New Affordable Care Act Repeal Estimate Still Shows Deficit Increase

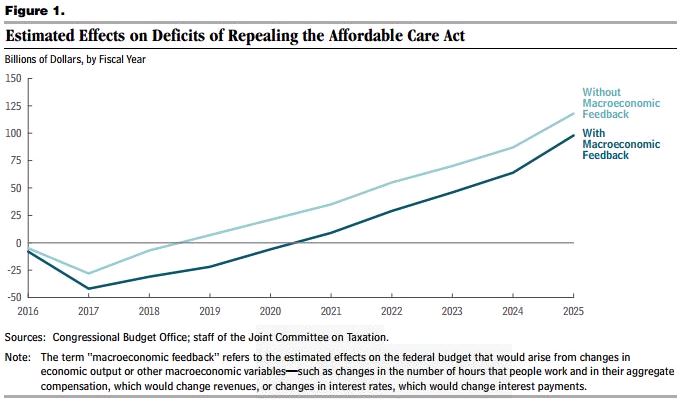

For the first time in nearly three years, the Congressional Budget Office (CBO) released a new estimate of the budgetary effect of repealing the entire Affordable Care Act (ACA). Just like in its previous estimates, CBO finds that repealing the ACA would increase ten-year deficits – and this time, they come to that same conclusion even with the economic effects included.

CBO's static estimate of repeal, which excludes macroeconomic effects, shows a ten-year deficit increase of $353 billion, the net effect of $1.174 trillion of tax cuts and $821 billion of spending cuts. Repeal would save money in the first three years of the budget window by $40 billion, but then increase deficits in subsequent years and by $118 billion in 2025 alone. Using this static score, debt would be about 1.4 percentage points higher in 2025 as a result of repeal.

Incorporating the dynamic macroeconomic effects into the budget score reduces the resulting ten-year deficit increase by $216 billion, making the total deficit increase with dynamic scoring $137 billion. The macroeconomic effects peak at $29 billion in 2019 and fall slightly to $20 billion by 2025. The main economic effects include: the decrease in labor supply due to a greater availability of insurance outside employment and from the implicit marginal tax rate increases from the insurance subsidies, as they diminish with income; the decrease in the capital stock from increased tax rates on investment income; and the decrease in aggregate demand from repeal of the insurance subsidies. CBO estimates that ACA repeal would boost GDP by an average of 0.7 percent in 2021-2025.

| Deficit Effect of Repealing the ACA | |

| Policy | Ten-Year Cost / Savings (-) |

| Coverage Expansions | -$1,658 billion |

| Eliminate exchange subsidies | -$822 billion |

| Eliminate Medicaid/CHIP coverage spending | -$824 billion |

| Eliminate small business tax credits | -$11 billion |

| Coverage-Related Provisions | $502 billion |

| Eliminate individual mandate | $43 billion |

| Eliminate employer mandate | $167 billion |

| Eliminate "Cadillac" tax on high-premium insurance plans | $87 billion |

| Other changes in revenue from coverage provisions | $209 billion |

| Spending Changes | $879 billion |

| Repeal Medicare provisions | $802 billion |

| Repeal Medicaid provisions | $66 billion |

| Other changes | $10 billion |

| Revenue Changes | $631 billion |

| Eliminate high-income taxes | $346 billion |

| Eliminate fees on manufacturers and insurers | $196 billion |

| Other revenue | $89 billion |

| Net Effect | $353 billion |

| Macrodynamic Estimate | -$216 billion |

| Net Effect (With Dynamic Scoring) | $137 billion |

Source: CBO

Under either the static or dynamic estimate, CBO also estimates that ACA repeal would continue to increase deficits beyond the ten-year window. As it explains:

According to that analysis, and excluding the budgetary effects of macroeconomic feedback, a repeal would increase annual deficits over the 2026–2035 period by amounts that lie within a broad range around one percent of GDP. Although the macroeconomic feedback stemming from a repeal would continue to reduce deficits after 2025, the effects would shrink over time because the increase in government borrowing resulting from the larger budget deficits would reduce private investment and thus would partially offset the other positive effects that a repeal would have on economic growth. Consequently, taking that feedback into account would not substantially alter the increases estimated for federal deficits that would occur over that period.

This 1 percent of GDP increase would amount to $3-4 trillion in the 2026-2035 period.

Overall, CBO shows a somewhat similar cost for repeal as it has previously, even when macroeconomic effects are included. The long-term cost should also underscore the danger of repealing just the cost-saving provisions in the ACA like the Independent Payment Advisory Board. Of course, the estimate may become outdated very quickly if the Supreme Court decides King v. Burwell for the plaintiff, so stay tuned for more on the ACA.