It Could Take $8 Trillion to Balance the Budget

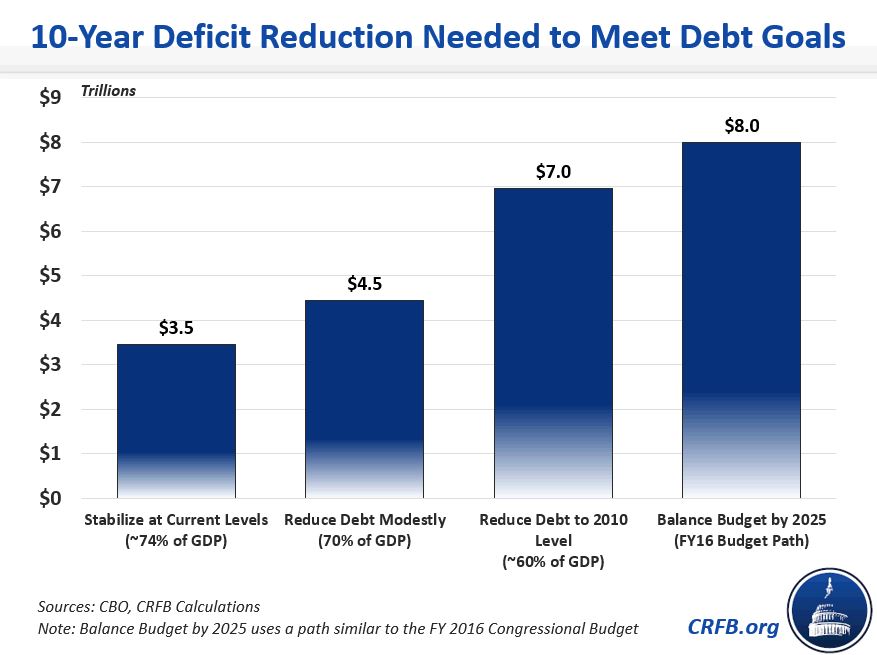

Tuesday’s release of the topline numbers for this year's Congressional Budget Office (CBO) baseline is a gut punch to congressional budget writers. The already-difficult task of balancing the budget is now far harder, requiring nearly $1.4 trillion to plug the deficit in Fiscal Year (FY) 2026 alone. By our math, that would mean about $8 trillion of ten-year deficit reduction to balance the budget, and it would take $3.5 trillion just to stabilize the debt at its current record-high levels.

As we show in our paper on the CBO baseline, the debt is on an even more unsustainable path than previously projected, with deficits expected to rise every year going forward, reaching over $1 trillion by 2022. When comparing the 2016 to 2025 budget window in the January report to last August's numbers, the deficit is now expected to be $1.5 trillion worse than projected. Lower interest rate projections will also, somewhat counterintuitively, make budget goals more difficult to achieve since direct spending cuts and increases in revenue will now receive less credit for interest savings.

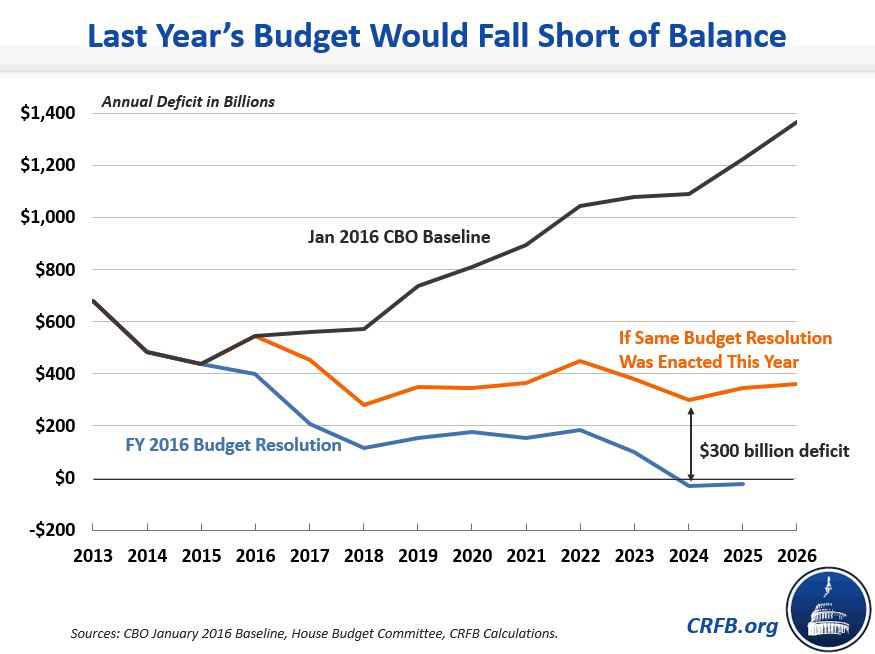

As a result, last year's budget resolution, which reached balance by 2024, would fall short this year. In fact, enacting the same budget resolution as last year would now lead to a $300 billion deficit in 2024 and a $400 billion deficit in 2026. Getting to balance will now require more than $2.2 trillion more in savings than last year's congressional budget resolution produced – bringing the total to about $8 trillion.* To put this in perspective, Congress would need to cut primary spending by 15 percent, raise revenue by 17 percent, or some combination of the two.

Of course, one does not need to balance the budget to put it on a more sustainable path. But all fiscal goals are now more difficult. For example, pursuing a more modest goal of slightly reducing the debt-to-GDP ratio – from about 75 percent today to 70 by 2026 – would require $4.5 trillion; last year we estimated it would require $2.2 trillion. As another example, holding debt to its current record-high levels, as the President proposed last year, would require $3.5 trillion; last year CBO scored the President's budget as saving $1.2 trillion.

When the savings needed to achieve these debt goals is compared between this year and last, the variance reveals just how difficult it will be to achieve them now that policymakers have passed legislation that added $1.2 trillion to the debt.

| Fiscal Policy Goal | Previous Savings Needed | Savings Needed Now |

| Stabilize Debt at Current Levels | $1.0 trillion | $3.5 trillion |

| Reduce Debt Modestly (70% of GDP) | $2.2 trillion | $4.5 trillion |

| Reduce Debt to 2010 Level (~60% of GDP) | $5.0 trillion | $7.0 trillion |

| Balance Budget in 2025* | $5.8 trillion | $8.0 trillion |

| Reduce Debt to Historic Average (~40% GDP) | $10.6 trillion | $13.0 trillion |

As policymakers write their FY 2017 budgets and propose new legislation, they should take into account the dangerous path that the new baseline shows. Deficits will no longer be in decline as they have been for the past five years, and debt will continue to increase toward record-high levels.

For more on the CBO baseline, read our full analysis.

* The path of non-interest deficit reduction assumed is a linear increase of the FY 2016 congressional budget resolution's savings with implementation starting in 2017. The deficit reduction is run through an interest model that calculates total deficit reduction. Due to timing shifts and our assumed path, the budget would balance in FY 2024 as well.