Paying the Costs of Bonus Depreciation

In the coming weeks, both the House and Senate are expected to begin discussing what to do with a number of expired tax provisions known as the "tax extenders." Most of these provisions are extended year after year and have become, in many ways, a fixture of the tax code. Bonus depreciation does not fall into this category.

First passed in the Economic Stimulus Act of 2008 and later extended in 2009, 2010, and 2012 when the economy took longer than anticipated to return to strength, bonus depreciation was meant as a temporary stimulus measure.

While it would be a mistake to extend any of the expired tax provisions without paying for them, it would be particularly problematic to lump temporary stimulus with provisions that are generally passed year after year. Instead, Congress should evaluate the effectiveness and continued necessity of this provision to determine whether it should be allowed to expire or else phased out as the economy returns to strength. This was the approach Congress took in 2004, when it allowed bonus depreciation to expire on schedule after the bursting of the tech bubble and the economic shock of 9/11, and this is the same approach Congress should take now.

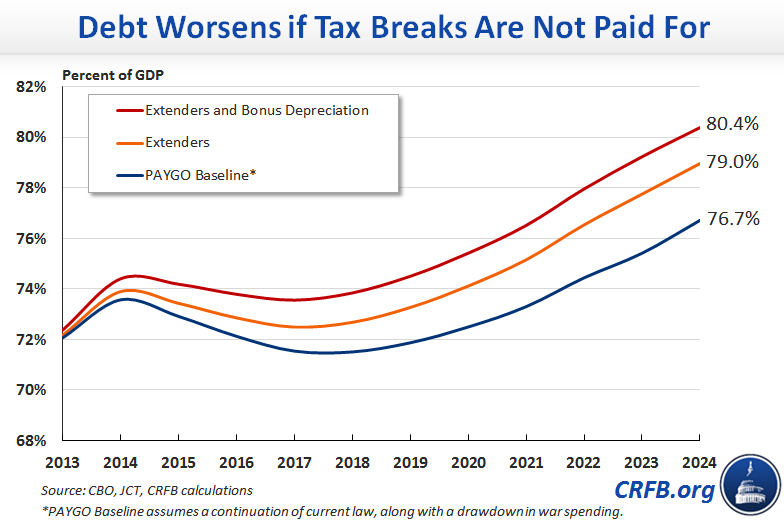

Treating bonus depreciation like the other tax extenders makes little economic sense, but presents a serious problem for the budget. Normal tax extenders are typically extended for one or two years at a time, a fact which already masks their cost. For instance, continuing the normal tax extenders for one year would cost around $40 billion through 2024, while continuing them permanently would cost about 11 times as much, or $465 billion (before interest). Because bonus depreciation changes the timing of taxes paid, the difference between a temporary and permanent extension of bonus depreciation is far more drastic.

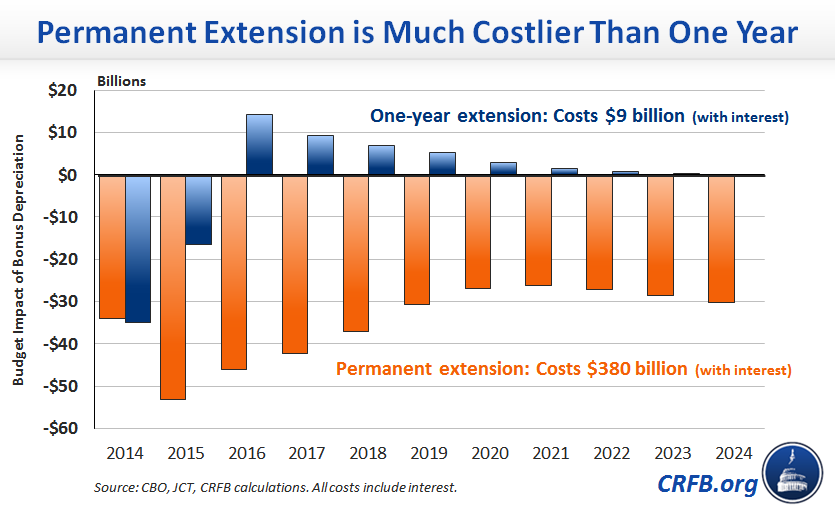

A one-year extension of bonus depreciation costs about $5 billion ($9 billion with interest), since the upfront costs are mostly offset with savings in later years as businesses are no longer writing off the cost of equipment. But a permanent extension would cost $300 billion ($380 billion with interest), 40 to 60 times as much as a one-year extension.

If policymakers intend to make bonus depreciation a more permanent part of the tax code, they need to weigh the benefits against this steep cost.

Bonus depreciation was enacted as a temporary stimulus measure and should not be automatically extended for one year like the other extenders may be. Policymakers should weigh the merits of providing bonus depreciation and consider either letting it expire or phasing it out. If policymakers do think bonus depreciation deserves to be a permanent part of the tax code – rather than a stimulus measure as was intended – they should make it permanent and acknowledge the substantial cost. Regardless of what path lawmakers choose, they should fully offset the costs of extending tax breaks to avoid making our deficit problem worse.