An Overview of the FY16 House Republican Budget

This morning, House Budget Committee Chairman Tom Price released his FY 2016 budget proposal, "A Balanced Budget for a Stronger America." The budget reaches balance in 2024 by cutting about $5.5 trillion of spending over ten years (relative to a "PAYGO baseline" which excludes savings from drawing down war spending), and it assumes an additional $147 billion in deficit reduction from a "fiscal dividend" that incorporates the longer-term economic benefits (and short-term economic drawbacks) of the deficit reduction contained in the budget.

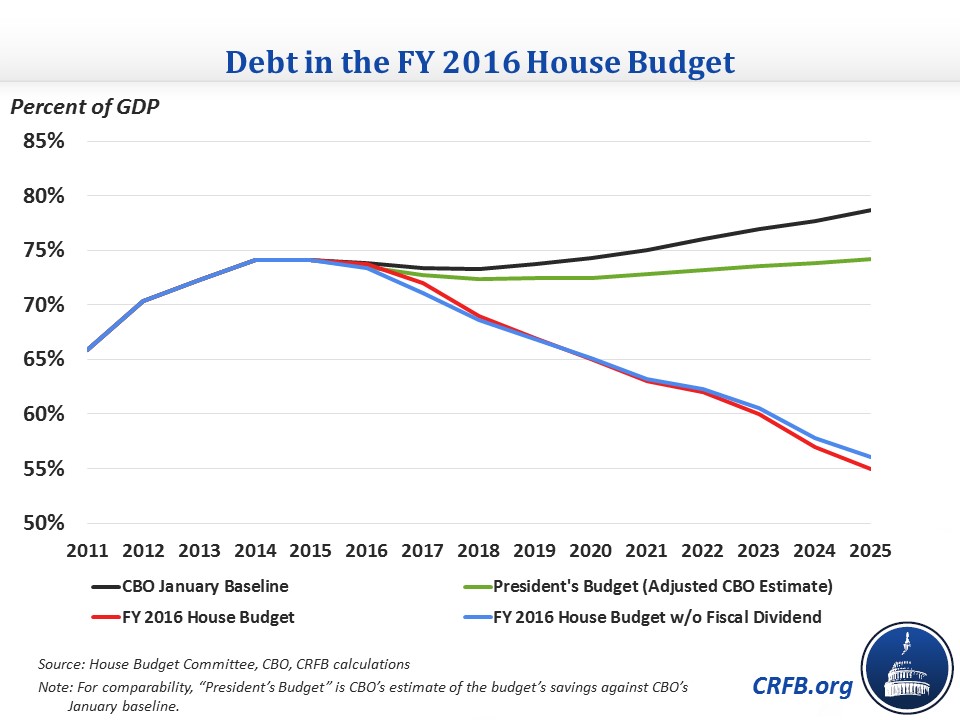

Importantly, the budget puts debt on a clear downward path as a share of the economy, with debt falling from about 74 percent of GDP today to 55 percent by 2025. Even excluding the higher revenue, lower spending, and higher GDP created from the fiscal dividend, debt would still fall to 56 percent by 2025 and would still be on a clear downward path.

Chairman Price’s first House budget is very similar to last year’s budget by then-Chairman Paul Ryan. It gets the bulk of its savings from health care programs, particularly the Affordable Care Act, and also includes sizeable cuts to other mandatory programs. In addition, the budget calls for somewhat similar domestic discretionary cuts (while increasing defense spending) after abiding by the current spending caps in law for the first year, as the budget resolution did last year. Finally, the budget assumes the fiscal dividend would generate $83 billion of savings in 2025.

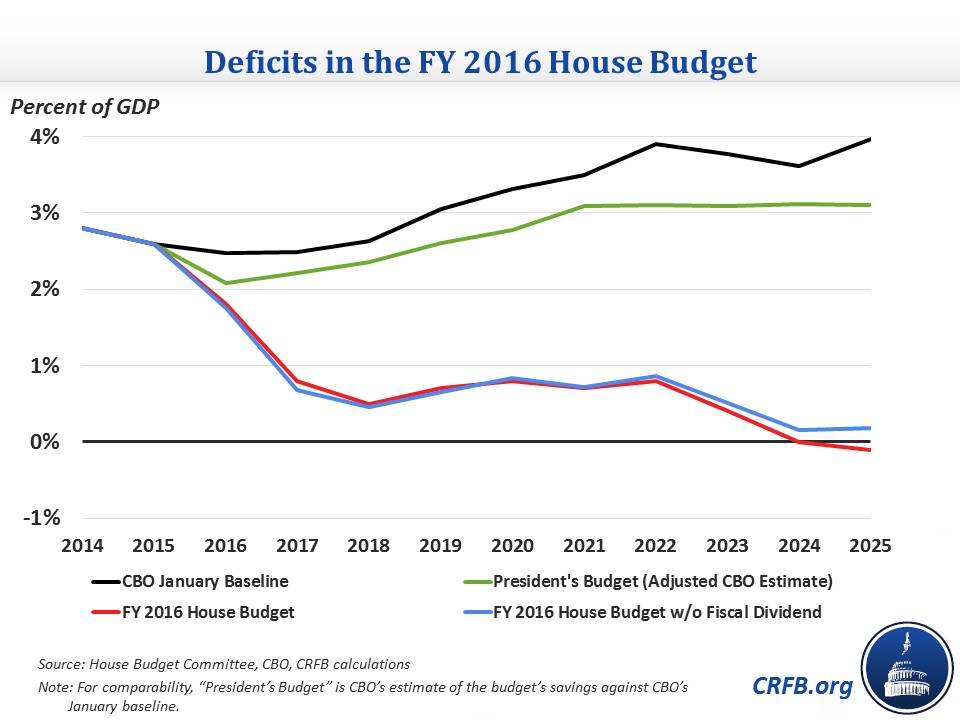

This last assumption is based on CBO's estimate about the economic benefits of the budget's deficit reduction, though we would caution against banking these uncertain savings. Still, even without the fiscal dividend, the 2025 deficit would only be $50 billion, or less than two-tenths of one percent of GDP. However, the budget might balance, because it calculates its savings against CBO's January baseline, which has a 2025 deficit that is about $49 billion higher than their most recent baseline released last week.

The deficit reduction in the budget causes deficits to fall from 2.7 percent of GDP in 2015 to a small surplus in 2024 and a 0.1 percent surplus in 2025. This is a large improvement over the 3.5 percent of GDP deficit in 2025 in the PAYGO baseline. By the end of the ten-year window, both spending and revenue would roughly equalize at just over 18 percent of GDP.

As in previous House Republican budgets, Chairman Price's budget would achieve all of its deficit reduction on the spending side. The largest savings, $2 trillion, come from repealing the coverage expansions in the Affordable Care Act while on net leaving the bulk of the Act's Medicare reductions. The budget also banks about $900 billion of savings by block granting and capping the growth of Medicaid while consolidating the State Children's Health Insurance Program (SCHIP) into Medicaid. The budget gets nearly $1.1 trillion savings from other mandatory programs as well, with policies such as block granting food stamps, capping Pell Grants, and reducing fraud and abuse throughout government.

It also abides by the current discretionary spending limits in law for FY 2016, but lowers discretionary budget authority after that to $372 billion below sequester levels through 2025 – the net effect of $759 billion in non-defense cuts and $387 billion in defense increases. At the same time, the budget provides $94 billion in FY 2016 for Overseas Contingency Operations (war spending), which is $36 billion above the President's request and appears to be a way to use that category as a slush fund to provide back-door defense sequester relief.

| Policy Changes in the House FY 2016 Budget | |

| 2016-2025 Savings | |

| Affordable Care Act | $2,042 billion |

| Medicaid and Other Health | $913 billion |

| Medicare (net) | $148 billion |

| Social Security | $4 billion |

| Other Mandatory | $1,064 billion |

| Discretionary and Highway | $499 billion |

| Revenue | $0 billion |

| Interest | $798 billion |

| Subtotal, Policy Savings (HBC Claimed Savings) | $5,468 billion |

| Fiscal Dividend | $147 billion |

| Subtotal, Claimed Savings with Fiscal Dividend | $5,615 billion |

| Baseline Adjustments | $692 billion |

| Total, Claimed Savings Compared to CBO January Baseline | $6,307 billion |

Source: House Budget Committee

Over the course of the week, we will continue to analyze the House Republican budget, as well as the Senate Budget Committee’s Chairman’s Mark and any alternative budget resolutions on our blog. You can also read more about developments with the FY 2016 budget here.