Four Takeaways from the Solutions Initiative Plans

The Peterson Foundation's Solutions Initiative III produced five different fiscal plans that would improve the current long-term budget outlook. We have already gone over the topline numbers for the plans, but another important aspect is how they get to those numbers. Below are four takeaways from the policies that the plans propose.

Consensus on the Gas Tax

Lawmakers will have to find a way to fund the Highway Trust Fund in the next few months, and one of the possible solutions that has gained popularity with the current relatively low gas prices has been raising the gas tax. Four of the five plans - the American Action Forum (AAF) being the exception - proposed increasing the gas tax by a significant amount. The American Enterprise Institute (AEI) would increase it by 11.7 cents and index it to inflation, the Bipartisan Policy Center (BPC) would increase it by 15 cents and index it to inflation, and the Center for American Progress (CAP) and Economic Policy Institute (EPI) would increase it by an unspecified amount. AEI's and BPC's increases would fully close the trust fund shortfall through 2025. We also proposed increasing fuel taxes by 9 cents in our plan The Road to Sustainable Highway Spending.

No One Likes the Sequester

The sequester will be a big deal in the coming months when lawmakers will have to decide the level of spending for appropriations. The President's budget would repeal most of the sequester for FY 2016, while the Congressional budget would leave the sequester in place but provide backdoor sequester relief for defense through the war spending category. A notable theme in the think tanks' plans is that all of them propose some form of sequester relief, and three of them would provide sequester relief to both defense and non-defense. The only plans that left the sequester in place were AEI's for non-defense spending and EPI's for defense spending. Clearly, none of the plans were satisfied with the tight caps that the sequester prescribes, although they varied on how much to lift them (AEI stood out in particular on defense, while EPI had much, much higher non-defense caps). Although these plans do not make changes to the budget until FY 2017, their approaches can be instructive for lawmakers for FY 2016.

Agreement on Revenue Increases, Not Necessarily How to Do It

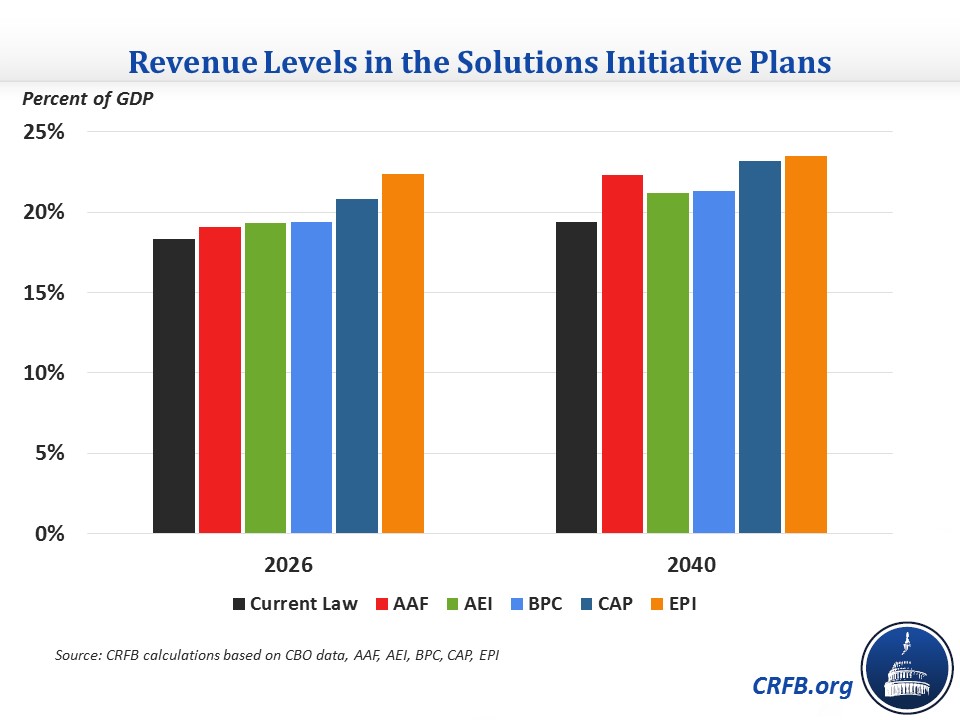

Despite the fact that taxes have been a major point of contention for President Obama's entire tenure, all five plans are scored as raising revenue, and not by a small amount either (AAF said it intends to be revenue-neutral but its stated plan is revenue-positive). The Congressional Budget Office's current law projections show revenue reaching just over 18 percent of Gross Domestic Product (GDP) by 2026, but all of the plans have revenue over 19 percent of GDP. Similarly, current law revenue is projected to be in the 19-20 percent of GDP range by 2040, but all of the plans have it over 21 percent.

There are some common policies among them, including limiting major tax breaks like the mortgage interest deduction, state and local tax deduction, and health insurance exclusion. However, there are also key differences in the approaches as well. Three of the plans (AAF, AEI, and BPC) would lower marginal tax rates while two (CAP and EPI) would raise them. Three of the plans (BPC, CAP, and EPI) would increase taxes on investment income while two (AAF and AEI) would change the income tax to a progressive consumption tax, which would not tax investment income at all.

Improving Social Security's Finances

Even though lawmakers have been loath to address it, all five plans would improve Social Security's finances. Both AAF and AEI propose changes to Disability Insurance specifically, which is projected to go insolvent next year, with AAF reforming eligibility rules and AEI proposing to "experience rate" the payroll tax to encourage employers to keep disabled workers in the workforce. And all of the plans would improve Social Security's overall finances by either changing the benefit formula, adopting chained CPI, raising the payroll tax cap, subjecting employee benefits to the payroll tax, or a combination of these changes.