Tax Cut Extensions Could Cost $4 Trillion or More

According to new Joint Committee on Taxation (JCT) estimates published by the Congressional Budget Office, extending the expiring or changing elements of the Tax Cuts and Jobs Act could add $4 trillion to the deficit, plus interest, through 2034. Extending the expanded Affordable Care Act health insurance subsidies and other expiring tax provisions could add another $550 billion to the deficit. And growing discretionary appropriations with economic output instead of inflation could cost $1.2 trillion more.

The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget:

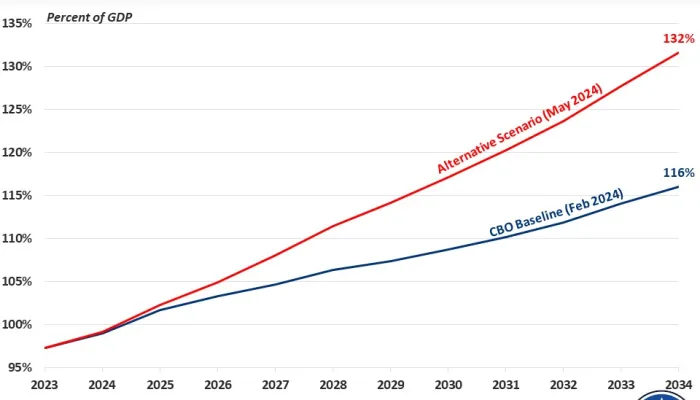

The national debt is approaching record levels as a share of the economy, interest costs are surging, and Americans are continuing to face high prices and high interest rates.

How could anyone look at our current situation and think we need to add another $4 trillion to the national credit card?

The cost of extending these tax cuts is not only massive, but also growing. It looks like extending the tax cuts will cost at least 10 percent more than we thought last year and roughly 50 percent above what we thought back in 2018.

Given our precarious fiscal situation, 2025 should be a year for reducing the debt, not exploding it. Policymakers should not extend these costly tax cuts without a plan to fully cover the costs and preferably generate net deficit reduction.

It’s important we have a competitive and pro-growth tax code. But we can’t borrow our way to prosperity. Enough is enough; it’s time to put our fiscal house in order.

###

For more information, please contact Matt Klucher, Assistant Director for Media Relations, at klucher@crfb.org.