Delaney Combines Tax Reform and Infrastructure...With a Twist

Tax reform has been an increasingly common way to pay for infrastructure spending in recent years. Both President Obama and outgoing House Ways and Means Chairman Dave Camp (R-MI) proposed using revenue from business tax reform to fund the Highway Trust Fund (HTF) for a number of years.

Last week, Representative John Delaney (D-MD) proposed a version of this idea as well, but with a twist: he would also set up a deadline for tax reform and a backstop in case it wasn't passed.

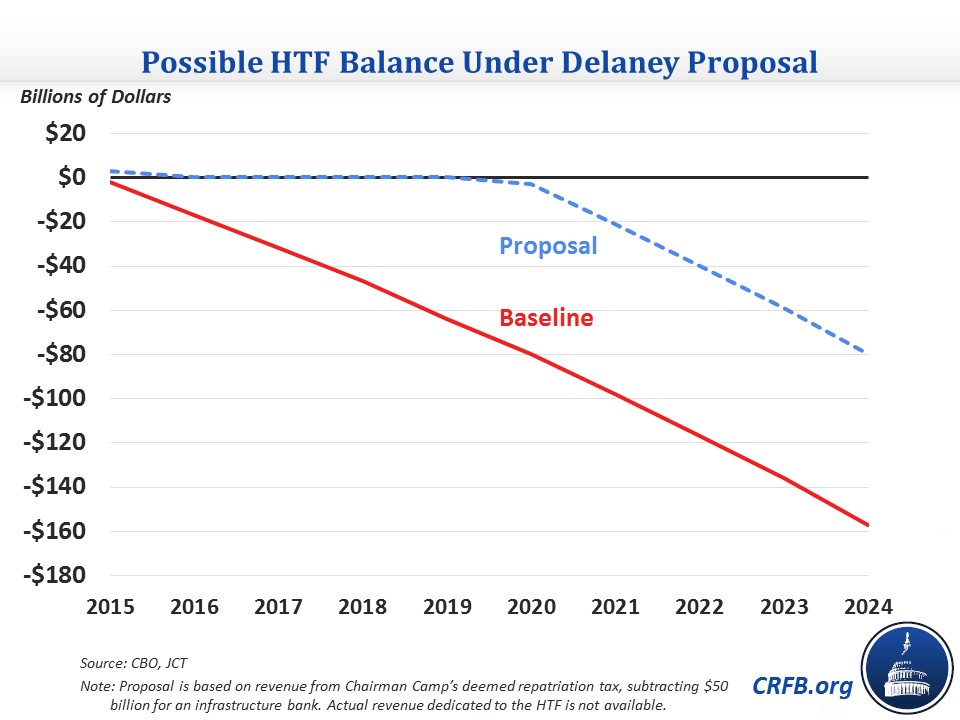

Like Chairman Camp's proposal, Delaney's bill would use an 8.75 percent deemed repatriation tax to fund the Highway Trust Fund, in this case for six years. The tax would apply to the approximately $2 trillion of foreign earnings by U.S. companies held outside the country. He would also use the revenue to fund a $50 billion infrastructure bank. Camp's proposal raised $170 billion, $127 billion of which was dedicated to the HTF. It appears that Delaney would dedicate the same amount to infrastructure and use the remainder for the $50 billion bank.

But Delaney's proposal would go further than this partial solution. Since a deemed repatriation tax is usually done in the context of international tax reform, Delaney would set an eighteen-month deadline for Congress to enact tax reform. If it did not act, the legislation would implement a modified version of "Option Z" from former Senate Finance Chairman Max Baucus's (D-MT) international tax discussion draft, which would tax active income – the income that is taxed when it is repatriated and is the subject of the international tax debate – in the year it is earned at a lower rate, based on the rate it is taxed by other countries.

In addition, the proposal would establish a bipartisan and bicameral commission to propose a lasting solution to HTF financing. Since the repatriation tax would only fund the HTF for a six-year reauthorization and wouldn't address its structural solvency issues, the commission would have to recommend changes to existing revenue sources, bring in new revenue sources, or reduce spending to more permanently bring HTF spending and revenue in line.

Delaney's proposal is fiscally responsible: it appears to raise enough revenue to offset the HTF shortfall and fund an infrastructure bank, all without double-counting revenue as Camp's Tax Reform Act did. (Camp's tax reform plan claimed that same revenue as contributing toward overall revenue-neutrality). More importantly, the proposal recognizes this solution is only a band-aid for both the issues of tax reform and infrastructure spending, and puts processes in place to accomplish both. In addition, the increased infrastructure spending and more efficient tax code would boost long-term economic growth. For these reasons, the proposal is certainly worthy of consideration next Congress.