Budget Will Be Difficult to Balance Without ACA Savings

For the past three years, Republicans have proposed budgets with a goal of achieving balance within the next decade. However, that goal will be much harder to attain in next fiscal year's (Fiscal Year 2018) budget resolution if Republicans follow their current plans to repeal and replace the Affordable Care Act (ACA), also known as Obamacare.

To help achieve balance, previous budget resolutions – including the Chairman Price's proposed FY 2017 House budget resolution – assumed $2 trillion of savings over ten years from repealing the ACA. That amount of savings is the equivalent of removing all spending provisions in the ACA while leaving in place the Medicare savings, revenue increases, mandate provisions, and penalties. The Senate budget resolution just approved, on the other hand, allows for "repeal and replace" legislation that saves just $2 billion. In other words, policymakers are now calling for only one-tenth of one percent the Obamacare savings as in their previous budget.

The $2 billion target in the budget resolution is a minimum, so lawmakers could pass a bill with more savings. But if they only achieved the $2 billion target, the task of achieving a balanced budget in their next full budget resolution would be much harder.

Adopting the same savings from last year's proposed budget would be sufficient to reach balance by 2027. Yet if ACA repeal and replace saved only $2 billion instead of $2 trillion, the budget would leave a $350 billion deficit at the end of the decade.

In that scenario, significant additional cuts would need to be identified in order to achieve balance. Outside of the ACA, defense (which was increased), and Social Security (which is "off-budget"), last year's proposed budget called for a 27 percent spending cut below currently projected levels for the end of the decade. With ACA repeal saving only $2 billion, the remainder of the non-defense non-Social Security budget would need to be cut by 35 percent to achieve balance. And if lawmakers were to rely on a current policy baseline for tax reform, those cuts would need to be even deeper.

Of course, achieving somewhere between $2 billion and $2 trillion of savings would make the task somewhat easier. For example, if lawmakers pursue "repeal and delay" similar to their 2015 reconciliation bill – with all revenue and mandate provisions repealed immediately and coverage provisions repealed after two years – they would save $750 billion (on a dynamic basis) over a decade. This would result in a 2027 deficit of $250 billion. In this situation, however, it is likely that much or all of this savings would be used in the future to pay for ACA replacement legislation and not for deficit reduction, bringing the 2027 deficit back to the $350 billion range.

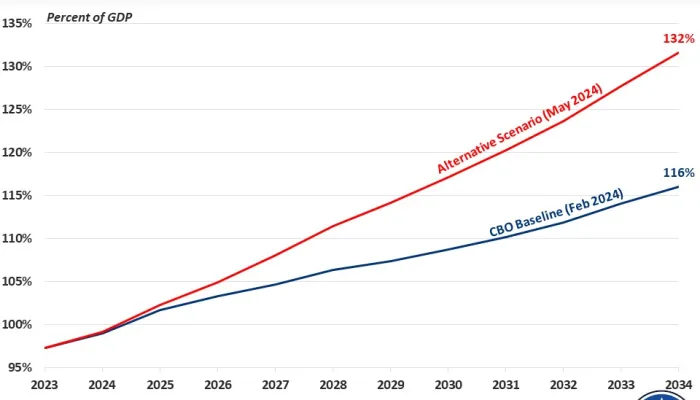

Ultimately, the desire to repeal some of ACA's offsets and retain or replace some of its spending will make balancing the budget more difficult and leave policymakers with two options. They will either need to identify substantial new savings (spending cuts and/or revenue increases) outside of ACA reform or they will need to identify a new fiscal goal that falls short of achieving budget balance within a decade. If they choose the latter course, they should ensure this fiscal goal puts today's post-WWII era record-high national debt on a downward path relative to the economy and on a sustainable course over the long term.