CRFB's MacGuineas Dispels Five Social Security Myths

In an op-ed that appeared in several papers, including the Providence Journal, CRFB President Maya MacGuineas dispelled five myths about Social Security that are often brought up in the debate about the program (and have been revisited with the release of the Trustees' Report). MacGuineas notes that the Trustees "echoed the warnings made by the nonpartisan Congressional Budget Office that the program is financially unsustainable without changes," but many are still downplaying the shortfall.

In the piece, she addresses five myths about Social Security:

Social Security Does Not Face a Significant Funding Shortfall: In fact, it does. MacGuineas points to both the medium-term concern of the trust fund becoming insolvent in 2033, leading to a 23 percent cut in benefits, and the sizeable 75-year shortfall Social Security faces. According to CBO, spending is set to grow from 4.9 percent of GDP this year to 6.9 percent in 75 years, while revenue is projected to remain flat at 4.5 percent of GDP.

Social Security Revenue and Benefits (Percent of Payroll)

Social Security Has Nothing To Do With the Deficit: This point has been the subject of much debate. MacGuineas notes that the program is paying out $75 billion more than it collects in revenue in 2014, and those cash-flow deficits will total $1 trillion over the next ten years. While the previous accumulation of the trust fund balance technically "pays for" these deficits in future years via surpluses in past years, the federal government will still have to borrow money to pay the trust fund for the Treasury bills it redeems.

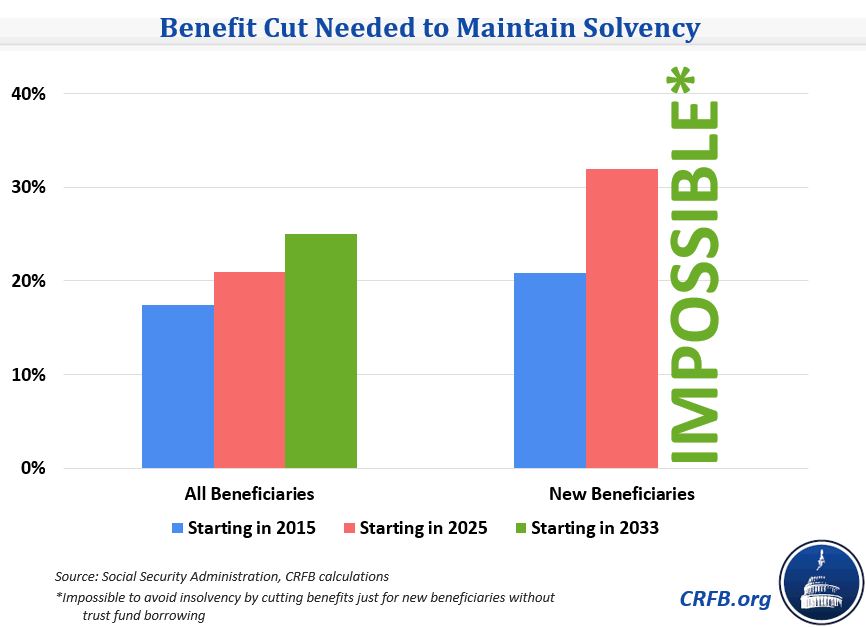

Social Security is Good for Now and We Can Make Adjustments Later: Importantly, changes to Social Security will likely be phased in over years to allow beneficiaries and taxpayers time to adjust. But it will be more difficult to use gradual changes to make ll be more difficult the longer we wait. MacGuineas explains that the necessary benefit cut for new beneficiaries to maintain solvency grows by half if we wait ten years and quadruples if we wait until 2030.

Reforms to Restore Social Security Solvency Would Cut Benefits: Since initial Social Security benefits are indexed to wage growth, benefits for future beneficiaries will be higher in inflation-adjusted terms than for current beneficiaries. This growth, MacGuineas says, means that lifetime benefits will be twice as high in real terms in 75 years as they are now. Thus, just about any plan that "cuts" benefits actually just reduces the built-in growth of benefits. Moreover, she notes that many bipartisan plans include benefit increases for vulnerable beneficiaries.

Raising Taxes on the Wealthy Can Provide a Pain-Free Fix for Social Security: A popular option for those who want to maintain benefits is to eliminate the cap on income subject to Social Security payroll taxes, currently set at $117,000. But MacGuineas notes the CBO estimate that this would close less than half of the 75-year shortfall. Further, as we noted recently, using revenue to close the 1.4 percent of GDP shortfall would leave less room for revenue increases to finance other priorities in the budget. As MacGuineas stated, doing so "would represent a judgment that preserving 100 percent of scheduled benefits for all seniors is a higher priority for increased revenues than other needs."

As the largest program in the budget, the debate over Social Security's future is an important one. However, these myths serve only to cloud the debate rather than have it focus on the solutions at hand. As MacGuineas concludes, "that debate must begin with an honest acknowledgment of the magnitude of the problem and the trade-offs involved in addressing it."