provide analysis and updates as budget resolutions are debated, amended, and passed. You can also read more about developments with the FY 2016 budget here.