How Much Would Student Loan “Hardship” Provision Cost?

We recently estimated the President’s new student debt cancellation plan would cost between $250 billion and $750 billion over a decade, and have since revised our estimate to between $220 billion and $750 billion. $150 billon of this cost comes from a variety of specified changes, estimated by the Department of Education, that largely cancel accumulated interest and loans that have been in repayment for a long period of time. The remaining cost comes from a yet-unspecified plan to cancel “student debt for borrowers experiencing hardship paying back their loans.” We estimate that this hardship provision could cost between $70 to $600 billion over the next decade by offering hugely expansive authority to the Secretary of Education.

Although the White House has yet to release the language of the rule, it is based on an earlier proposal reached by “consensus” among stakeholders in the negotiated rulemaking process. The plan would give the Secretary of Education the authority to cancel the debt of those likely to default or experiencing hardship. We estimate cancellation based on likelihood to default could cost $70 to $220 billion and cancellation based on hardship could cost another $0 to $380 billion.

Potential Cost of Student Debt Cancellation and Hardship Provision

| Provision | Low Cost | High Cost |

|---|---|---|

| Cancelling Defaulted Debt | $50 billion | $90 billion |

| Cancelling Delinquent Loans | $20 billion | $130 billion |

| Cancelling due to "Hardship" | $0 billion | $380 billion |

| Total Cost of Hardship Provision | $70 billion | $600 billion |

| Reported Cost of Partial Rule | $150 billion | $150 billion |

| Total Potential Cost Overall | $220 billion | $750 billion |

Sources: Department of Education and CRFB estimates.

Likelihood to Default

In its draft proposed language, the Department of Education proposed to waive all student debt for borrowers who are “experiencing hardship such that their loan is at least 80% likely to default.” In its current form, the rule would only take place within two years of implementation and only applies to existing loans. We estimate this provision could cost between $70 billion and $220 billion in total.

Although we don’t know how the Secretary of Education would determine this 80 percent likelihood, the draft rules allow the Department to consider “current repayment status and other repayment history,” which is likely the clearest cut way to predict default risk. We estimate there is currently at least $100 billion in defaulted debt that would not be cancelled by other parts of the recent student debt rule. Simply wiping out defaulted debt is likely to cost the federal government between $50 and $90 billion, after accounting for the debt that is unlikely to be paid back otherwise.

Presumably, many delinquent borrowers would also be considered at high risk of default. We estimate there are currently about 9 million borrowers in delinquency, two-thirds of which are beyond 90 days delinquent. These borrowers may owe between $180 and $270 billion. Although this delinquency rate is likely elevated as a result of the three-year interest-free payment pause, it is probable that some will end up in default. Given this wide range of uncertainty, we estimate cancelling delinquent loans could cost anywhere from $20 to $130 billion.

Experiencing Hardship

In addition to cancelling debt based on likelihood of default, the draft rule would also let the Secretary cancel debt for those experiencing hardship. According to the language, the Secretary would have the authority to:

“waive up to the outstanding balance of a loan owed to the Department… when the Secretary determines that a borrower has experienced or is experiencing hardship related to such a loan such that the hardship is likely to impair the borrower’s ability to fully repay the Federal government or the costs of enforcing the full amount of the debt are not justified by the expected benefits of continued collection of the entire debt.”

The provision lists 16 specific factors that could be used to determine hardship, including past and current repayment status, outstanding debt (including consumer debt), whether the borrower has “high cost burdens” for things like housing, caretaking, and healthcare. It also includes a 17th factor -- “any other indicators of hardship identified by the Secretary.” This authority would be ongoing, and so applies to current and future loans.

The cost of this provision is hugely uncertain and depends on how the current and future Secretaries of Education decide to interpret and implement it. At the low end, it might have no meaningful cost beyond current policy. At the high end, it could cost up to $380 billion over the 10-year window.

Since a great many borrowers have costs relative to their incomes that can make student loan payments a “hardship”, and since the provision itself contains perverse incentives to not pay one’s loans and to take on additional private debt with the knowledge it will squeeze out the student loan debt according to the Department’s calculations, the Department appears to be asserting its right to cancel almost all student debt, but using the authority of a different law than the Supreme Court already ruled illegal. Furthermore, the provision does not explicitly account for if a borrower is in an income-based plan and thus has low monthly payments, meaning the Department could cancel debts even for those who are already paying less based on their income.

Since there is no limiting principle to this provision in either direction, its potential costs are therefore almost limitless. And even if the current Administration decides not to use this authority or to limit its use, a future Administration could employ it as they wish. Our high-end $380 billion estimate assumes the Secretary would use some expansive measure or measures to cancel a large portion of loans held by borrowers that meet viable criteria according to draft regulations. For example, the Secretary could cancel loans for a large portion of borrowers who also carry a credit card balance, received a Pell Grant, or make below the median U.S. household income.

* * * * * * * * * * * *

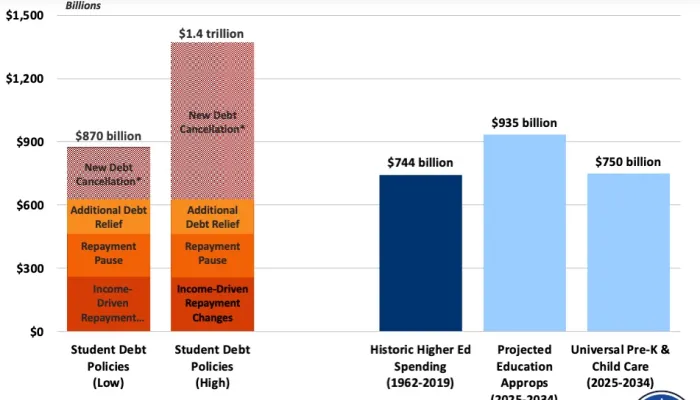

In total, the President’s likelihood-to-default and hardship proposal for cancelling student debt could cost between $70 billion and $600 billion over a decade. That would bring the total cost of his new proposals to between $220 and $750 billion, and the total cost of all recent and proposed debt cancellation to between $840 billion and $1.4 trillion.

And not only would this plan be costly, but it would put upward pressure on inflation and interest rates, create moral hazard for borrowers and institutions, create huge administrative challenges, and undermine Congress’s power of the purse. While the entire cancellation plan is problematic, the hardship component is particularly alarming due to its ill-defined parameters and seemingly limitless potential cost. The administration should drop this plan, and instead work with Congress on thoughtful and responsible reforms.