GOP Campaigns Discuss Tax Plans

The Conservative Reform Network and Americans for Tax Reform recently hosted a forum where representatives from the Republican presidential campaigns of Gov. Jeb Bush, Sen. Ted Cruz, Gov. John Kasich, Sen. Rand Paul, and Sen. Marco Rubio discussed their candidates’ tax reform proposals. You can read our brief summaries of the candidates' tax plans here.

Cruz and Paul both advocate for flat tax proposals combined with what is essentially a value-added tax, while Bush, Kasich, and Rubio propose reforms to lower corporate and individual rates while broadening the tax base. Bush’s primary goals for tax reform are growth and increasing workforce participation. Cruz wants to fix the broken system with a simplified tax regime. Kasich proposes a three-part test for tax reform: it should increase jobs, growth and freedom; it should be able to pass Congress; and it should unite the Republican Party. Paul argues for eliminating the payroll tax for workers, taxing business on what they produce, and taxing imports while exempting domestic production. Rubio promotes a pro-family policy that also establishes parity among all corporate and non-corporate businesses.

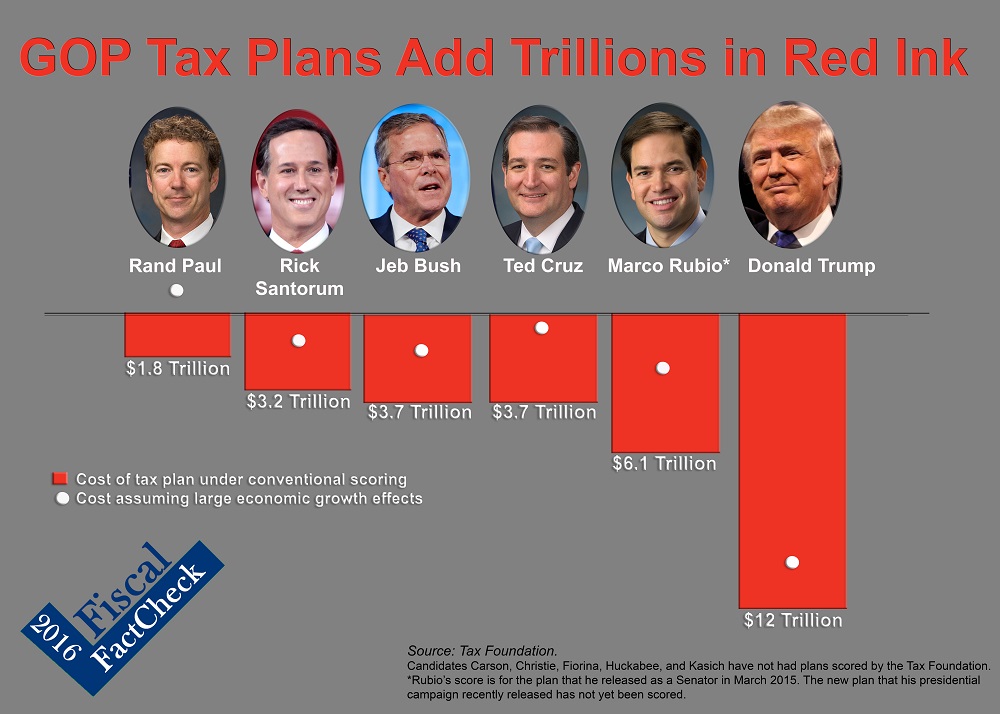

Another central topic of the discussion was replacing current depreciation schedules with full and immediate expensing. Proponents of this idea argue that hidden taxes exist under the current depreciation schedules allow policymakers to extend depreciation periods, effectively raising rates. A popular tax reform today is to make permanent bonus depreciation, which allows business to immediately write off 50 percent of capital costs instead of using lengthy and complicated depreciation schedules. Making bonus depreciation permanent could cost $250 billion over ten years. If we eliminated depreciation schedules all together, as this ATR panel suggested, the cost could exceed $1 trillion over a decade by adding $70 billion to the debt in a single year. Not only does full expensing add significantly to the debt, but it also moves in the opposite direction of tax reform proposals that have been offered by Democrats and Republicans ranging from former Ways and Means Chairman Dave Camp, President Obama, and the Simpson-Bowles Commission, all of which move away from accelerated depreciation and toward economic depreciation. To our knowledge, Donald Trump’s $12 trillion tax proposal is the only one not to include some form of full expensing.

During the question and answer session, an audience member asked how the candidates would pay for the significant revenue loss in their tax plans. Nearly every one of the campaigns said that entitlement reforms would be necessary part of keeping their tax plans from adding to the debt. Bush would promote entitlement reform, ACA repeal, and across-the-board cuts to nondefense discretionary spending. Kasich would support entitlement reforms, a glide path to a balanced budget, a hard freeze on nondefense discretionary spending, and block grants to states. Rubio would take a holistic approach that would include mandatory spending reforms. Paul's representative pointed out that the Senator has previously proposed more than enough spending cuts to pay for his tax package, and that if we can get to 3.5% growth, the trillions of dollars in added wealth would swamp the deficit (however, we have previously debunked the myth that the debt can be addressed with economic growth alone). Cruz’s representative offered less specifics, saying the key would be budget process reform that gets us out of a cycle of omnibus discretionary spending bills.

We look forward to hearing additional detail about these candidates’ spending reforms. Read more on the candidates’ tax plans here.