House Reconciliation Instructions Sets Stage for Way Too Much Borrowing

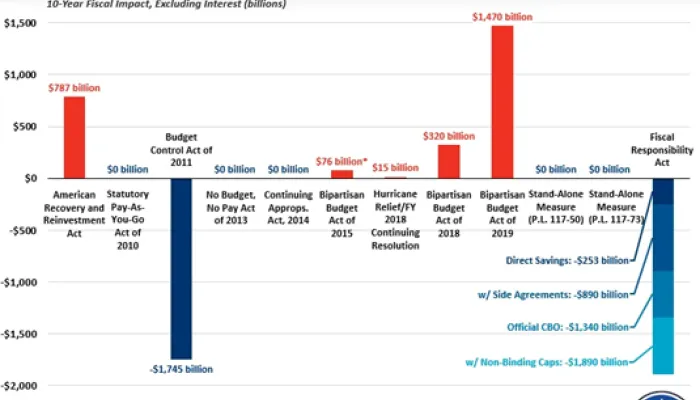

The House Budget Committee released a proposed budget resolution for Fiscal Year (FY) 2025 today. The budget resolution includes reconciliation instructions that would allow up to $4.8 trillion in new spending and revenue reductions, at least $1.5 trillion in savings, and thus $3.3 trillion in new borrowing, or $4 trillion when accounting for interest. The budget also includes a non-binding policy statement setting a goal of $2 trillion of savings.

The budget resolution is through the 2034 budget window, which means that it would generally cover a nine-year period as opposed to the typical ten, and in order to comply with the Byrd rule prohibition on long-term deficit increases, it is likely lawmakers would enact most tax cuts for only 8 years. For these reasons, the annual allowed borrowing is larger than meets the eye.

The budget also assumes $2.6 trillion of savings from unrealistically high economic growth assumptions that are nearly certain not to materialize as a result of these policies and are well out of the range of outside estimates, which on average have found tax cut extensions would generate $213 billion of dynamic feedback, with the highest estimate being $581 billion.

The following is a statement from Maya MacGuineas, president of the Committee for a Responsible Federal Budget, with regard to the reconciliation instructions in the proposed House budget resolution:

By every metric, the current U.S. fiscal situation is in terrible shape, and we should not adopt budgets or pass legislation that would make it worse. This reconciliation plan would damage the fiscal health of the country and present risks we should not be willing to take.

By all accounts, the House majority has been divided over how much tax cuts to allow and savings to require in reconciliation, and progress has been made in the past weeks by increasing required savings. They should continue to add more savings and/or shrink the amount of tax cuts or new spending.

There are those who have been pushing for more savings, real deficit reduction, and realistic assumptions. And there are those who want to expand the price tag by growing the tax breaks that are included and taking various savings items off the table. This comes down to governing responsibly versus being willing to weaken the economy and cheat the next generation. To govern is to choose, and choosing to layer on more debt when we are already in deep fiscal trouble is a failure of responsible governing.

We are also on track to spend $89 trillion over the coming decade with more than $20 trillion of additional spending through the tax code. For those who have championed smaller government, cutting spending, and fiscal responsibility, now is their moment—supporting roughly $4 trillion in new debt would be an incredibly damaging display of fiscal hypocrisy.

Congress should be making thoughtful choices over which parts of TCJA to extend, which to modify, how to make the tax code more efficient, and where to cut spending so that any net tax cuts don’t add to the debt. Instead, they are relying on phony economic assumptions that are far too large to be credible but still too small to cover all their new borrowing.

So much important progress has been made in the negotiations over the last few weeks, but this budget is still not ready for prime time. We encourage lawmakers to adjust their reconciliation instructions to offsets that match their costs and leave the economic growth dividends to reduce the deficit rather than justify more borrowing.

###

For more information, please contact Matt Klucher, Assistant Director of Media Relations, at klucher@crfb.org.