Capping Hospital Prices

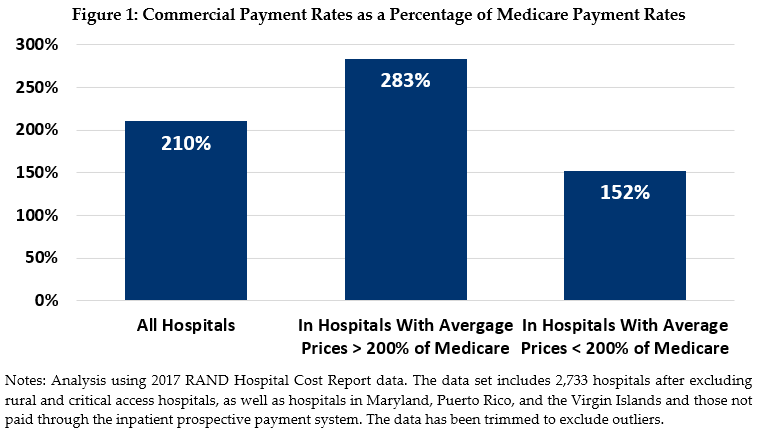

High hospital prices are a leading driver of high and rising costs in the U.S. health care system, resulting in insurance premium growth that outpaces the growth in wages and inflation. In particular, the cost of hospital care accounts for one-third of all U.S. health care expenditures. On average, hospitals command prices in the commercial market that are more than twice as high as Medicare, with some hospitals charging three or four times as much. High hospital prices have been fueled by a number of factors, including increasing market consolidation and “must-have” hospitals flexing their market power to negotiate significantly higher prices from commercial insurers.

As part of the Health Savers Initiative, this paper examines an option to address high prices and combat the effects of excess hospital market power by capping commercial prices at 200 percent of the Medicare rate.

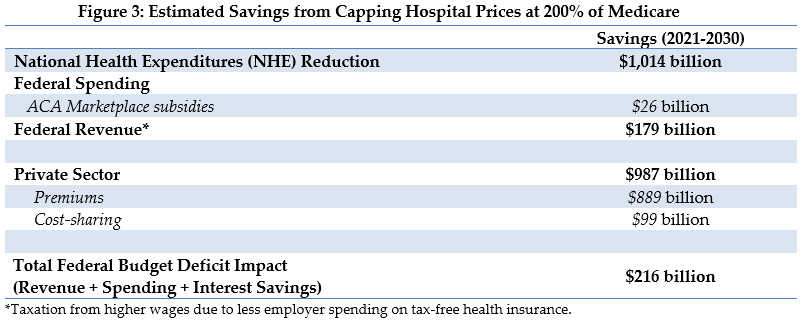

Over the next decade (2021-2030), capping commercial hospital prices at 200 percent of Medicare could:

- Reduce total national health expenditures, primarily through reduced commercial payments to hospitals, by just over one trillion dollars

- Reduce commercial premiums by $889 billion and cost-sharing by $99 billion

- Reduce the federal budget deficit by $216 billion

If the cap were limited to highly concentrated markets, savings would shrink by about 30 percent. On the other hand, tightening the cap to 150 percent of Medicare prices would almost double the savings.

Given the high and rising costs of health care, a number of bold policy changes will be needed to assure long-term affordability and sustainability. In this context it is worth examining policies that place an upper boundary on the market failure of high hospital prices.

The Health Savers Initiative is a project of the Committee for a Responsible Federal Budget, Arnold Ventures, and West Health, which works to identify bold and concrete policy options to make health care more affordable for the federal government, businesses, and households. This brief presents an option meant to be just one of many, but it incorporates specifications and savings estimates so policymakers can weigh costs and benefits, and gain a better understanding of whatever health savings policies they choose to pursue.

Background on Hospital Market Power, Consolidation, and Prices

Medicare’s administratively set payment rates pay hospitals based on the national average of reported costs, accounting for both operating and capital expenses. On the other hand, commercial insurers rely on negotiation to arrive at hospital payment rates. In a well-functioning competitive market, this negotiation would take place against a backdrop where there would be many providers and no one provider would have the ability to unduly influence prices. Furthermore, in a well-functioning market the prices paid by insurers would reflect the value of the service, taking into account the actual cost and the perceived quality of the service.

This is not a description of the market for hospital care in the United States. Many hospitals are able to demand high prices relative to prices set by the government in Medicare. For example, our analysis found more than 300 hospitals1 with a three-to-one ratio of commercial-to-Medicare payment rates. They are able to achieve this, in part, because of market power bolstered by increasing consolidation along with limited information on value and quality.

It is well-documented that per capita health spending in the U.S. relative to other countries is substantially higher.2 In a seminal Health Affairs article, authors Gerard Anderson, Uwe Reinhardt, and others made the case that the high prices in the U.S. drive our health care spending.3

Consolidation in the United States hospital market has increased steadily over the past few decades. This has led to less competition in the hospital market, an imbalance in negotiating power between insurers and hospitals, and higher prices. Research has shown the following: Hospitals are able to charge significantly higher prices to commercial insurers than they would have in an otherwise reasonably competitive market4; in most markets, a single hospital system accounts for more than 50% of inpatient admissions5; hospital consolidation is associated with significant price increases but no corresponding improvement in quality of care6; and that high hospital prices are passed along to consumers, employers, or the government in the form of higher premiums and/or cost-sharing.7

Another contribution to hospital market power is the existence in many communities of so-called “must-have” hospitals. Despite the limited availability of transparent information on the value and quality of care across hospitals, certain hospitals have brand name recognition. They are “perceived to provide the best care for complex and less common conditions”8 and are considered to be essential in plan networks. As a result, these hospitals have more leverage in negotiations and use that power to obtain higher reimbursement from employers and insurers.

To be sure, not all hospitals charge exorbitant prices. The commercial market is characterized by wide variation in payments for similar services across communities. For the same service, commercial prices can range from 150% of Medicare prices to 400% or more.9 Prices vary not only across regions, but among hospitals within the same region and even within hospitals for the same services.10 On average, intrastate variation in hospital prices is actually higher than variation between states.11 Addressing this variation in prices could lead to substantial savings.

Comparing commercial reimbursement rates to Medicare payment rates allows for transparency and provides a benchmark for examining prices across geographic regions. Our analysis found on average hospitals are reimbursed by commercial payers at slightly more than twice (210%) Medicare rates (see Figure 1).

Hospitals often point to “cost-shifting” to justify charging higher commercial rates, claiming that Medicare rates are not sufficient to cover their costs. There has been substantial, consistent research on this issue and as noted in a recent analysis by the Medicare Payment Advisory Commission (MedPAC), there is little to no evidence to suggest that cost shifting is a driving factor in hospital fees. Instead, “research suggests that hospitals engage in traditional price discrimination in areas where they have the market power to negotiate higher rates charged to insurers.”12

Contrary to the cost-shifting theory, one study found that lower Medicare rates led to lower commercial rates: a ten percent reduction in Medicare rates led to a reduction in commercial rates of between 3 and 8 percent.13 Furthermore, hospitals with relatively slow growth in Medicare rates also had relatively slow growth in commercial rates. Other research shows that higher payment rates are often associated with higher hospital costs because these hospitals are under less financial pressure to constrain costs (and in these cases, because their unconstrained costs are higher, Medicare rates may be below costs).14 Research also shows the converse -- hospitals under significant financial pressure do constrain costs.15

Current Efforts to Address High Prices

Lowering commercial hospital prices by enacting some type of cap on outlier prices has been proposed by state and federal policymakers, researchers and policy analysts from across the ideological spectrum.16

States have begun trying to leverage their own power as purchasers of health care services to limit the prices they pay for care for their employees or as part of creating a public option. States, such as Montana, Oregon, Washington, and Colorado, have implemented or are considering approaches that would cap payment for hospital services at a percentage of Medicare for state employee health plans or public options. These payment rates range from 160% to 234% of local Medicare reimbursement rates.17 Many of these proposals are in the development phase and there has been mixed success while encountering stiff opposition from hospitals.

Other states have broader policies to control health spending. Maryland, for example, has a waiver from CMS to use an all-payer model which establishes uniform payment rates on a global budget basis that Medicare, Medicaid, and commercial insurers must pay. A recent five-year evaluation report of Maryland’s program showed reductions in hospital spending for both Medicare beneficiaries and privately insured patients. Total Medicare expenditures also declined, but overall commercial expenditures did not due to increases in other non-hospital spending.18 Rhode Island also imposed inflation price controls on hospital spending paired with payment increases for primary care, resulting in lower health care spending for commercially insured adults.19

Implementing payment caps in expanded public insurance options could lower provider prices in the commercial market.20 Proposals for a “public option” often have provisions that administratively limit hospital prices. For example, the proposal to add a public option to the Affordable Care Act (ACA) marketplaces limited payment to around Medicare’s levels. The Congressional Budget Office analysis of that plan found that many hospitals would still participate, and that it would force hospitals to lower prices charged to private plans in the exchanges in order to maintain access to the patient population.21

Efforts to combat the negative effects of consolidation on competition have varied in success. The Federal Trade Commission (FTC) has antitrust authority to block anti-competitive mergers and acquisitions. After a period of losses in the courts and little enforcement, recently the FTC has had some success in challenging and ultimately blocking horizontal mergers among hospital systems operating in the same region. But, while efforts by the FTC are important tools to try to constrain consolidation, they are insufficient on their own to reduce high hospital costs.

Changes to Medicare and other existing public programs could help lower hospital costs by reducing the incentive for consolidation and establishing a payment structure that could be replicated by private insurers. We discuss one such option in our Health Savers Initiative brief “Equalizing Medicare Payments Regardless of Site-of-Care.”22

Policy Option to Cap Private Hospital Prices

Given the market failure in hospital pricing, we analyzed the effects of capping commercial prices for hospital services at 200 percent of the hospital’s current Medicare payment rates. In other words, under this policy, no hospital would be paid more than twice as much by private insurance as under Medicare for a given service. This would rein in the hospitals with the highest prices and reduce overall health care costs.

Under this policy option, rural hospitals and critical access hospitals would be excluded from this cap, along with hospitals exempt from the Medicare inpatient prospective payment system -- though alternative limitations could be designed in these cases.

By using Medicare rates as the benchmark, this option is administratively feasible and transparent, and it reduces employer and enrollee costs while addressing the wide variation in hospital rates. With median commercial payments almost double that of Medicare, this cap would be limiting for less than half of all eligible hospitals.

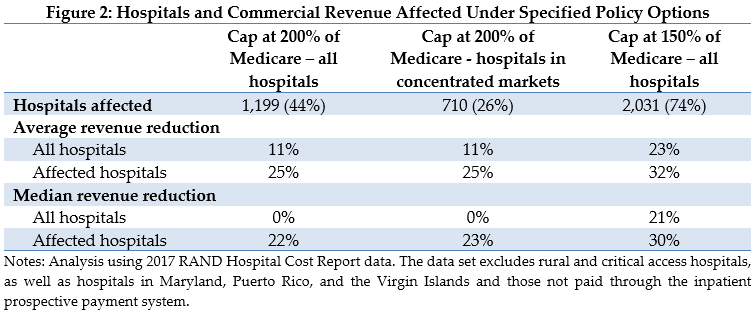

Alongside savings estimates of this policy option, we include estimates of two alternative policy options: only caping hospitals in highly concentrated markets (see Appendix for details on defining concentrated markets) and capping payment rates at 150 percent of Medicare. The percent of hospitals and revenue affected under each option are presented below (see Figure 2).

Estimated Fiscal and Financial Impact

Immediately capping all hospital payment rates at 200 percent of Medicare will reduce National Health Expenditures by just over one trillion dollars over 10 years (see Figure 3). Specifically, we estimate that lower payments to hospitals would reduce insurance premiums by $889 billion and reduce patient cost sharing by $99 billion over a decade. The Appendix outlines the methodology used to generate these estimates.

We also estimate that with premiums falling, employers would likely shift a share of compensation from non-taxable health care benefits to taxable wages. Meanwhile, lower premiums in the Affordable Care Act exchange marketplaces would reduce federal government premium subsidies. With the deficit reduction from those changes, along with the related lower interest payments on the national debt, we estimate the federal budget deficit would be reduced by $216 billion from 2021 to 2030.

Based on our projections, we expect this policy would affect about 44 percent of eligible hospitals. These hospitals would see an average revenue reduction of 25%. The majority of hospitals would not see any change in revenue resulting from this policy.

While these estimates reflect the savings from immediately implementing a price cap at 200 percent of Medicare, different policy choices could lead to different outcomes. For example, phasing in the cap would reduce ten-year savings but give hospitals more time to prepare and adjust. We estimate that limiting the cap to highly concentrated markets, using the Department of Justice definition (see Appendix), would shrink the National Health Expenditure and deficit savings by about 30 percent, reducing overall savings to $687 billion and $144 billion, respectively. On the other hand, tightening the cap to 150 percent of Medicare prices would almost double savings to $1.94 trillion and $421 billion, respectively.

Appendix: Estimating Methodology

The estimates in this document were produced through the joint effort of The Committee for a Responsible Federal Budget, Arnold Ventures, and West Health.

The starting points for savings estimates were the March 2020 Congressional Budget Office baseline and the March 2020 National Health Expenditure projections from the actuaries at the Centers for Medicare and Medicaid Services. The Health Savers Initiative will use this pre-Covid-19 baseline for all options to allow for the best comparisons because the full impact of Covid-19 on the baselines is unknown at this time.

The impact on the federal budget deficit was calculated by adding spending and revenue changes to interest cost savings estimated using CBO’s October 2020 interactive debt matrix.

This analysis used the RAND Hospital Cost Report Data from 2017. This data includes public cost report data from CMS Healthcare Cost Report Information System (HCRIS), with key metrics added.

The capping of commercial payments applies to specific hospitals, based on market concentration and a comparison of commercial payments and revenues to Medicare payments and revenues. The following hospitals are excluded from the analysis:

- Non-short-term hospitals,

- Critical access hospitals,

- Rural health clinics,

- Hospitals not paid through the Prospective Payment System and

- Hospitals in Puerto Rico, the Virgin Islands, and Maryland.

After excluding the above hospitals, 2,733 remained in our dataset. Analytic variables were developed based on the methodology described in Duffy et al.23 The new variables were created as follows.

- Total charges as the sum of inpatient and outpatient charges

- Charges per discharge equivalent as the ratio of charges to discharge equivalent

- Medicare discharge equivalents as the sum of Medicare inpatient discharge equivalents and an estimate of Medicare outpatient discharge equivalents

- Medicare revenue as the sum of Medicare inpatient and outpatient revenues

- Medicare revenue per discharge equivalent as the ratio of Medicare revenue to Medicare discharge equivalents

- Marginal operating costs per discharge equivalent as a fraction (100/109) of Medicare revenue per discharge equivalent

- Commercial discharge equivalents as the product of total discharge equivalents and the ratio of estimated commercial gross patient revenue to total gross patient revenue

- Commercial revenue as net patient revenue less the sum of revenue attributed to Medicare, Medicaid, SCHIP, state and local indigent care programs, private grants, donations, or endowment income for charity care, government grants for support of hospital operations, and partial payments by insured patients approved for charity care

- Any negative commercial revenue results were replaced with 0

- Commercial revenue per discharge equivalent as the ratio of commercial revenue to commercial discharge equivalents

Fields were identified within the RAND dataset to facilitate the analysis of hospital Payment-to-Cost Ratios (PTCRs), as follows

- Medicare PTCR as the ratio of the sum of Medicare inpatient and outpatient revenues to the sum of Medicare inpatient and outpatient costs.

- Estimated Commercial Revenue as the maximum of either 0 or net patient revenue less the sum of Medicare inpatient and outpatient, Medicare Advantage, Medicaid, Medicaid DSH, SCHIP, and state and local indigent care revenues as well as private grants for charity, government grants for uncompensated care, and charity payments for insured patients.

- Estimated Commercial Costs as the maximum of either 0 or the sum of total inpatient and outpatient costs less the sum of Medicare inpatient and outpatient, Medicaid, SCHIP, state and local indigent care, Medicare Advantage, and unreimbursed or uncompensated costs.

- Commercial PTCR as the ratio of estimated commercial revenue to estimated commercial costs.

- Ratio of commercial PTCR to Medicare PTCR as the quotient of the appropriate variables referenced above. In the event of undefined Commercial PTCR or Medicare PTCR, this value was set to 0, such that these hospitals are unaffected by any proposal. This affected 17 observations.

Only hospitals with positive values for charges per discharge equivalent, commercial revenue per discharge equivalent, marginal operating costs per discharge equivalent, and Medicare revenue per discharge equivalent were included. The data was trimmed for outliers, excluding an additional 44 observations, which reduced the average PTCRs.

The payment rate cap is set by examining both commercial and Medicare payment-to-cost ratios and limiting the ratio between the commercial PTCR to the Medicare PTCR to 200% and 150%.

To estimate the savings from imposing a cap only on hospitals in highly concentrated areas, we sorted all hospitals into Hospital Referral Regions (HRRs) and hospital systems within those HRRs.24 The Herfindahl–Hirschman Index (HHI), an indicator of market concentration, is calculated for each HRR using the hospitals and hospital systems within the region. The HHI is calculated by summing the squares of the proportion of inpatient discharges allocated to each hospital and system within the HRR and allows for the categorization of HRRs by HHI level. In our sample, HHI levels range from 527 to 10,000, with 10,000 indicating complete concentration. HRRs were identified as highly concentrated using the Department of Justice definition of having a HHI over 2,500. The 200% payment cap was applied using the PTCR for hospitals in HRRs with an HHI score of 2,500 or more.

1 Data was trimmed to eliminate outliers.

2 See annual data from the Organization for Economic Development.

3 Gerard F. Anderson et al. “It’s the Prices, Stupid: Why the U.S. is So Different from Other Countries,” Health Affairs 22, no. 3 (2003), DOI: https://www.healthaffairs.org/doi/10.1377/hlthaff.22.3.89.

4 Ginsburg PB, “Wide Variation in Hospital and Physician Payment Rates Evidence of Provider Market Power,” HSC Research Brief No. 16, November 2010, https://pubmed.ncbi.nlm.nih.gov/21117341/.

5 MedPAC Report to Congress, Chapter 15, “Congressional Request on Health Care Provider Consolidation,” March 2020, https://www.medpac.gov/docs/default-source/reports/mar20_medpac_ch15_sec.pdf?sfvrsn=0.

6 Martin Gaynor and Robert Town, “The Impact of Hospital Consolidation,” The Robert Wood Johnson Foundation Synthesis Project, June 2012, https://www.rwjf.org/en/library/research/2012/06/the-impact-of-hospital-consolidation.html.

7 Andrew S. Boozary et al. “The Association Between Hospital Concentration And Insurance Premiums In ACA Marketplaces,” Health Affairs 38, no. 4 (2019): 668-674. DOI: https://doi.org/10.1377/hlthaff.2018.05491; Richard M. Scheffler et al. “Differing Impacts Of Market Concentration On Affordable Care Act Marketplace Premiums,” Health Affairs no. 5 (2016): 880-888. DOI: https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2015.1229.

8 Sherry A Glied and Stuart H. Altman, “Beyond Antitrust: Health Care and Health Insurance Market Trends And The Future Of Competition,” Health Affairs 36, no. 9 (September 2017): 1572–1577DOI: https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2017.0555.

9 Chapin White and Christopher M. Whaley, “Prices Paid to Hospitals by Private Health Plans Are High Relative to Medicare and Vary Widely: Findings from an Employer-Led Transparency Initiative,” RAND Corporation, 2019, https://www.rand.org/pubs/research_reports/RR3033.html.

10 Zack Cooper et al. “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured,” The Quarterly Journal of Economics (2019), 51–107. DOI: https://www.nber.org/papers/w21815.

11 Christopher Whaley et al. “Nationwide Evaluation of Health Care Prices Paid by Private Health Plans Findings from Round 3 of an Employer-Led Transparency Initiative,” RAND Corporation, 2020, https://doi.org/10.7249/RR4394.

12 MedPAC, “Congressional Request on Health Care Provider Consolidation,” March 2020, https://www.medpac.gov/docs/default-source/reports/mar20_medpac_ch15_sec.pdf?sfvrsn=0.

13 Chapin White, “Contrary To Cost-Shift Theory, Lower Medicare Hospital Payment Rates For Inpatient Care Lead To Lower Private Payment Rates,” Health Affairs 32, no. 5 (May 2013): 935–943. DOI: https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2012.0332.

14Jeffrey Clemens and Joshua D. Gottlieb, “In the shadow of a giant: Medicare’s influence on private physician payments,” Journal of Political Economy 125, no. 1 (February 2017): 1–39, https://pubmed.ncbi.nlm.nih.gov/28713176/; Zack Cooper et al. “Politics, hospital behavior, and health care spending.” National Bureau of Economic Research working paper no. 23748, 2017, https://www.nber.org/papers/w23748; Chapin White and Vivian Yaling Wu, “How do hospitals cope with sustained slow growth in Medicare prices?” Health Services Research 49, no. 1 (February 2014): 11–31, https://pubmed.ncbi.nlm.nih.gov/24094438/.

15 MedPAC, “Report to Congress: Medicare Payment Policy,” March 2019, https://www.medpac.gov/docs/default-source/reports/mar19_medpac_entirereport_sec.pdf?sfvrsn=0.

16 Michael Chernew et al. “A Proposal to Cap Provider Prices and Price Growth in the Commercial Health-Care Market,” The Hamilton Project, March 2020, https://www.hamiltonproject.org/papers/a_proposal_to_cap_provider_prices_and_price_growth_in_the_commercial_health_care_market; Avik Roy, “The Fair Care Act of 2020: Market-Based Universal Coverage,” FREOPP, October 2020, https://freopp.org/the-fair-care-act-of-2020-market-based-universal-coverage-cc4caa4125ae

17 Lovisa Gustafsson and Audrey McIntosh, “States’ Role in Combatting High Health Care Prices,” The Commonwealth Fund, September 2019, https://www.commonwealthfund.org/blog/2019/states-role-combatting-high-health-care-prices.

18 Susan Haber et al. “Evaluation of the Maryland All-Payer Model Volume I: Final Report,” RTI for CMS, 2019, https://downloads.cms.gov/files/md-allpayer-finalevalrpt-app.pdf.

19 Aaron Baum et al. “Health Care Spending Slowed After Rhode Island Applied Affordability Standards To Commercial Insurers,” Health Affairs, 2019, https://www.healthaffairs.org/doi/10.1377/hlthaff.2018.05164.

20 S. 3 Keeping Health Insurance Affordable Act of 2019; S. 489 State Public Option; S. 981/H.R. 2000 Medicare-X Choice Act of 2019; H.R. 2085 CHOICE Act; and S. 1261 Choose Medicare Act.

21 Congressional Budget Office, “Analysis of a Proposal to Offer a Public Plan Through the New Health Insurance Exchanges,” Letter to the Honerable Fortney Pete Stark, July 22, 2010, https://www.cbo.gov/publication/21654.

22 https://www.crfb.org/sites/default/files/HSI_EqualizingPayments_0.pdf

23 Duffy et al. “The Price and Spending Impacts of Limits on Payments to Hospitals for Out-of-Network Care,” 2020, https://www.rand.org/pubs/research_reports/RR4378.html.

24 Hospital Referral Regions by zip code were obtained from Dartmouth Atlas Data website [accessed August, 2020], which was funded by the Robert Wood Johnson Foundation, The Dartmouth Clinical and Translational Science Institute, under award number UL1TR001086 from the National Center for Advancing Translational Sciences (NCATS) of the National Institutes of Health (NIH), and in part, by the National Institute of Aging, under award number U01 AG046830. https://atlasdata.dartmouth.edu/downloads/supplemental#crosswalks.